Thailand emerges as unlikely bond-flow magnet

Thailand’s sovereign bonds don’t yield much more than US Treasuries, they cost less to insure than Spanish notes and its currency is more stable than China’s managed yuan.

In a sign of how the flood of money into emerging markets is upending conventional wisdom, military-run Thailand with a credit rating just three levels above junk at Moody’s Investors Service has become a favoured low-yielding destination for bond investors.

A current-account surplus that’s forecast to be around 10% of gross domestic product this year and Asia’s best-performing currency of 2017 are luring foreign money. Overseas investors have pumped a net $2.6 billion into Thai notes so far this month, more than for South Korea, India and Indonesia combined. While Indian and Indonesian debt have attracted more foreign money this year, the two countries offer 10-year yields almost triple that of Thailand.

“Thai assets provide some relief for investors given the stability of the local currency,” said Kenta Tadaide, a market economist at Mizuho Bank Ltd in Tokyo. Thailand “is better positioned geographically compared with the east Asian countries in terms of issues on the Korean peninsula” and the central bank hasn’t introduced strict measures to curb baht appreciation, he said.

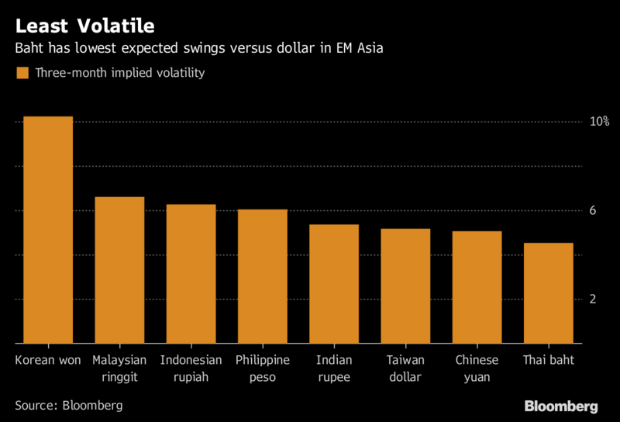

Here are three charts illustrating Thailand’s growing popularity with bond investors:

The baht’s three-month implied volatility, a gauge of expected swings used to price options, is the lowest among Asia’s emerging-market currencies. That, together with its 8.2% advance against the dollar this year, has proved alluring. While the Thai currency’s strength has caused some angst about export competitiveness, authorities have so far taken only limited steps to curb gains.

Such is the popularity of Thai bonds that they now yield slightly less than those from South Korea, which has a credit rating five levels higher at Moody’s. The yield on Thailand’s 10-year government bonds was 2.25% on Tuesday, compared with 2.13% for similar-maturity Treasuries.

If the cost of insuring the country’s bonds against default is anything to go by, investors don’t seem too worried about a rekindling of political risk in a country that’s been under military rule since May 2014 and has endured around a dozen coups since 1932. Thai five-year credit default swaps are lower than for developed-market Spain and cost around half as much as for Indonesia.

Source: http://www.bangkokpost.com/business/news/1322847/thailand-emerges-as-unlikely-bond-flow-magnet

English

English