Thailand: Cryptocurrencies a new issue for SEC

Cryptocurrencies have given rise to a new set of challenges for the Securities and Exchange Commission (SEC) as the recent price surge has lured numerous new investors to the market and spurred the trading value to 6.6 billion baht per day.

The regulator has warned cryptocurrencies are highly volatile at about 30-100%, so investors must carefully assess the risks associated with the assets before investment.

Ruenvadee Suwanmongkol, the SEC’s secretary-general, said the number of crypto traders has increased rapidly to around 1.49 million accounts, of which 311,528 are active trading accounts.

On Wednesday, the Bitcoin price also skyrocketed from around US$42,000 earlier this year to over $62,000, supported by positive sentiment from the debut of Bitcoin futures exchange-traded fund on Tuesday on the New York Stock Exchange.

Supported by the market-wide sentiment, other altcoins such as Ethereum and XRP reportedly rose as well.

According to CoinMarketCap, the total market cap of the global digital asset market stood at $2.34 trillion as of Oct 11, of which about 46% was from Bitcoin with an average trading value of $109.97 billion per day.

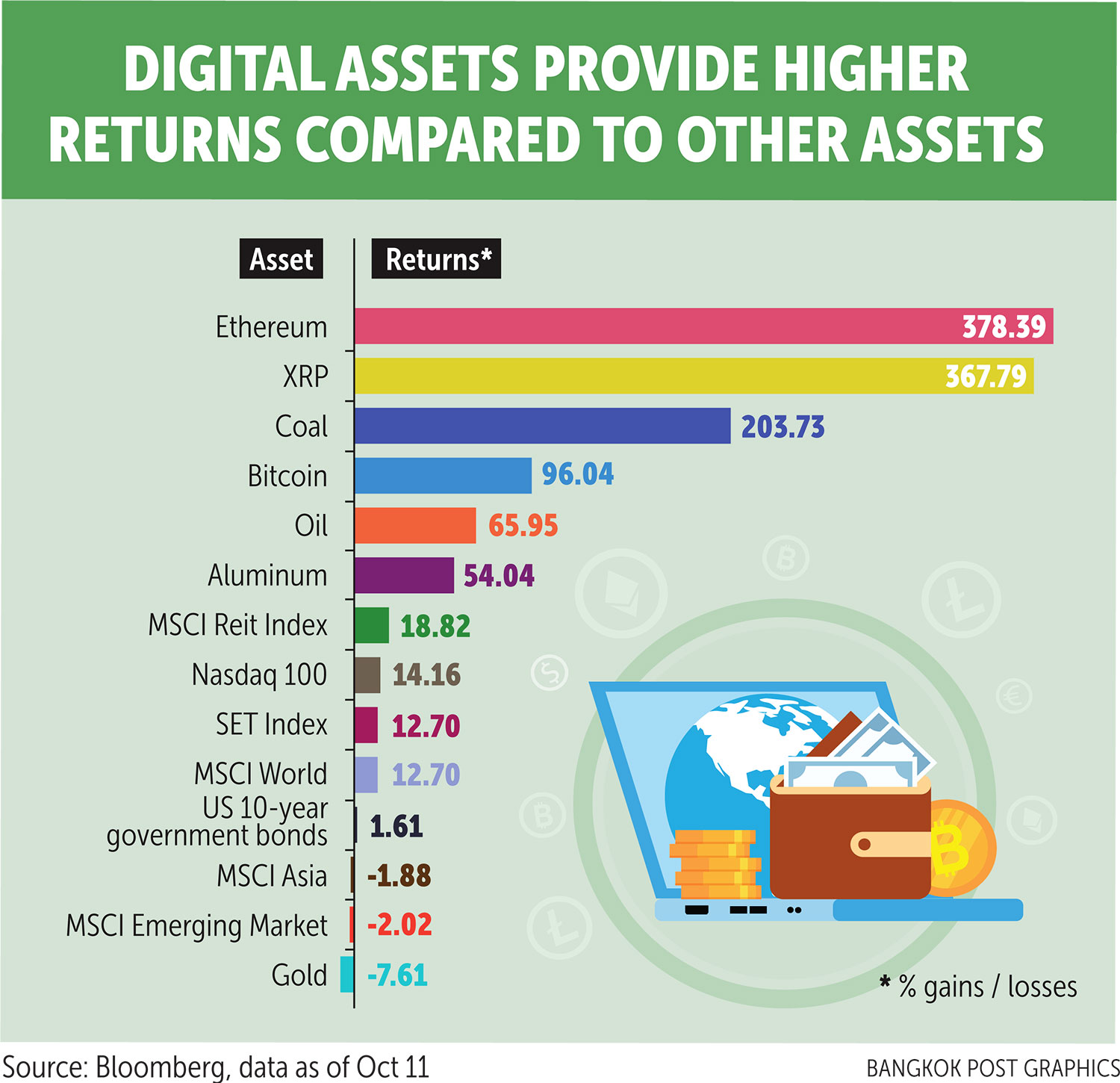

According to the SEC, digital assets also provide higher returns than other types of assets this year. Ethereum provides the highest at 378.39%, followed by XRP (367.79%), coal (208.73%), Bitcoin (96.04%) and oil (65.95%).

“Cryptocurrency is an asset without supporting fundamentals whose price is based purely on demand and supply. An investor who wishes to invest in cryptocurrencies should study the assets before investing because they are highly risky and volatile,” Ms Ruenvadee said.

The SEC has organised a programme to educate investors through online channels to provide them with a better understanding of how to invest in digital assets that is the current attractive investment trend, she said.

Meanwhile, fundraising through an initial coin offering (ICO) has also enjoyed a good start this year as a company has reportedly successfully raised 2.4 billion baht through its first ICO. The SEC expected other companies will follow suit.

In addition, blockchain technology, an infrastructure underlying the development of digital assets, has also been rapidly improved and will play a more active role in the digital asset ecosystem.

“The rapid growth of digital assets poses a challenge to market regulators, particularly the entry of new generation investors with little knowledge and experience of investing. We hope all educational programmes we are providing will help them learn more about risky assets,” said Ms Ruenvadee.

Ms Ruenvadee said the SEC has also supported stocks with good compliance with environmental, social and governance criteria.

Source: https://www.bangkokpost.com/business/2202035/cryptocurrencies-a-new-issue-for-sec

English

English