Thailand: Consumption weakening due to drop in earnings of non-farm labour: BOT

Veerathai Santiprabhob, governor of the Bank of Thailand (BOT), said the central bank had forecast an economic growth of 2.8 per cent this year, which is below the country’s growth potential. However, he said, this does not mean there is an economic crisis looming, though BOT’s monetary policy committee is still concerned about the strong baht, which could have an adverse impact on the economy.

The currency has, however, been on a downward trend, he added.

Meanwhile, Don Nakornthab, senior director at the Economic and Policy Department of the central bank, said all indicators, apart from tourist arrivals, appeared to be weaker in August as economic slowdown continues.

Private consumption indicators expanded moderately from the same period last year. The National Economic and Social Development Council, a state think-tank, previously considered consumer spending as a growth engine, at a time when exports, private investment and public investment weakened.

BOT said on Monday (September 30) that spending on durable goods significantly contracted following a decrease in every category of vehicle sales, partly due to weakening of income, together with credit tightening of financial institutions, after credit quality showed signs of deterioration. Spending on non-durable goods expanded at a softer pace mainly from moderate fuel usage, in line with contracting domestic vehicle sales.

In addition, spending on semi-durable goods was flat. However, spending on services expanded at a higher rate, attributed to the expansion of expenditures on hotel and restaurants. The fundamental factors supporting the overall purchasing power remained weak.

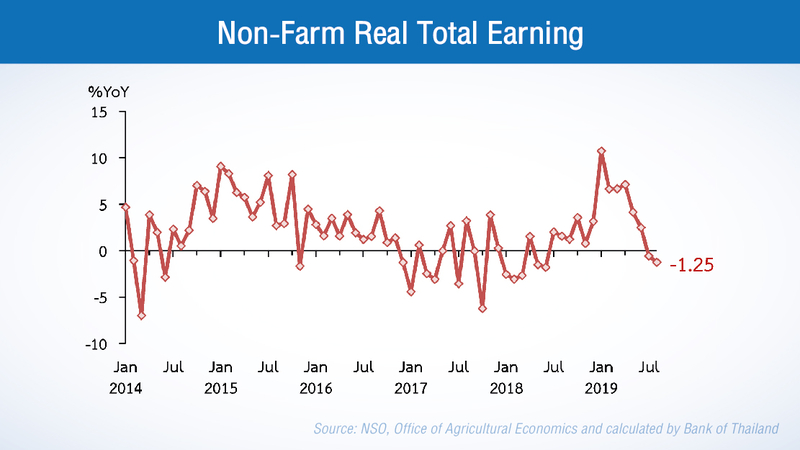

Non-farm income further contracted, while farm income rose mainly due to rising agricultural prices. Consumer confidence continued to deteriorate for the sixth consecutive month.

The report came as many factories have started laying off workers, or cutting down on overtime, especially in industries that rely heavily on exports.

The central bank said the value of merchandise exports turned into contraction by 2.1 per cent from the same period last year. With the exception of gold, the value of all merchandise exports continued contracting at 8.9 per cent.

The continual contraction for the 10th consecutive month can be attributed to weaker global demand as a result of slower economic growth in a number of major trading economies, the US-China trade conflict, the continued downturn in electronic cycle, the contraction of global crude oil prices and a high base effect from front-load exports last year before the US started imposing import tariffs on Chinese products.

This contraction was also put down to a drop in the export of petroleum-related products and electronic products, which continued to contract for a ninth month. However, hard disk drive exports showed signs of recovery, as the production of hard disk drives, which were previously supported by the relocation of production base from Malaysia, expanded this month.

Exports in several other categories also expanded, partly due to the substitution of Chinese and American goods in the two markets, such as exports to the US market, which is continuing to expand, includes car tyres, refrigerators, television set, and apparel and textiles; while exports to China expanded at a higher rate with some products, such as high-end cars and motorcycles. However, the gains were not large enough to offset the slowdown in other export markets.

Private investment indicators also contracted from the same period last year, said the central bank.

Investment in machinery and equipment turned into contraction mainly from the drop in import of capital goods and the number of newly registered motor vehicles for investment. Investment in construction contracted due to a drop in permitted construction areas, apart from areas allocated for factories, which expanded. The sale of construction materials subsequently contracted, consistent with the slowdown in the real-estate sector. After seasonal adjustment, private investment indicators decreased from the previous month.

Public spending, excluding transfers, turned into contraction from the same period last year

due to current expenditures mainly on the back of expenditure on goods and services for the Army and the Royal Thai Police.

However, capital expenditure rose slightly from the disbursement of the Department of Highways, and additionally state enterprises’ capital expenditures rebounded from the disbursement of funds to PTT Public Co Ltd and Airports of Thailand Public Company Limited.

The value of merchandise imports sharply contracted by 15.5 per cent from the same period last year. Excluding gold, the value of merchandise imports contracted by 8 per cent.

The contraction was attributed to a drop in:1) Imports of raw and intermediate goods, particularly material for base metal, consistent with the contraction of private construction and car production; electronic parts, consistent with the contraction of production and exports of this product; and imports of fuel which contracted as global crude oil prices declined; 2) Imports of capital goods excluding aircraft, ships, floating structures, and locomotive, particularly telecommunication equipment and machinery and equipment, consistent with the contraction of private investment indicators;

3) Imports of consumer goods; and 4) Imports of automotive and parts, consistent with the slowdown of private consumption.

Meanwhile, the number of foreign arrivals rose by 7.4 per cent from the same period

last year, due to: 1) A low base effect from the tour boat incident in Phuket last year and

2) An increase in tourist arrivals who benefited from the exemption of visa on arrival fees, particularly those from China, India and Taiwan.

Moreover, some Chinese tourists chose Thailand over Hong Kong due to the political unrest. However, the number of European tourists, particularly from Germany and Russia, continued to drop due to the economic slowdown, according the central bank.

On the stability front, headline inflation decelerated to 0.52 per cent from 0.98 per cent

last month, due mainly to a larger contraction in energy prices caused by a fall in global crude oil prices, coupled with a decrease in fresh food prices. Meanwhile, core inflation accelerated from the previous month.

The seasonally adjusted number of employed persons decreased from previous month, mainly owing to a decline in non-farm employment. The seasonally adjusted unemployment rate remained nearly unchanged from the previous month. The current account registered a higher surplus due mainly to an increase in trade surplus. The overall capital and financial accounts registered a deficit from both the assets and liabilities positions, the central bank added.

Source: https://www.nationthailand.com/business/30376919

English

English