Thailand: Construction outlook steady

The construction market is expected to maintain its growth prospects in the next few years, helped primarily by major public sector infrastructure projects. We believe that private-sector construction work will also increase, helped by the expansion in public infrastructure projects and a recovery in residential property activity.

However, competition will remain fierce; hence our neutral rating. Some domestic contractors have partnered with foreign firms to enhance their competitiveness. Foreign contractors typically have larger capital bases, greater skills and technology. We expect more cooperation between local and foreign contractors in large, high-value infrastructure projects.

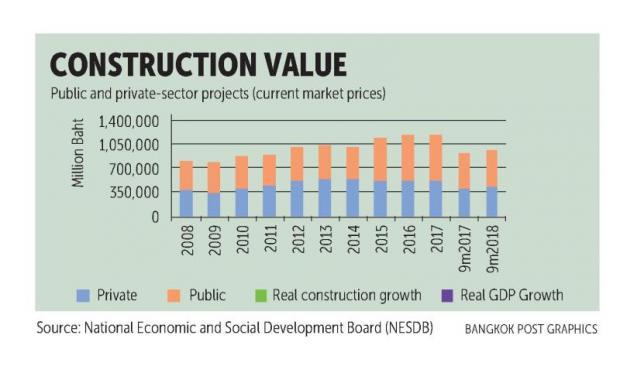

Market recap: In 2017, the construction industry in Thailand accounted for approximately 8% of GDP or 1.2 trillion baht. In the first nine months of 2018, the value of the market was 977 billion baht, a 2.8% year-on-year increase in real terms. This was an improvement from 2017, when construction activity dropped by 2.2% from a year earlier.

In 2017, the real value of public sector construction fell by 3%. This reflected more stringent regulations under the new Government Procurement and Supplies Management Act. It requires central, regional and local state agencies and other government-affiliated organisations to follow the state procurement process.

It took time for organisations to learn and implement the new procedures. As a result, government budget disbursements in the fourth quarter of 2017 and the first half of 2018 were much lower than expected.

It took time for organisations to learn and implement the new procedures. As a result, government budget disbursements in the fourth quarter of 2017 and the first half of 2018 were much lower than expected.

The real value of private-sector construction projects rose 4% in the first nine months of 2018, after staying relatively flat in the past few years. A recovery in residential property construction and improved private investor confidence underpinned the rise.

KEY OUTLOOK FACTORS

Public sector work to lead the market: Large infrastructure projects will drive activity in the industry. Nine megaprojects, worth 276.5 billion baht, began construction in 2018, but most of the work so far has been land clearing and site preparation. Consequently, growth was marginal in the first nine months of 2018, at only 1.9% year-on-year. However, we expect the value will grow faster once the projects are fully under way.

Another eight megaprojects, worth 901 billion baht, will open for bids within 2019. Some may start construction in 2019, such as the Denchai-Chiang Khong double-track rail project, and the Rama III road-western outer ring road motorway.

Other projects, such as the high-speed railway connecting the Eastern Economic Corridor (EEC), U-tapao airport, and the third phase of Laem Chabang port, could be delayed pending environmental impact assessment (EIA) completion.

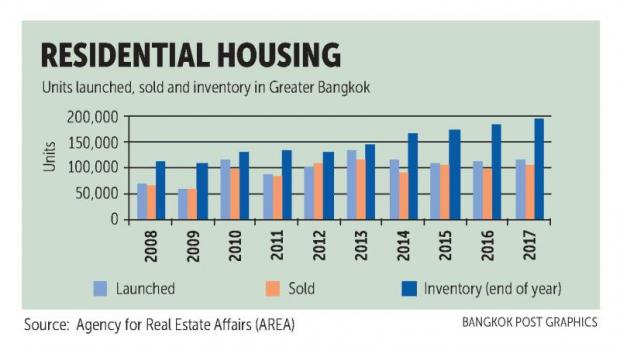

Residential property recovering: Residential property development has always accounted for the majority of construction activity in the private sector, averaging a 56% share from 2013-17.

The number of housing units sold in Bangkok and vicinity grew by 5.5% in 2017, with similar growth expected in 2018. The value of presales, project backlogs, and newly launched properties by major developers also rose by 25-30% in 2017. Significantly, the value of housing units sold rose faster than the number of units sold because major developers are marketing more high-end properties. This shift has boosted investment and construction value.

The number of housing units sold in Bangkok and vicinity grew by 5.5% in 2017, with similar growth expected in 2018. The value of presales, project backlogs, and newly launched properties by major developers also rose by 25-30% in 2017. Significantly, the value of housing units sold rose faster than the number of units sold because major developers are marketing more high-end properties. This shift has boosted investment and construction value.

The growth prospects reflect an improving economy in 2018. Moreover, new infrastructure projects open up the possibility of more housing development along new mass transit lines.

Competition high as contractors increase competitiveness: The industry is fragmented, with over 10,000 contractors, according to registrations with the Department of Business Development. But big contractors dominate, with the top five (by revenue) accounting for 10% of all construction activity in 2017.

Many contractors are increasing their expertise and capital bases. Some have formed joint ventures with foreign partners. More contractors from abroad, especially China, are competing for big infrastructure projects. Many have competitive cost structures in addition to solid capital bases.

For example, Unique Engineering and Construction Plc has partnered with Sinohydro Corp, a Chinese contractor specialising in hydropower projects, and won several infrastructure projects. KS-C Joint Venture, another Thai-Chinese venture, has won one double-track rail contract. The recent bid for the 225-billion-baht high-speed rail line linking there airports featured consortia with Thai and foreign partners.

FINANCIAL HIGHLIGHTS

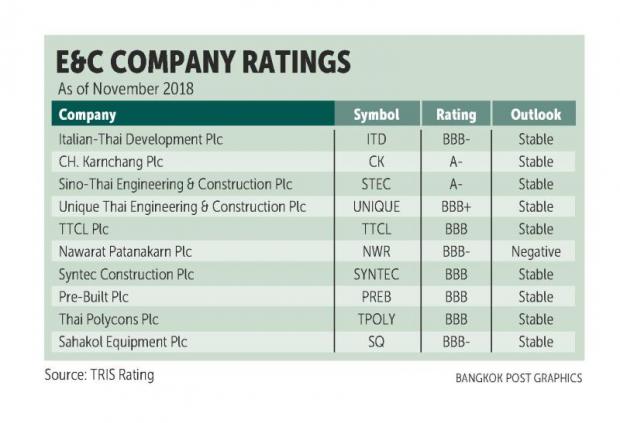

There are various types of construction work, both specialised and general. Typically, the top-tier companies will be more diversified both in terms of projects and investment in other businesses. Small or medium-sized contractors, in the meantime, handle fundamental construction work.

The financial profiles of companies in the industry vary considerably due to differing business models and different levels of expertise. For example, contractors that focus on the petrochemical sector suffered during the recent downturn in the petrochemical industry.

Operating margins steady: Tris Rating forecasts the weighted average operating margin of rated construction firms to average 5% over the next few years. The figure was 5.9% in the first nine months of 2018 and averaged 5.3% between 2013 and 2017.

The construction industry by nature has low margins. The critical skills most strongly affect profit margins are the ability to control cost and finish projects on time.

Margins will improve as private sector investment and construction activities rebound. In general, the margin for a private sector project could be two times higher than for a public sector project. However, public sector contracts are generally larger and for longer periods.

Leverage on the rise: A greater number of public sector construction projects will drive the winning contractors to take on more debt during the construction period. Public private partnership projects will require the private sector partners to carry the construction cost.

Source: https://www.bangkokpost.com/business/news/1605270/construction-outlook-steady

English

English