Thailand: BoT records net profit on baht retreat

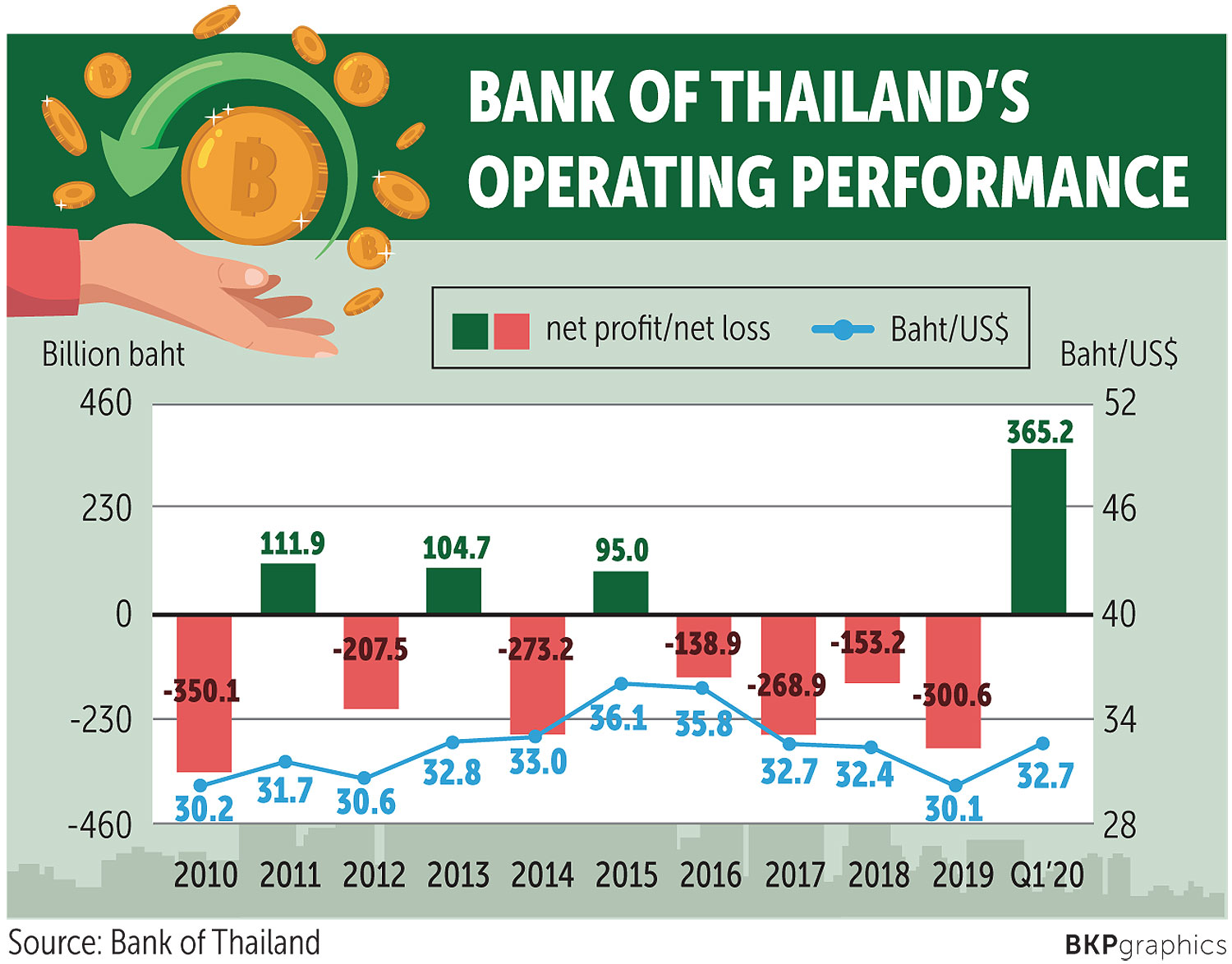

The Bank of Thailand swung back to a net profit of 365 billion baht for the first three months of this year, largely because the baht retreated against the greenback.

“Even though the baht weakened 8.3% against the dollar in the period, the profit didn’t affect our ability to act,” the central bank said in a statement.

The baht’s weakness resulted in an unrealised valuation profit from holding foreign reserves.

The local currency dropped to 32.7 to the dollar at the end of March from 30.1 at the end of last year.

According to Bank of Thailand data, it delivered a 95 billion baht net profit in 2015 before plunging to net losses of 139 billion in 2016, 269 billion in 2017, 153 billion in 2018 and 301 billion last year.

The statement said major currencies last year fell against the baht due to several challenges including the US-China trade spat, Brexit, geopolitical tensions, major central banks’ easing monetary policy and Thailand’s high current account surplus.

The central bank continued to take care of the local currency and bumped up foreign reserves to US$259 billion at the end of 2019 from $239 billion a year earlier.

Higher net losses in 2019 could be attributed to unrealised loss as the baht gained 7.62% against the greenback, with income from investing in foreign assets exceeding interest payment cost incurred from executing policy for a second straight year, it said.

Net interest income amounted to 14.5 billion baht last year compared with 18.8 billion in 2018.

The central bank’s net interest income sat in negative territory to the tune of 15.1 billion baht in 2017, 29.1 billion in 2016, 44.8 billion in 2015, 62.6 billion in 2014, 96.6 billion in 2013, 100 billion in 2012 and 74.7 billion in 2011.

The positive net interest income was due to higher global policy rates than Thailand’s benchmark rate, the Bank of Thailand said.

The bank posted an unrealised valuation loss of 189 billion baht from holding foreign reserves in 2019, as the baht was stronger against major currencies such as the US dollar, euro, and yuan.

Accounting standards require the central bank to record the value of foreign reserves in baht at year-end.

“The net loss in 2019 largely stemmed from converting overseas asset prices into baht currency terms, while the central bank’s foreign reserve management aimed to have ample foreign reserves to provide a buffer against the global capital and financial market volatility, maintain purchasing power in the global market, prepare sufficient liquidity in case of emergencies and back banknote printing. International reserves in terms of foreign-denominated currency should be a focus rather than valuation in baht,” it said.

Source: https://www.bangkokpost.com/business/1905385/bot-records-net-profit-on-baht-retreat

English

English