Thailand: BoI approves more perks for 2021

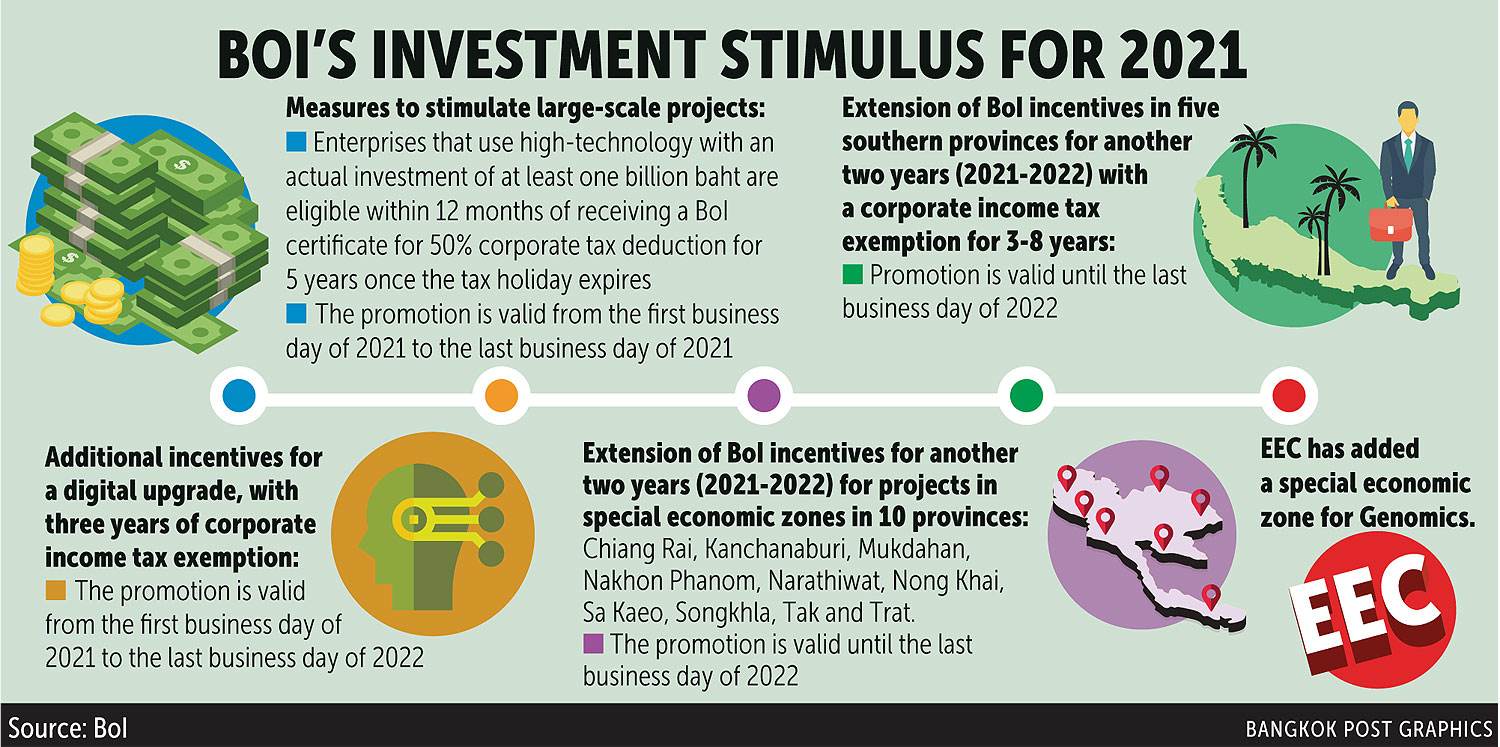

The Board of Investment (BoI) yesterday approved additional measures including a 50% corporate tax deduction for five years for investment projects worth at least 1 billion baht to stimulate investment next year.

According to BoI secretary-general, Duangjai Asawachintachit, the 50% corporate tax deduction incentive aims to stimulate real investment.

She said the promotion will be valid from the first business day of 2021 to the year’s last business day.

The BoI usually offers the longest exemption from corporate income tax of eight years. The government offers firms in the Eastern Economic Corridor (EEC) a corporate income tax exemption of up to 13 years and a 50% tax reduction for up to five years.

According to Ms Duangjai, the board also agreed to extend the promotional measures for another two years to investment projects in special economic zones in 10 provinces.

The measures cover 300 categories of investment with privileges ranging from the corporate income tax exemption for a period of 3-8 years. For 14 targeted industries, among which are agriculture, fisheries, textiles, garments, leather, furniture, jewellery and ornaments, investors are eligible for an additional 50% corporate income tax deduction for five years.

The 10 provinces referred to here are Chiang Rai, Kanchanaburi, Mukdahan, Nakhon Phanom, Narathiwat, Nong Khai, Sa Kaeo, Songkhla, Tak and Trat.

Since 2015, 84 projects worth 19 billion baht have applied for BoI privileges in special economic zones. A large portion of the investment went to Songkhla for rubber glove manufacture worth 7 billion baht.

Yesterday, the board approved another two-year extension (2021-22) for the measure to promote investment in five southern provinces of Narathiwat, Yala, Pattani, Satun and four districts in Songkhla.

Investors are eligible to three, five and eight years of corporate income tax exemption depending on the category.

The board also approved the establishment of a new special economic zone of Genomics at Burapha University following a proposal by the EEC Office. Investors are eligible for promotional privileges on par with those given to the aviation city in EEC, EEC of digital (EECd) and EEC of innovation (EECi).

The BoI yesterday also improved the measure to upgrade digital efficiency among manufacturers.

Investors will be eligible for the corporate income tax exemption for three years.

Source: https://www.bangkokpost.com/business/2039079/boi-approves-more-perks-for-2021

English

English