Thailand: Banks feel dropped-fee pinch

The banking industry is expected to announce 10% lower earnings for the second quarter than the previous quarter, mostly attributed to the decision to eliminate fees for digital transactions.

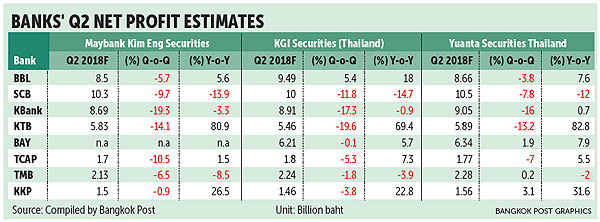

KGI Securities forecasts the combined net profit of nine listed banks in the second quarter of the year at 46.05 billion baht, down 10.7% quarter-on-quarter, but increasing 3.3% year-on-year. The nine banks under its coverage are Bangkok Bank (BBL), Krungthai Bank (KTB), Siam Commercial Bank (SCB), Kasikornbank (KBank), Bank of Ayudhya (BAY), Thanachart Bank, TMB Bank, Tisco Bank and Kiatnakin Bank.

KGI Securities forecasts the combined net profit of nine listed banks in the second quarter of the year at 46.05 billion baht, down 10.7% quarter-on-quarter, but increasing 3.3% year-on-year. The nine banks under its coverage are Bangkok Bank (BBL), Krungthai Bank (KTB), Siam Commercial Bank (SCB), Kasikornbank (KBank), Bank of Ayudhya (BAY), Thanachart Bank, TMB Bank, Tisco Bank and Kiatnakin Bank.

The lower results mainly stem from the zero-fee scheme for online transactions introduced in March, covering internet and mobile banking.

KBank, the country’s fourth-largest lender by assets and top-ranked in mobile banking service, is expected to be hardest-hit by the no-fee scheme.

KGI has cut its outlook for KBank’s transaction fee income to 9.68 billion baht for the second quarter, declining 70% from the previous forecast. As well, the bank’s non- interest income (NII) for the second quarter is expected to decline 18% year-on-year.

KGI also cut its outlook for transaction fee income of the other big three players: Siam Commercial Bank (SCB) by 50%, Bangkok Bank (BBL) and Krungthai Bank (both by 40%). The negative factor, on a year-on-year basis, will lower the NII of BBL by 5%, KTB (6%) and SCB (7%).

Maybank Kim Eng Securities predicts the eight banks excluding BAY will post a total net profit of 40.3 billion baht for the second quarter, down 11% quarter-on-quarter, but rising 4% year-on-year.

The lower earnings, on a quarter-on-quarter basis, are being pinned on the scrapping of the transaction fees for the big four banks.

KBank, with the largest number of mobile banking users in the industry (8.4 million), will be most affected. The bank’s second quarter net profit is expected to drop 19% quarter-on-quarter, followed by 14% for KTB, 10% for SCB, and 6% BBL.

Despite lower fee-based income, loan loss provisions for the big players will decline from the previous quarter, in line with asset quality.

Kattiya Indaravijaya, KBank’s president, said the bank estimates lower fee-based income in the second quarter of this year than in the first quarter after the bank eliminated banking transaction fees over digital channels in late March.

Apart from the free service for online banking transactions, higher prudence on bancassurance and mutual fund sales under the central bank’s market conduct regulations is another key factor dampening fee income.

Meanwhile, the bank expects net interest margin (NIM) growth of 3.2-3.4% for 2018.

The improving NIM is expected to be supported by better financial cost management among positive loan demand, in line with robust economic growth, while interest rates remain unchanged.

The Bank of Thailand is expected to maintain its repurchase rate at the existing level of 1.5% by the end of the year.

Source: https://www.bangkokpost.com/business/finance/1504174/banks-feel-dropped-fee-pinch

English

English