Thailand: Applications for VAT refund agents to open

The Revenue Department is set to open applications for permanent downtown value-added tax (VAT) refund agents after satisfactory outcomes during a trial run, with higher sales from VAT-free shops to tourists.

The tax-collecting agency is outlining the application process, which is expected to be completed soon, said director-general Ekniti Nitithanprapas.

The department was satisfied with the trial run of five downtown VAT refund agents, saying the service helped boost sales of shops with free VAT for tourists, he said.

The five agents included Counter Service Co, VAT Refund Centre Thailand Co and Thai VAT Refund Co.

During the trial run, each was allowed to open up to five locations for the service.

Mr Ekniti said allowing interested companies to apply for downtown VAT refund service for tourists is meant to boost domestic sales.

Applicants who win approval as VAT refund agents will be allowed to provide such services at any location, but the Revenue Department prefers the service points at airports in other provinces, he said.

The department does not expect higher VAT refunds for tourists, but it wants to make the refund process more convenient, encouraging them to spend more in Thailand, Mr Ekniti said.

Before the trial run of VAT refund agents, about 2 million foreign tourists reclaimed sales tax worth 2-3 billion baht a year.

To be eligible to claim a VAT refund, foreign tourists must spend at least 2,000 baht per store per day, and are required to show expensive items such as watches, pens, smartphones, jewellery, bags, belts and laptops to revenue officials after clearing immigration to ensure that these products are taken out of Thailand.

For the downtown VAT refund service during the trial run, the maximum VAT refund is 12,000 baht.

Claimants must depart from Suvarnabhumi or Don Mueang airports within 14 days after the date of the downtown VAT refund claim, and goods must be taken out within 60 days from the date of purchase.

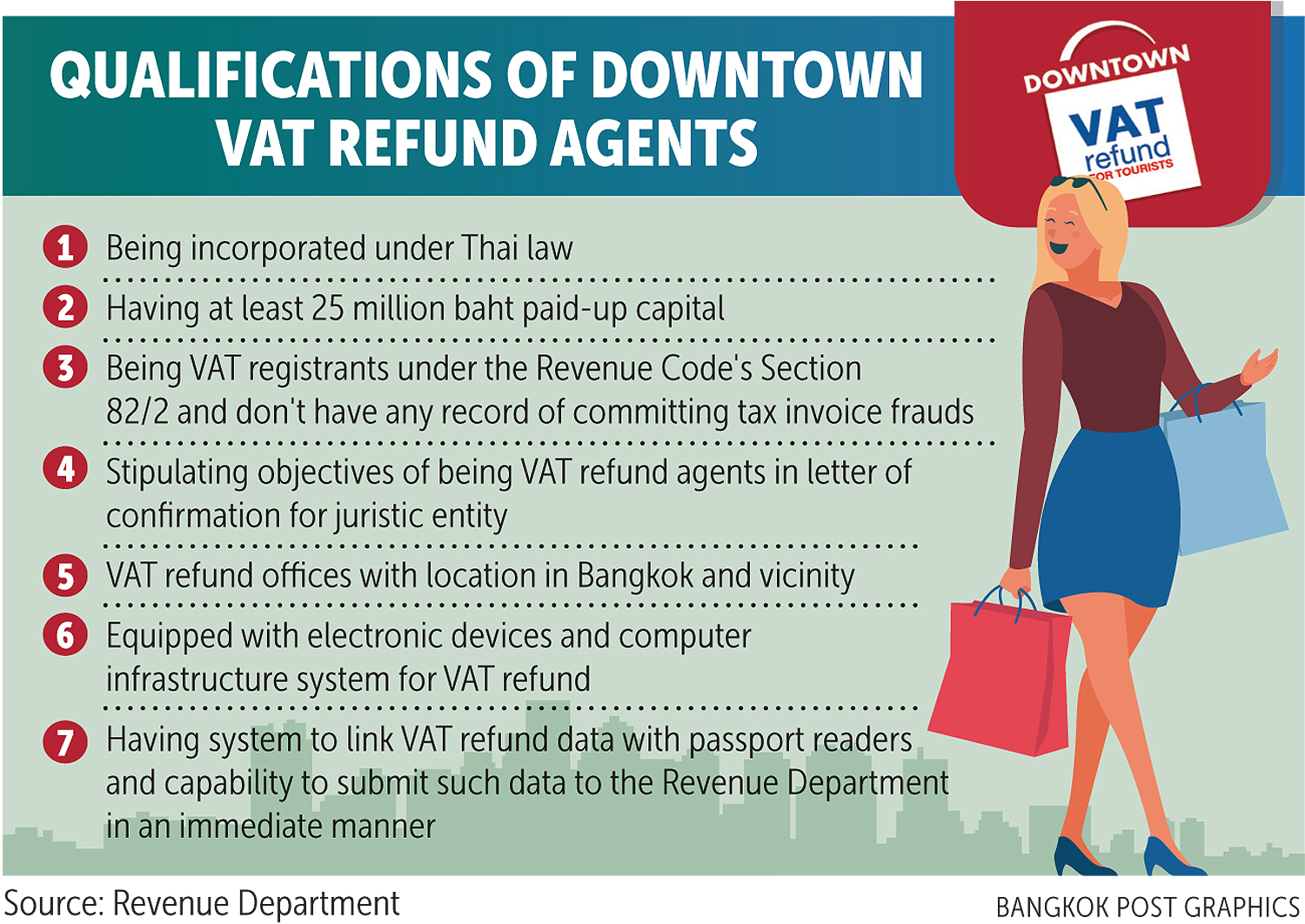

Qualifications for downtown VAT refund agents during the trial period include that they must be incorporated under Thai law, with at least 25 million baht in paid-up capital.

Their VAT refund offices must be located in Bangkok and the vicinity, and they must have a letter of confirmation for a juristic entity stipulating the objective of being a VAT refund agent.

Agents must be equipped with electronic devices and a computer infrastructure system for VAT refunds, as well as have a system that links VAT refund data with passport readers, with the capability to submit such data to the Revenue Department in an immediate manner.

Source: https://www.bangkokpost.com/business/1756084/applications-for-vat-refund-agents-to-open

English

English