Reform of Indonesia’s sluggish manufacturing sector urgently needed: Analysts

The downturn in Indonesia’s manufacturing sector is likely to continue until the end of the year as demand and factory activity will remain low even after the COVID-19 pandemic ends, analysts have warned.

Centre for Strategic and International Studies economic department head Yose Rizal Damuri said that the sluggish growth of Indonesia’s manufacturing industry, which was the worst among Asian countries in April, may further decline in the coming months as demand would remain low and many factories would remain closed.

“Looking ahead, manufacturing industry will indeed experience a downturn because the market is dwindling,” Yose told The Jakarta Post on April 6.

In addition to the closure of many factories especially in Jakarta, Banten and West Java, the decline in manufacturing growth is also a result of difficulties in the procurement of raw materials abroad.

He said the country’s manufacturing industry was heavily reliant on raw materials from overseas, which were hard to get during the crisis because of lockdown measures that not only disrupted distribution but also led to the closure of many factories.

Consumers were also delaying the purchase of manufactured goods that are durable and considered nonessential, with the exception of a few products such as health equipment, Yose told the Post.

He believed that the trade in manufactured goods would take longer to recover from COVID-19 than from the 2008 financial crisis. “In the past, the problem was demand. Now, the problem is demand and supply.”

He went on to say that for spending on manufacturing goods to return, people needed to be able to maintain a steady job with a stable income. Without that sense of security, it is possible that the demand for manufactured products would not recover even after the pandemic ended as people were still uncertain about spending.

“We should take this as an opportunity for structural reform,” he said, noting how even before the pandemic Indonesia’s manufacturing industry had been stagnating and was not considered to be an attractive place for investment.

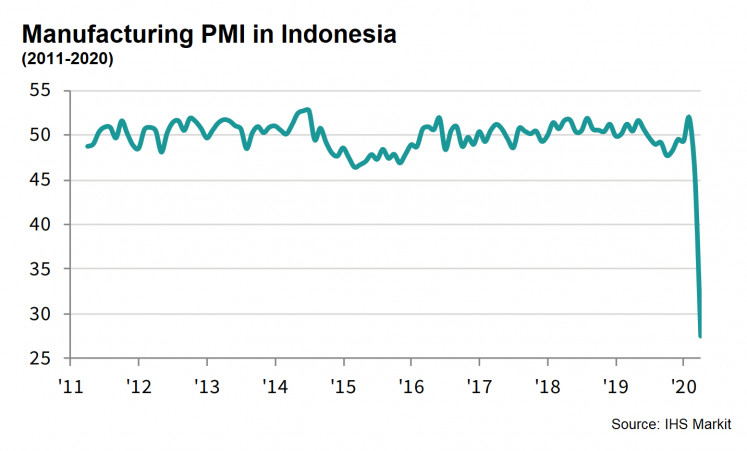

Manufacturing Index (manufacturing/IHS Markit)

Manufacturing Index (manufacturing/IHS Markit)

Foreign investment has fled to neighboring countries such as Vietnam and Cambodia, which are deemed to be more competitive.

According to Statistics Indonesia (BPS) data published on May 5, manufacturing growth slowed to 2.06 percent in the first quarter of 2020 from 3.85 percent recorded during the same period last year.

Its contribution to the country’s gross domestic product (GDP) has also declined. In the first three months of the year, manufacturing industry accounted for 19.98 percent of GDP, a decline from 20.06 percent reported in the previous year, BPS data show.

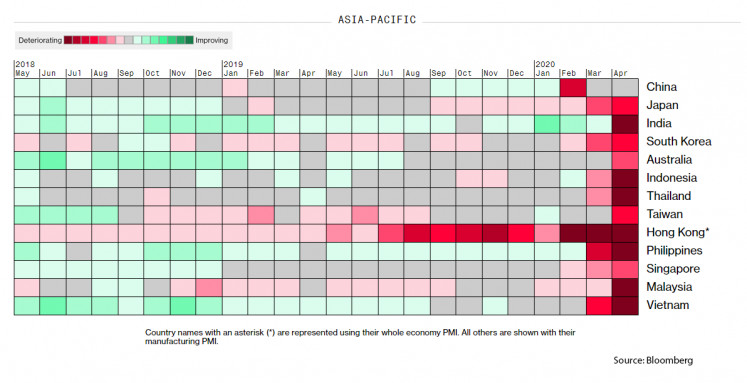

Meanwhile, data firm IHS Markit announced on May 4 that Indonesia’s Purchasing Managers Index (PMI), a gauge of the nation’s manufacturing activities, fell to 27.5 in April from the 45.3 recorded in March, the worst decline in the survey’s nine-year history and the steepest drop recorded in Asia. South Korea reported a PMI of 41.6; Taiwan 42.2; Vietnam 32.7; Malaysia 31.3; and the Philippines 31.6.

“We expect manufacturing industry to record only 1.5 percent growth in 2020, implying a 230-basis points [bps] reduction compared with the 2019 figure,” Mirae Asset Sekuritas Indonesia economist Anthony Kevin wrote in an economic outlook report published on April 30, explaining that the “major setback” projected for the industry throughout 2020 would be a result of weak international trade.

Aside from weakening global trade, Bahana Sekuritas pointed to falling domestic demand to contribute to the industry’s gloomy outlook: “Core inflation, a representation of aggregate demand, defied historical patterns as it tumbled during the Ramadan month,” the securities firm said in its weekly report published on May 5.

Institute for Development of Economics and Finance (Indef) senior economist Aviliani expressed similar views. The downward trend in Indonesia’s manufacturing industry could carry on even after the crisis ends if there are no structural changes within the industry.

“If we don’t get ourselves ready from now [and] change the structure of our industry, we will have a big problem in the future,” she told the Post, adding that the government had to be strategic in selecting the country’s top industries to be promoted in the global value chain.

Government incentives, such as tax cuts had to be addressed for those selected industries, a task for the Industry Ministry and Finance Ministry to figure out, she said.

Manufacturing Index (manufacturing/Bloomberg)

Manufacturing Index (manufacturing/Bloomberg)

Indonesian Employers Association (Apindo) deputy chairman Bob Azam told the Post that many of its members’ cash flows could only sustain them until June.

“The manufacturing sector has been pressed for three months, so by June, it needs to get back on its feet. If not, the industry will collapse, impacting employment as it’s a labor-intensive sector,” Bob said on April 6, hoping that the relaxation of social restriction measures would be accelerated so that by July 50 percent of industry could operate again and by the first quarter next year manufacturing could run at full speed.

When asked about the worst-case scenario, he said it could take the industry two to three years to recover to the rate before the pandemic occurred if the handling of the crisis was ineffective

On April 30, Coordinating Economic Minister Airlangga Hartarto said in an online briefing that only 15,000 manufacturing companies were still operating at present out of a total of 40,000 in normal times. Meanwhile, 4.7 million workers in the sector were still working, out of 17 million workers previously.

Source: https://www.thejakartapost.com/news/2020/05/11/reform-of-indonesias-sluggish-manufacturing-sector-urgently-needed-analysts.html

English

English