Philippines: Uptick risks hardly erased as inflation steadies in April

MANILA, Philippines — The annual pace of inflation was steady in April from March, a welcome stability coming off from an easing the prior month but one that analysts said remained vulnerable to future surges.

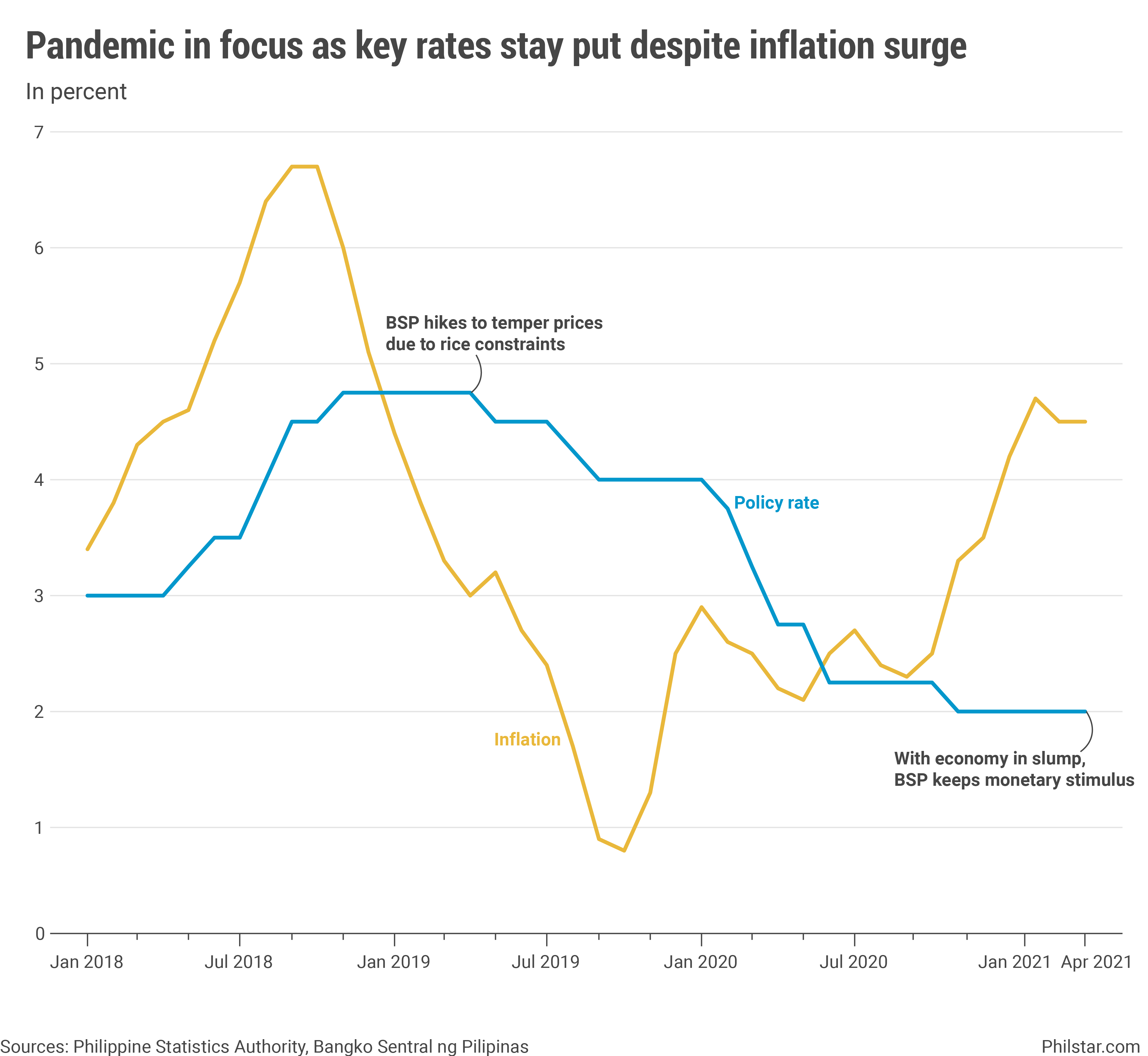

For now, inflation at 4.5% year-on-year in April would remove some pressure from the Bangko Sentral ng Pilipinas (BSP) to act against rising prices it said are coming from tight food supplies that monetary policy cannot influence. The reprieve started in March when inflation slowed from a 2-year high of 4.7%, and last month’s result fell comfortably within the 4.2-5% forecast for April.

Government statisticians that reported the data on Wednesday noted some decline in prices of rice, fruits and vegetables— the latter until recently were fanning inflation due to low supplies after crops were damaged by typhoons last year. That now proved to be transitory, as the central bank had projected, and are now stabilizing.

But not all food items are following a decelerating trend. Meat prices have remained stubbornly high in April, fueled by pork hurt by the lingering African swine fever. The epidemic, which has killed 400,000 pigs, is worrying government inflation hovering above the 2-4% annual target would exacerbate the hardships of consumers already suffering stripped incomes due to the pandemic.

According to official calculations, pork inflation rose 57.7% year-on-year in April, up from March’s rate of 51.8%. That already went down from over 70% in January. In Metro Manila which is heavily dependent on pork supplies from the provinces, average prices rose a heftier 68.5% from 54.4%, signaling the recent climb was disrupted only briefly by price ceilings enforced for 60 days and lapsed already last month.

The problem is the pork situation is not getting any better and is in fact spreading outside the capital region where pork inflation hit 55.5% on-year in April from March’s 51.3%. In Metro Manila alone, a 1-kilogram of pure meat cost an average of P360 from P329 from a month ago, while those with bones increased to P331 from P302.

“We are already seeing some decline in prices in rice, corn and even fruits and vegetables…But there are still some items that pushed up prices,” National Statistician Claire Dennis Mapa said in a briefing.

The polarizing trend on some food products reveal that the Philippines is not yet out of the woods in battling inflation this year. Beyond pork, transport costs are showing signs of strain from higher oil prices, with fares following suit as a cap on public transport since last year fail to meet commuter demand just as the economy have reopened. The transport subindex rose an annual 17.9% in April, sustaining a rise from August last year when it was only 6.3%.

Despite the threat that inflation poses to other products and services, BSP Governor Benjamin Diokno has led a seven-man team at the Monetary Board to stay unfazed and focus instead on ensuring the pandemic-stricken economy gets the monetary boost that it needed. Policy rates used by banks to price their loans have been kept steady at record-low of 2% in a so far futile attempt to get the banks to lend.

“The balance of risks to the inflation outlook remains balanced around the baseline path in 2021, while toward the downside in 2022,” Diokno said. “The ongoing pandemic continues to pose downside risks to the inflation outlook and growth prospects.”

“However, improvements in external demand as well as continued rollout of the government’s COVID-19 vaccination program and other stimulus measures will bolster economic recovery,” he added.

Economists are divided on whether inflation have already peaked and is now set for a much-needed easing. Sanjay Mathur, Southeast Asia chief economist at ANZ Bank, does not want to celebrate yet due to uncertainties posed by movement restrictions that have come and go in Metro Manila and key urban areas. Last year, observers agreed that lockdowns depressed consumer demand that eventually floored prices.

This time however, lockdowns in Metro Manila, Bulacan, Rizal, Laguna and Cavite last month were not that strict, and some people were even allowed to commute to workplaces. Even Mapa of the Philippine Statistics Authority was hesitant to speculate whether the same demand-dissipating impact was a factor for the leveling off of prices last month.

Nicholas Antonio Mapa, senior economist at ING Bank in Manila, said inflation can start decelerating convincingly in May and June if pork supplies improve. That, in turn, is heavily dependent on the outcome of a policy that lower pork tariffs and relaxes quantitative restrictions in meat, one staunchly opposed by senators.

For now, BSP intends to use this new inflation data and next week’s reporting of the first quarter gross domestic product to guide its monetary policy decision on May 13. “The BSP remains watchful over the evolving economic conditions and challenges brought about by the pandemic,…” Diokno said.

Source: https://www.philstar.com/business/2021/05/05/2096046/uptick-risks-hardly-erased-inflation-steadies-april

English

English