Philippines: Inflation leaps to 3-year high of 4%

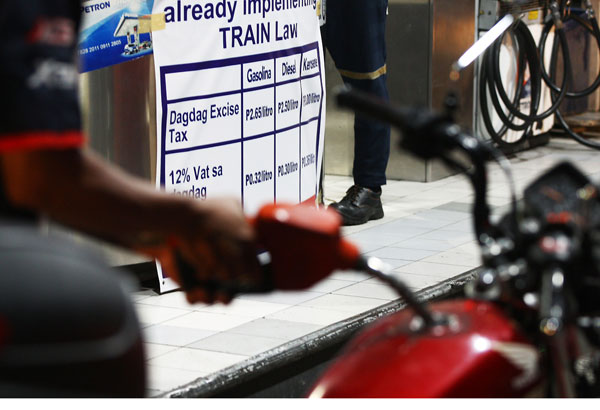

MANILA, Philippines — Inflation leapt to its highest level in more than three years at four percent in January from 3.3 percent in December as the implementation of the tax reform law translated to higher prices, the Philippine Statistics Authority (PSA) reported yesterday.

This was the highest level for the consumer price index (CPI) since averaging 4.3 percent in October 2014.

Excluding selected food and energy items, core inflation picked up to 3.9 percent in January from three percent in December.

“The push in inflation is partly due to TRAIN, considering particularly the excise on fuel and additional sin taxes,” Socioeconomic Planning Secretary Ernesto Pernia said.

He reiterated, however, that the effects of the TRAIN, which overhauled the country’s tax system for the first time in two decades, would be “minimal and temporary.”

The CPI last month also touched the higher end of the two to four percent target between 2018 and 2020 as well as the 3.5 to four percent forecast for January set by the Bangko Sentral ng Pilipinas (BSP).

Although inflation was at the top end of the forecast for the month, BSP Governor Nestor Espenilla Jr. said the higher reading was expected “due mainly to the combined first round effects of the implementation of Republic Act 10963 or the Tax Reform for Acceleration and Inclusion (TRAIN), oil prices, and food to some extent.”

“We think these are temporary drivers of inflation and would eventually stabilize,” he said.

The TRAIN Law signed by President Duterte last Dec. 19 lowered personal income tax rates but raised the excise tax rates slapped on oil, cigarettes, motor vehicles, and sugary drinks.

Based on its December assessment, the BSP’s Monetary Board forecasts inflation to pick up to 3.4 percent this year before easing to 3.2 percent in 2019. Inflation kicked up to a three-year high of 3.2 percent last year from 1.8 percent primarily due to higher pump prices of petroleum products.

The benign inflation environment and robust domestic demand have allowed the BSP to keep interest rates low over the past three years to support the growing economy. It last raised rates by 25 basis points in September 2014.

“Nevertheless, BSP will be closely monitoring the situation and stand ready to take timely action based on our evaluation of all relevant data,” Espenilla said.

The BSP chief said earlier said the first round upward inflationary effects of TRAIN are transitory but monetary authorities would closely assess the next round effects and how inflation expectations would be affected.

The PSA said the uptrend in inflation last month was primarily due to higher annual increment in the heavily-weighted food and non-alcoholic beverages index to 4.5 percent in January from 3.5 percent in December.

The index for alcoholic beverages and tobacco registered a double-digit annual mark-up to 12.3 percent from 6.4 percent as the implementation of the TRAIN law in January raised prices of cigarettes and alcoholic beverages in most of the regions.

Likewise, other commodity groups recorded higher increases led by restaurant and miscellaneous goods and services with 3.7 percent; transport with 3.2 percent, health with 2.6 percent as well as furnishing, household equipment and routine maintenance of the house with two percent.

The country’s food alone index jumped to 4.5 percent last month from 3.7 percent in December as weather disturbances affected supplies of fish and vegetables in the markets.

The National Economic and Development Authority (NEDA) said there is a need to fasttrack the provision of cash transfers to vulnerable sectors and liberalize rice trade to drive down the price of the staple.

“With the initial inflationary effects of TRAIN, we must ensure faster provision of financial assistance through the unconditional cash transfer (UCT) program,” Pernia said.

This, he said, will help the poorest 50 percent of Filipino households cope with the transitory impact of TRAIN on prices, he added.

He also reiterated the agency’s call to replace quantitative restrictions on rice imports with tariffs to stabilize the country’s rice supply and lower the price of rice.

“When the quantitative restrictions are replaced by tariffs, the government will also be better able to help enhance the country’s competitiveness and productivity in agriculture. Revenues from tariff on imported rice will be used to finance government programs for agriculture,” he said. – With Czeriza Valencia

Source: http://www.philstar.com/business/2018/02/07/1785222/inflation-leaps-3-year-high-4

English

English