Philippines: ‘Economy to shrink by 1%’

BSP says flat growth is best case scenario

MANILA, Philippines — The Bangko Sentral ng Pilipinas (BSP) expects the economy to contract by as much as one percent this year as monetary and fiscal authorities ramp up efforts to prepare for a soft landing amid the coronavirus disease 2019 or COVID-19 pandemic.

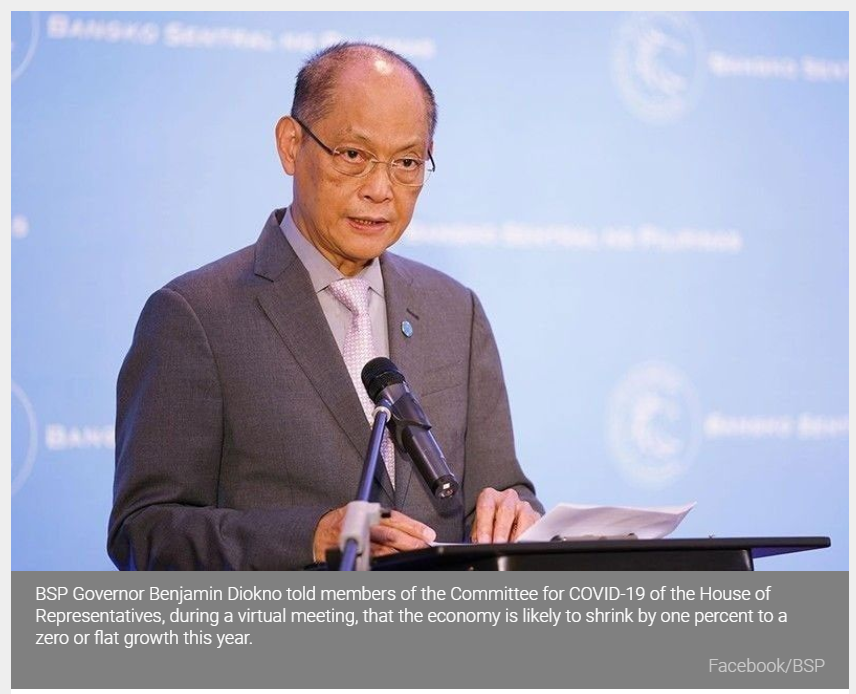

BSP Governor Benjamin Diokno told members of the Committee for COVID-19 of the House of Representatives, during a virtual meeting, that the economy is likely to shrink by one percent to a zero or flat growth this year.

“Worst case is negative one, best case is zero. Many things can still happen,” Diokno said. The last time the Philippine economy contracted was in 1998 or during the Asian financial crisis at negative 0.6 percent.

Diokno said he has instructed BSP Deputy Governor Francisco Dakila Jr. to compute the quarterly growth under the current scenario. “We are still finalizing,” the BSP chief said.

The Philippines has booked 84 straight quarters of positive growth despite a slower growth of six percent last year due to soft global markets amid the US-China trade war, the tightening cycle by the BSP that saw interest rates jump by 175 basis points, and the delayed passage of the 2019 national budget.

Economic managers through the Development Budget Coordination Committee (DBCC) originally penned a GDP growth target of 6.5 to 7.5 percent for this year.

However, the DBCC is now looking at a contraction of 0.8 to one percent or a flat growth this year due to the impact of the health crisis.

Aside from the global virus outbreak, the Philippines was also hit by natural disasters including Typhoon Tisoy late last year as well as the eruption of Taal Volcano early this year.

Amid the benign inflation environment, Diokno said the BSP has so far reduced interest rates by 125 basis points so far this year, bringing the overnight reverse repurchase rate to an all-time low of 2.75 percent and the overnight deposit and lending rates to 2.25 percent and 3.25 percent, respectively.

In all, the central bank has slashed interest rates by 200 basis points from 4.75 percent since May last year, reversing the cumulative 175 basis points rate hike in 2018 due to an inflation breach.

“This was designed to ensure adequate liquidity in the financial system and help reduce borrowing costs,” he told legislators yesterday.

Diokno has been undertaking bolder moves including deeper rate cuts as well as further lowering of the reserve requirement ratio to prepare a soft landing for the economy as businesses came to a grinding halt after Malacañang imposed a Luzon-wide enhanced community quarantine.

Source: https://www.philstar.com/business/2020/04/22/2008843/economy-shrink-1

English

English