Malaysia set to buck global foreign direct investment trend

PETALING JAYA: Amid a global declining trend in foreign direct investment (FDI) due to weaker economic growth, Malaysia’s FDI inflows are set to buck the trend.

Economists are bullish on the country’s FDI inflows this year despite the downside risks from weaker economic global growth and uncertainties that could impact the inflows.

Sunway University Business School economics professor Yeah Kim Leng told StarBiz it is likely that global FDI would continue to decline in 2018 and 2019 due to slower global demand and rising trade tensions.

However, he said Asean may see sustained FDI inflows due to rising trade integration and infrastructural development augmented by projects under China’s Belt and Road Initiative as well as trade and investment diversion from the US-China trade war.

“The reconfiguration of global supply chains arising from the US-China trade tension could see higher FDI from China and the US into Asean countries.

“Malaysia, being a top recipient of global FDI in the region, will see enhanced prospects of receiving some of these diversions,” he said.

Yeah, however, cautioned that there is a downside risk that weaker global growth prospects amid heightened global uncertainties may dampen FDI flows in 2019.

Up till 2015, Malaysia was the third-largest recipient of FDI in the region but has since been overtaken by Indonesia and Vietnam, with Singapore still maintaining the pole position among Asean countries.

While Malaysia still has considerable advantages in terms of location, infrastructure quality and resource endowment, he said these factors have become less important in the digital economy where top-class talent, an adaptive workforce, efficient and integrated business services, as well as pro-active and consistent policies matter more to investors.

To create a more conducive and supportive investment environment, Yeah felt the Pakatan Harapan (PH) government could leverage on its institutional reforms as well as its clean and corruption-free image to attract a higher level of FDI.

He added that PH has to demonstrate that it is not a one-term government, as political stability is a prime concern, especially among first-time greenfield investors.

AmBank Group chief economist Anthony Dass said despite a moderated gross domestic product growth of 4.5% this year, he foresees a favourable FDI trend this year.

Malaysia would continue to attract FDI as a result of its competitiveness, he noted.

“The country has advanced nine places to the 15th spot among 190 economies worldwide in the World Bank’s Doing Business 2019 Report, which based its rankings on business regulations and ease of doing business, large reforms in terms of starting a business and dealing with construction permits.

“Malaysia is ranked second among Asean countries with a score of 80.60, behind Singapore but ahead of Thailand (27th), Brunei (55th), Vietnam (69th), Indonesia (73rd) and Myanmar (171th).

“On that note and with certain tariffs placed on Chinese goods by the US, there could then be a reshuffling of the supply chain to take production out of China and move it to other countries, including Malaysia,” Dass said.

Other economists foresee the manufacturing sector to remain as the centre of attraction with regards to FDI flows. Approved FDI numbers last year showed strong appetite in this sector, which rose by RM35bil in the first nine months of 2018 or 250% to RM49bil compared with RM14bil recorded in the same period in the previous year.

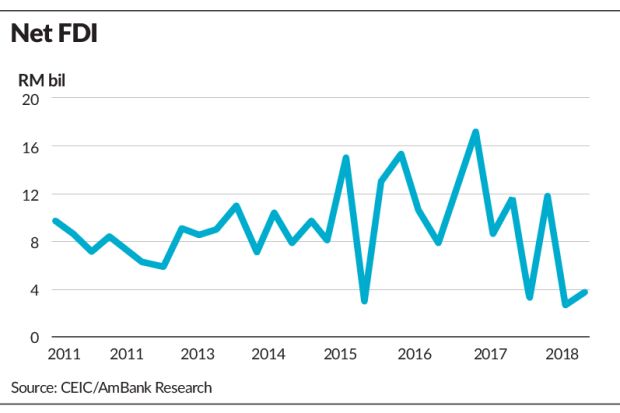

Malaysian Rating Corp Bhd chief economist Nor Zahidi Alias said in spite of a notable decline in FDI net inflows in the first nine months of 2018, the country’s current economic condition remained conducive to foreign investors. For the first nine months of last year, net inflows stood at RM18.8bil against RM41.0bil in 2017.

Besides the external headwinds, he said certain aspects of the domestic labour market could draw investors’ attention, like the declining trend of labour productivity in the manufacturing sector. The sector saw labour productivity falling from around 5.1% year-on-year (y-o-y) in the first quarter of 2015 to 2.2% y-o-y in the third quarter of 2018.

“We expect a continuing trend of inflows into the manufacturing sector, although weaker export performance this year could limit the amount of investments into the sector this year.

“Inflows of FDI could remain relatively strong in export-oriented industries such as petroleum and petrochemicals, electrical and electronics (E&E) as well as basic metals.

“In the first nine months of last year alone, the amount of total approved investments in the manufacturing sector surged to RM59.1bil, higher than the amount recorded in the corresponding periods in 2016 and 2017 (2016: RM41.0 bil; 2017: RM35.0bil),” Zahidi noted.

Bank Islam chief economist Mohd Afzanizam Abdul Rashid said global FDI could turn around this year after almost a 19% decline in 2018. Last year’s decline was largely due to the repatriation of accumulated foreign earnings by the US multinational enterprises.

Based on the latest United Nations Conference on Trade and Development report, he said the repatriation exercise should fade this year, adding that this would improve FDI inflows into the country.

In view of the external headwinds slowing global growth, economists said there are ways to further boost FDI inflows into the country.

Afzanizam said although Malaysia may not be able to compete with low-wage countries like Vietnam, for example, the country had an edge over its regional counterparts in terms of infrastructure, such as a reliable supply of electricity, ports, highways, telecommunications and a pool of talented labour, especially the technical and vocational education training graduates.

“Identifying the right industries that would benefit most from the trade diversion is paramount to harness the fullest potential of our resources. “Against such a backdrop, efforts should be directed at how to ease foreign companies’ experience whenever they approach Malaysia as their investment destination,” he noted.

Dass felt it is more important to continue to ensure that the government provides a business-friendly environment for foreign investors.

“We are currently ranked second at 80.6 against Singapore’s reading of 85.24 in the Asean region and behind Hong Kong (84.22) and South Korea (84.14) based on the World Bank’s 2019 report.

“So, we need to fix some of the opaque policies that could change overnight. It is important to remember that at the end of the day, when investors look at where to put their money, they want it to go to a place where they know this is what would happen in the next 10 years.

“Also, with Malaysia pushing for a more industrial revolution 4.0-friendly environment, it should ensure that it prepares the market with the necessary skills,” he said.

Dass said Malaysia should focus more on investment that drives productivity than focusing on “cherry-picking” sectors.

To spur FDI inflows, it is crucial to restore investors’ confidence, forge strong engagement between the relevant authorities and investors, and bring in more investments towards high-tech and capital-intensive industries, with the digital economy at the forefront, he said.

Zahidi noted that to attract FDI inflows, there is a need to break up industry monopolies by reducing barriers to entry. This would help foster competition, innovation and entrepreneurial spirit, he said.

Source: https://www.thestar.com.my/business/business-news/2019/02/04/msia-set-to-buck-global-fdi-trend/#HPQ1oq3QFzGr8awW.99

English

English