Malaysia: Private consumption growth faces headwinds

KUALA LUMPUR: There are potential headwinds that could moderate private consumption growth in Malaysia to around 6.5% in the second half of 2022 (2H22) and 2023, according to UOB’s Global Economics and Markets Research unit.

It said higher global uncertainties, rebalancing of household expenditure amid weaker household balance sheet, expiry of pandemic policy measures by mid-year (such as lower Employees Provident Fund or EPF employee contribution rate, special EPF withdrawal facility, special financing assistance, and exemption of sales and service tax for vehicle purchases), coupled with higher cost of living and interest rates, could restrain the strength of private consumption.

These headwinds could be countered through wider job opportunities, higher incomes and direct cash subsidies to consumers.

“But there runs the risk of fanning demand-driven inflation pressures that will have to be managed with larger quantum of rate hikes.

“Easier interest-free financing options (buy now, pay later) can provide more room for consumption growth albeit at the expense of potentially higher consumer debt, which is unsustainable in the medium term,” it said.

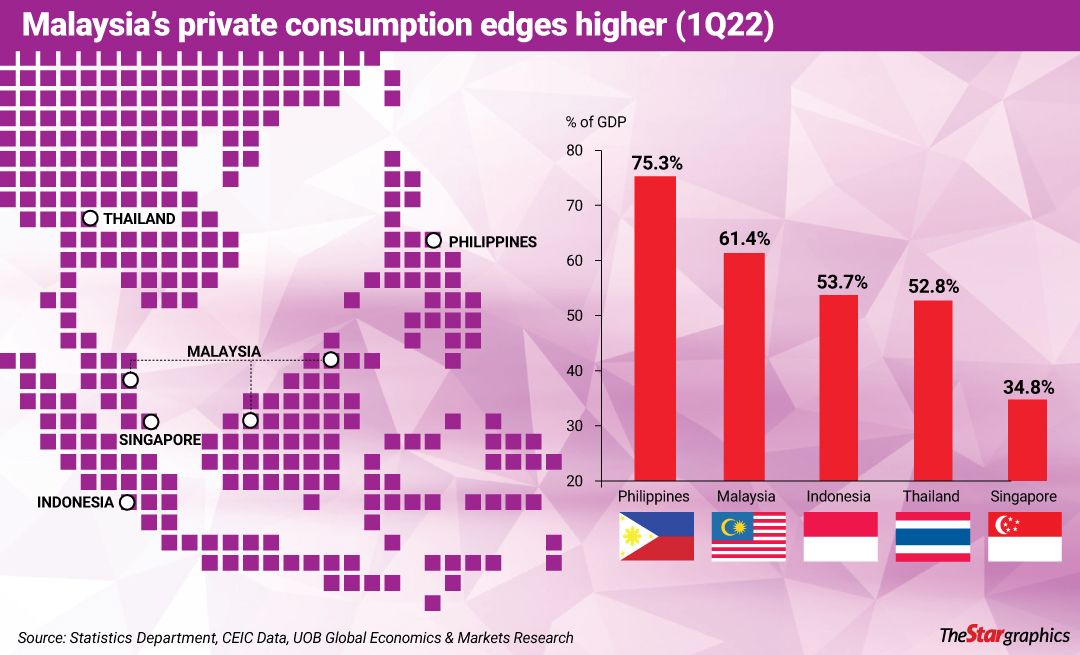

It also noted that a recovery in private consumption has powered Malaysia’s gross domestic product (GDP) performance to date, with a robust 5.5% growth and 3.4-percentage-point contribution to overall growth in the first quarter of 2022 (1Q22).

This follows the reopening of the economy, further easing of containment measures, higher vaccination rates and improving labour market conditions.

“We expect more tailwinds to drive private consumption in 2Q22, thanks to the full reopening and Hari Raya festive spending, pent-up demand and higher consumption of services,” said the research unit.

Source: https://www.thestar.com.my/business/business-news/2022/06/09/private-consumption-growth-faces-headwinds

English

English