Malaysia: 5%-6% loan growth seen for 2019

PETALING JAYA: The banking sector is not expected to see a significant rise in loans and earnings next year amid a tough investment environment and margin compression.

Bankers and analysts, however, said the sector would hold up and are maintaining their 2018 average loan and earnings growth projections for next year.

They are forecasting an average loan growth of between 5% and 6% and earnings growth of 6% to 8% next year. OCBC Bank (M) Bhd CEO Datuk Ong Eng Bin (pic), when contacted by StarBiz, said the overall sector outlook remains stable next year, underpinned by favourable operating conditions.

Whilst loan growth is expected to be at mid-single-digit levels, he said it was still at a point that is able to support profit growth if banks managed their portfolios well.

“The bank’s loan growth should be in line with the industry growth of 5%-6% for 2019 and will be largely driven by corporate and commercial loans, as well as the retail commercial segment,” Ong added.

In terms of margins, he said there was an improvement in net interest margin (NIM) this year and expects it to be stable next year.

NIMs showed an improvement when the overnight policy rate was hiked by 25 basis points (bps) in January, but was negated with the gradual repricing of fixed deposits in the second quarter coupled with deposit competition.

A banker said the performance of the sector would much be dictated by the growth of the country’s economy and economic policies under the current government. “But is fair to said the loan growth for next year will be in the range of 5% to 6% barring any unforeseen circumstances. If the US-Sino trade spat continues couple with US interest rate hikes, then there could be outflow of funds from the country and this could impact the local capital markets and fee income of banks,’’ he noted.

Economist are forecasting a gross domestic product (GDP) growth of between 4.5% and 4.8% for 2019 underpinned by private sector spending and between 4.6 and 4.8% for 2018. The country’s economic growth charted an annual rate of 4.4% in the third quarter of 2018, the slowest pace in almost two years.

Meanwhile, analysts remain bullish on the sector despite headwinds, with some like Maybank IB Research maintaining their “neutral” stance and a couple, including AmInvestment Bank, holding their “overweight” call on the sector. RAM Ratings co-head of financial institution ratings, Wong Yin Ching, said residential property mortgages would remain as the key growth driver, although expansion in this segment has been moderating gradually.

“RAM continues to maintain a stable outlook for the Malaysian banking sector in 2019. Loan growth is projected to stay flat next year at around the 5%-6% level underscored by our GDP growth expectation of 4.6% next year against our forecast of 4.7% for this year,” she noted.

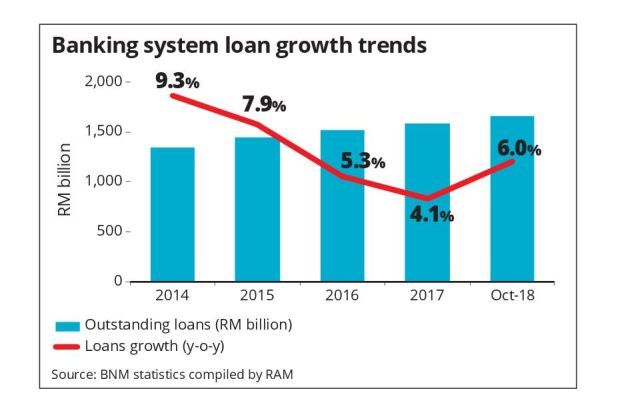

Based on the latest October 2018 data, loan growth stood at 6% year-on-year (y-o-y). While leading indicators such as growth in loan applications and approvals remained positive in the first 10 months of 2018, Wong said the rating agency was cognisant of the uncertain external demand and the more challenging business climate.

The RAM Business Confidence Index (BCI), which surveyed close to 3,500 SMEs and corporates on their business outlook over the next six months, further corroborated the agency’s views, she said. The BCI indicated that investment sentiment, though still favourable, was weaker for both domestic and export-oriented firms for the fourth quarter of 2018 to the first quarter of 2019.

Growth in low-cost current and savings account deposits (CASA) has also been slowing, which could put a lid on NIMs, she added. “Overall, we are of the view that there will be a mild downside for NIMs in 2019,” Wong said.

CIMB Research senior banking analyst Winson Ng, who is projecting a loan growth of about 5% for 2019, said NIMs would further contract by three to five bps quarter-on-quarter in the fourth quarter of 2018 and expects continued NIM compression next year due to continuous competition for deposits.

For 2019, the research house is forecasting a net earnings growth of 8%, based on the assumptions of a net interest income growth of 5.2%, an expansion of 6.7% in non-interest income, an increase of 5.5% in overheads, a marginal 0.7% rise in loan loss provisioning and a loan growth of around 5%. For 2018, Ng is projecting a net profit growth of 7.2% for the sector.

In view of domestic concerns and external headwinds, he still sees risks of an uptick in the gross impaired loan (GIL) ratio to 1.8% by end-2019.

The industry’s GIL ratio improved further from 1.53% at end-September to another all-time low of 1.52% at end-October. “Looking at the year-to-date trend, the GIL ratio could end 2018 at below our projected 1.8%,” Ng noted.

On NIMs. AmInvestment Bank analyst Kelvin Ong feels that NIMs of bank subsidiaries, namely, Malayan Banking Bhd  (Maybank) Indonesia and PT Bank CIMB Niaga Tbk, are likely to still encounter margin pressures in 2019 although lesser than in 2018. This will be engendered by the rise in interest rates in Indonesia to mitigate the impact of another two Fed rate hikes next year, he said.

(Maybank) Indonesia and PT Bank CIMB Niaga Tbk, are likely to still encounter margin pressures in 2019 although lesser than in 2018. This will be engendered by the rise in interest rates in Indonesia to mitigate the impact of another two Fed rate hikes next year, he said.

With the 10-year Malaysian Government Securities (MGS) yields unlikely to trend significantly lower going into 2019 with the looming of further US interest rate hikes, he said this could result in softer issuances of new sukuk/bonds next year.

“Markets are expected to remain volatile in the near term, and it continues to look challenging on banks’ fee income, particularly, the investment banking and fund-management business. For 2019, we have already projected a lower non-interest income for the larger-capitalised banks, like Maybank and CIMB Group Holdings Bhd  ,” he added. For GIL, he expects asset quality for banks to remain stable in 2019, albeit an anticipated slight uptick in the GIL ratio. The GIL ratio for domestic loans could inch up in 2019 from 1.5%, while that of overseas loans is expected to be holding up, barring any deterioration in oil prices and escalation in the US-China trade war.

,” he added. For GIL, he expects asset quality for banks to remain stable in 2019, albeit an anticipated slight uptick in the GIL ratio. The GIL ratio for domestic loans could inch up in 2019 from 1.5%, while that of overseas loans is expected to be holding up, barring any deterioration in oil prices and escalation in the US-China trade war.

Loan exposure to the commercial real estate, construction, and oil and gas sectors is likely to be closely monitored, he added. On allowances for loan losses, Ong said he expects provisioning to be slightly higher in 2019 versus 2018, owing to the slowdown in economic growth, noting that the research house has factored in a moderately higher credit cost assumption of 27bps for the sector in 2019 versus 25bps in 2018.

Maybank IB Research in a report this month said it expects aggregate net earnings growth for the banks in its coverage to be a stable 6.4% y-o-y into 2019. Excluding one-off gains at CIMB in 2018, it expects aggregate return on equity – a measure of a bank’s profitability – to average 10.5% in 2019 versus 10.4% in 2018.

The latest results season saw the research outfit upgrading calls on CIMB and BIMB Holdings Bhd  to a “buy” from a “hold” previously, adding to its existing “buy” call on AMMB Holdings Bhd

to a “buy” from a “hold” previously, adding to its existing “buy” call on AMMB Holdings Bhd  , Alliance Bank Malaysia Bhd and Hong Leong Financial Group Bhd

, Alliance Bank Malaysia Bhd and Hong Leong Financial Group Bhd  .

.

Source: https://www.thestar.com.my/business/business-news/2018/12/24/56-loan-growth-seen-for-2019/#wU6SHrVM5Xp2jZG3.99

English

English