Large growth potential for Vietnam banking services in long-term

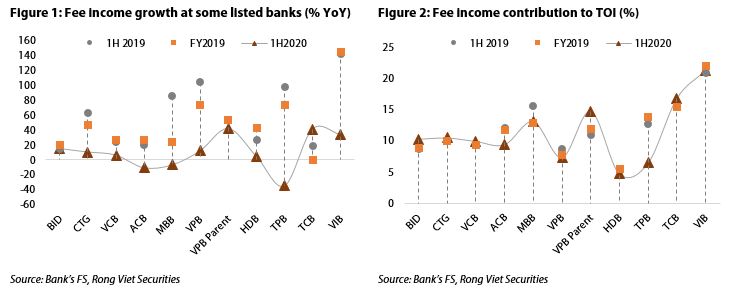

Many listed banks witnessed weak performance of fee income growth in the first six months of the year due to the Covid-19 pandemic.

Payment fees and card fees are expected to maintain growth momentum upon the promotion of non-cash payment, as banks are focusing on the retail segment and digital transformation, according to Viet Dragon Securities Company (VDSC).

Additionally, bancassurance fees should continue to see solid growth upon stronger penetration of insurance and the contribution of banca channel on total insurance premiums (especially life-insurance), while fee income structure can also be diversified with other activities such as bank guarantee, bond services and brokerage, stated VDSC in its latest report.

During the first half of 2020, many listed banks witnessed weak performance of fee income growth, which stayed at only 9.9% year-on-year, significantly lower than the growth rate of 42.1% in the same period of last year.

It is worth mentioning that fee income contributed to 10.6% of banks’ operating income during the period.

The main reasons for the a lower growth rate was due to (1) weak credit demand caused by the Covid-19 pandemic, which had hampered banking services, particularly insurance, trade service and FX gains, (2) net payment fee slowdown upon tariff discount, and (3) the decline in customer traffic over counters. Another contributor to this short-term trend could be the transfer in booking of some credit card fees (from fee income to interest income) in some banks since the beginning of this year.

Card and payment fees

|

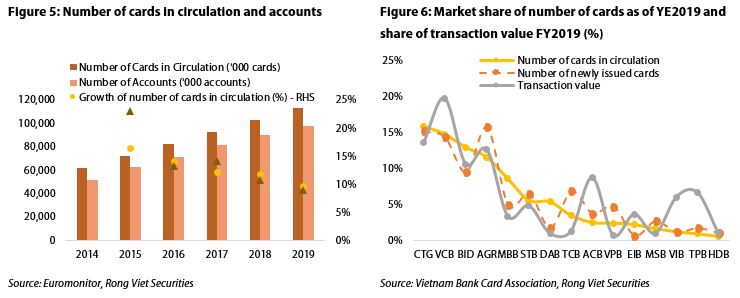

Total number of cards in circulation and total number of bank accounts have seen an upward trend in recent years, yet the growth rate is leveling off, added VDSC.

According to Vietnam Bank Card Association statistics, total number of cards in circulation at 2019 was nearly 103 million, of which, 91 million are debit cards (88.7%), 7 million are prepaid cards (6.5%) and 5 million are credit cards (4.7%).

|

The card market share is still dominated by state-owned banks. Several private banks are also focusing on promoting new card issuance to gain more market share, including Techcombank, ACB, VPBank, Vietnam Maritime Bank and TPBank. It’s noteworthy that actual efficiency (transaction value against number of issued cards) tends to be higher in retail-oriented banks such as Vietcombank, ACB, VIB and TPBank.

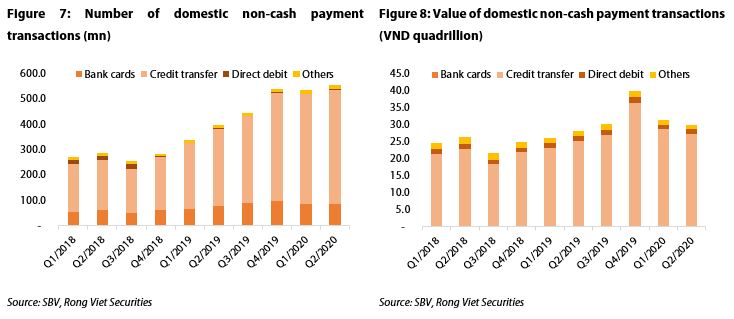

Besides, the trend of non-cash payment also facilitated a constant upward trend in domestic payment through bank cards, transfer and direct debit both in terms of transaction value and volume. These would be growth engines for payment and card fees, traditionally being the two most popular fee income sources.

Bancassurance service

|

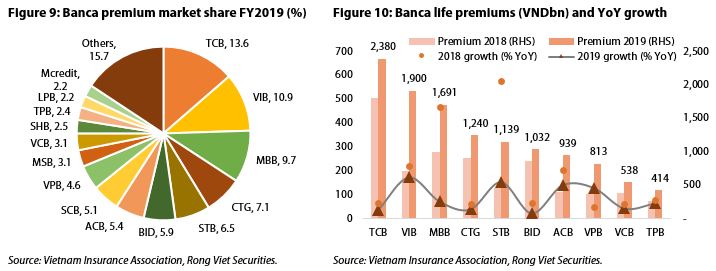

According to Insurance Association of Vietnam (IAV), total bancassurance premiums in the January – June period reached VND55.95 trillion (US$2.42 billion), up 19% year-on-year. This growth rate is well lower than the 25-32% year-on-year in the latest seven consecutive years, which can be traced back to the impact of Covid-19 and the strategic shift in many leading insurance companies, stated VDSC.

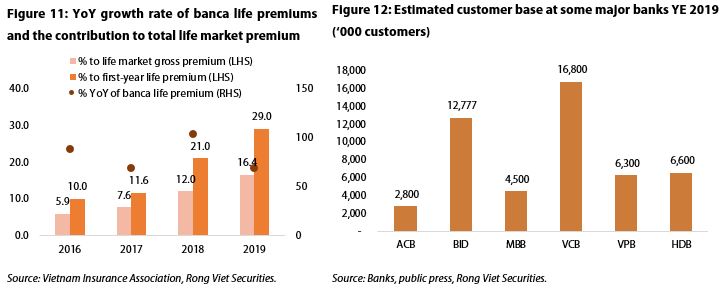

It should be noted that banca channel has become more important in the distribution of life sector as it contributed 29% to total new fee in 2019, a sharp rise from 10% in 2016. As such, overall VDSC expected bancasurance activity to maintain its growth momentum and become the main driver for banks’ service fee in upcoming period.

|

Techcombank, VIB and Military Bank are currently leading the banca market, yet it is expected the share to be redistributed between players upon more active penetration of some large banks. The expansion trend can be seen clearly at VIB, Sacombank, ACB and VPBank. Especially, Vietcombank and ACB are likely to achieve higher banca market share owing to their newly signed distribution agreements. Hanoitimes

Nhat Minh

Source: https://vietnamnet.vn/en/business/large-growth-potential-for-vietnam-banking-services-in-long-term-674149.html

English

English