Indonesia Central Bank to Step Up Rate Hikes Through March

(Bloomberg) — Economists see Indonesia’s central bank raising its benchmark interest rate faster and sooner than previously expected to make up for its late entry to the monetary tightening club.

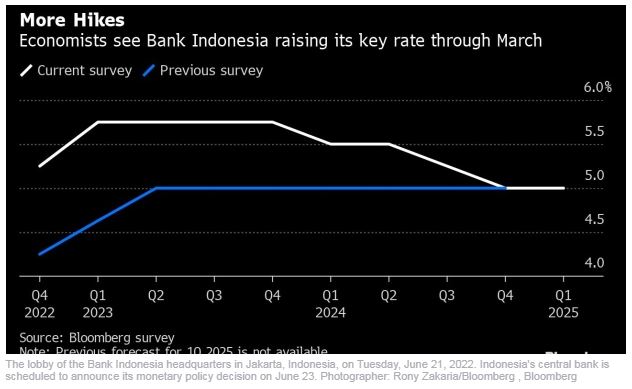

Bank Indonesia’s seven-day reverse repurchase rate is expected to be raised by a full percentage point by March from the current 4.75%, according to a prediction by analysts in a Bloomberg survey between Nov. 3-10. Policymakers are thereafter seen pausing for the rest of 2023.

A similar survey in August had predicted a 5% terminal rate by the second quarter of next year.

Forecasts for consumer prices were raised at least through the first quarter of 2024, according to the latest survey. Inflation for the current quarter is likely to average at 5.88% from 5.15% seen previously, with annual projections raised to 4.36% and 4% in 2022 and next year, respectively.

In a separate survey of nine economists, more than half see external growth slowdown as the biggest threat to the economy in the year ahead, while a-third of the respondents said tighter global financial conditions were a key risk.

“While exports positively contributed to the economic performance in recent quarters, helped by high commodity prices, a marked slowdown in global trade next year would make Indonesia losing a major driver of GDP growth,” said Eve Barre, an economist at Coface.

Source: https://www.bnnbloomberg.ca/indonesia-central-bank-to-step-up-rate-hikes-through-march-1.1845765

English

English