Covering Asia

Many Asians who have never owned a private insurance policy or received benefits have negative attitudes toward health and life insurance. Many lower-income consumers see it as something they cannot afford, while others are deterred by stories of fraud. More superstitious types see buying insurance as increasing the risk of something bad happening to them.

Given the wide economic disparity in the region, insurance is expensive for most people. But lack of awareness, inadequate professional advice and weak consumer protection mean that insurance is still wrongly considered a waste of money. Much of the insurance offered by governments is inadequate, the application and claims process is full of annoying red tape, and coverage is limited to rudimentary services at overcrowded public hospitals.

But a rising middle class, ageing populations, digital conveniences and a craving for wellness are changing the face of insurance in Asia. As Asians grow richer and accumulate more savings, the challenge for insurers is to persuade people to take some of that money out of bank accounts and invest it in other forms, including life and health coverage.

Advances in technology and healthcare mean people are living longer. Global life expectancy increased by five years between 2000 and 2015, the fastest increase since the 1960s, according to the 2016 World Health Statistics report by the World Health Organization (WHO).

Asia has, meanwhile, has been the fastest-growing region in the world economically for some time. A recent PricewaterhouseCoopers study forecasts India will overtake the United States as the world’s second largest economy after China by 2050. Vietnam, it says, will move up to 12th place from 32nd, the Philippines from 28th to ninth, and Indonesia to fourth place.

“Asia is the best place in the world to be in our business because of the large population and low (insurance) penetration rate, and these are the two huge forces that are driving growth. We have tremendous economic expansion. People in Asia are getting wealthier everywhere, compared to 10, 20 or 30 years ago,” said Stuart Spencer, group chief marketing officer at AIA Group.

The largest listed company on the Hong Kong Stock Exchange, AIA is the world’s third largest life insurer by market capitalisation after China Life and Ping An of China. It operates in 18 markets, all of them in Asia Pacific.

“There is a direct connection between increased wealth and the interest in private health insurance,” says Stuart Spencer, chief marketing officer of AIA. Photo courtesy of AIA Group

“Per capita GDP has grown everywhere, the middle class has grown everywhere, but as Asia has got wealthier, it has not necessarily got healthier,” Mr Spencer told reporters at the company’s annual media day in Hong Kong last month.

Growing economies, continued urbanisation, ageing populations in Japan, Thailand and Singapore and young populations in Cambodia, Vietnam and Indonesia all present opportunities for insurers. There is also a very low rate of public primary healthcare provision in many places in Asia where the private sector can fill the gaps.

“It is very rudimentary and fundamentally inadequate and we find that the healthcare systems are overburdened, they are beleaguered,” said Mr Spencer.

Many countries on the continent are far from having universal health coverage as measured by the WHO index of access to 16 essential services. At the same time, with more money in their pockets, many Asians are finding more ways to imperil their health.

“As people get richer, they are not necessarily getting healthier because it creates lifestyle diseases,” said Mr Spencer. “People are drinking, people are smoking, people are eating but they are not exercising and so we are seeing alarming increases in diabetes, in chronic heart disease and hypertension, and all these other non-communicable diseases.”

Because the infrastructure to take care of people who are unwell is still weak in some countries, a lot of governments in Asia are moving the burden for healthcare from the public sector to the individual consumer’s pocket.

“Individual consumers in all the markets where we do business are now having a bigger burden of expense for healthcare and as people get richer, they are much more interested in being able to provide private health insurance for their families,” he said.

“There is a direct connection between increased wealth and interest in private health insurance. People want to see a private doctor, they want to be in a room not a ward, and if they need drugs, they do not want generic drugs, they want brand-name drugs.”

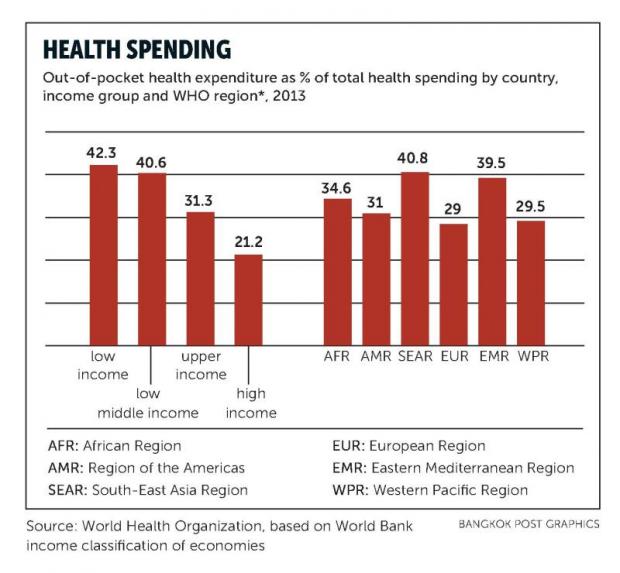

According to the WHO, a significant number of people who are using private services in Asia are actually facing catastrophic health expenses, which are defined as out-of-pocket health costs that exceed 25% of total household spending. What the WHO calls the “South-East Asia Region” is actually paying the highest when compared to other WHO regions at 40.8%. The region includes Bangladesh, Bhutan, North Korea, India, Indonesia, the Maldives, Myanmar, Nepal, Sri Lanka, Thailand and Timor-Leste.

Another key driver for life and health insurance businesses in Asia is the huge sums in savings accounts.

“People in Asia are sitting on a mountain of savings in cash and we are in a historically low interest rate environment, so the industry is trying to figure out how we get our hands on that cash,” said Mr Spencer. “We need to have relevant propositions to compel people to give us their money to invest because as you know in Asia, insurance is not just about protection, it is also about saving and investment.”

According to the World Bank, the world’s gross savings totalled 25.05% of GDP in 2015. The figure was 36.1% in East Asia Pacific, 31.4% in South Asia and a huge 48.3% in China.

Technology is helping insurers tailor products to customers’ life stages, says Keet Peng Onn of Aegon Insights Indonesia. Photos courtesy of Aegon Insights

TECHNOLOGY TRENDS

Asian insurance companies are preparing for these new challenges and opportunities. Simplifying the application and sales process is essential, though, as people still prefer face-to-face contact when buying life or health coverage, though they are comfortable with buying travel and car insurance online.

Kelly Yong, CEO of Aegon Insights Thailand, an insurance marketing consultancy, says one of the main problems in the Asian insurance industry is that products are “not being bought, they are being sold”, where most of the time “the customer does not very know what they have brought”.

“Insurance is needed all the time but you need to know what insurance you need at what life stage, and the challenge for insurers is to clarify all the technical jargon, terminology and small print that no one understands,” said Keet Peng Onn, president-director of Aegon Insights Indonesia, one of more than 20 countries where Netherlands-based Aegon operates.

“So the key to making insurance interesting is to use predictive analytics and big data to create a customer experience because you are selling something intangible and uninteresting. It is not a box with an iPhone 8, it is essentially a piece of paper that hopefully you will not have to use one day,” he told Asia Focus.

Once you understand the customers, who they are and what are they doing, he says, you can create more effective two-way communication and ultimately close the sale at the customer’s touchpoint.

While face-to-face meetings and telephone calls have long dominated sales interactions, online touchpoints are tools that all insurance companies must have. With the emergence of big data and social media, “unprompted surveys” available from analysis of personal information online allow insurers to concentrate more on each customer’s journey.

“The life stages are important. If you have kids, your insurance needs are different. If you are single you are likely to be adventurous and the travel insurance will be different,” Dr Onn said.

“You have to take the same journey with the customer, educate them, and with a smartphone you can now have an omni-channel platform to communicate with the customers, such as in payment affordability.”

One of the challenges in Indonesia’s insurance business, he observed, is that only 35% of the country’s adult population has a bank account, while a lot of insurance policies end up being cancelled because people cannot actually afford what they have brought, which creates a persistency problem.

“If you want your customer to stay with you longer, you have to sell products that they can actually afford,” he said.

Use of machine learning, social media and the data generated can create useful business and customer care information. Even a small detail such as a death in a family could be useful because you do not want to contact a person and try to sell them insurance at a sensitive time.

Aegon has developed IRIS, a platform that its partners in Asia are now using to provide data-driven, omni-channel insurance distribution to capture this trend.

“This whole customer journey analytics is the same as Google — when you search a keyword it can predict what is next and can keep on learning about you,” Dr Onn said, and offered an example:

“IRIS can find out that that you like to ski and it will send you travel information along with protection that you might need … and [direct you] gradually toward the insurance products that are relevant to you.”

One problem in Asia is that insurance products are “not being bought, they are being sold”, says Kelly Yong of Aegon Insights Thailand. Aegon Insights

FACE-TO-FACE

For large insurers such as AIA, new technologies such as e-application and i-underwriting mean that applications that used to be 13 pages long and took three days to underwrite can now be reduced to zero paper and six minutes’ underwriting time.

The interactive Point of Sale (iPoS) system, for example, is a tablet-based application that allows an agent to provide a financial needs analysis and quotations, while the customer can complete the application form with an electronic signature and make payment. It is now available in 11 of the company’s 18 markets.

The interactive mobile office (iMO), meanwhile, helps sales managers with business planning, recruiting, monitoring, managing sales activity and training.

These digital enhancements allow agents to connect more closely with customers and to offer the right insurance product at the right time, but the company says the human touch is still irreplaceable.

“In Asia, historically, culturally and functionally, people like to buy life and health insurance from an agent, from a caring professional. … No chat-bot, no robot, no website, no app is going to replace, anytime soon, the value that a trusted adviser and the input that he or she can give,” said Mr Spencer.

The company sees digital support as an enabler that helps agents to perform more efficiently and provide a better customer experience. Joe Cheng, chief executive officer for group agency distribution at AIA, said more than 85% of its new customers still prefer to buy life and health policies from an agent. AIA has more than 30 million individual policies in force.

“Because life and health products are complex and it is a lifetime product, face-to-face for life and health [sales] will continue to be the preference, especially here in Asia,” he said.

“What we need to do is to support our agents with a fully digitised platform so that they can talk to the client, find out about their needs, and sell to the client more effectively.”

HEALTH CHALLENGES

The scale of the challenge to healthcare around the world. Every year:

– 303,000 women die from complications of pregnancy and childbirth

– 5.9 million children die before their fifth birthday

– 2 million people are newly infected with HIV, and there are 9.6 million new tuberculosis cases and 214 million malaria cases

– 1.7 billion people need treatment for neglected tropical diseases

– More than 10 million people die before age 70 due to cardiovascular diseases and cancer

– 800,000 people commit suicide

– 1.25 million people die from road traffic injuries

– 4.3 million people die due to air pollution caused by cooking fuels

– 3 million people die due to outdoor pollution

– 475,000 people are murdered, 80% of them men.

Risk factors that contribute to disease. Around the world today:

– 1.1 billion people smoke tobacco

– 156 million children under age 5 are stunted, and 42 million children under 5 are overweight

– 1.8 billion people drink contaminated water, and 946 million people defecate in the open

– 3.1 billion people rely primarily on polluting fuels for cooking.

Source: World Health Organization World Health Statistics in 2016

Source: https://www.bangkokpost.com/business/news/1339239/covering-asia

English

English