Centre sees slight growth in Thai economy 2018

ONLINE shopping will continue to expand at a higher rate next year while real estate and SMEs would not fare well due to oversupply and fierce competition, according to the Kasikorn Research Centre.

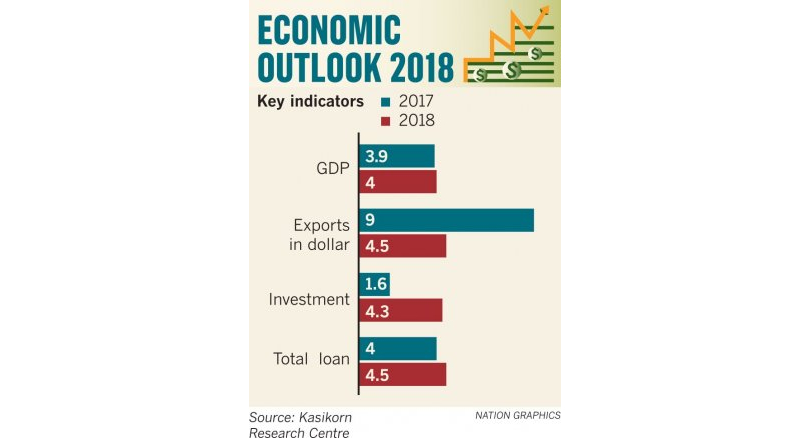

The overall economy is expected to slightly improve, expanding by 4 per cent from 3.9 per cent this year, Chao Kengchon, managing director of the Kasikorn Research Centre, said at a press conference yesterday.

The economy will be driven mainly by public and private investments, exports and tourism. This will support some businesses and the private sector is expected to increase their investments.

Online shopping is expected to grow 20-25 per cent next year compared with 20 per cent this year. E-commerce related businesses such as logistics, advertising media and payments would grow along with higher competition.

Tourism growth may slow to 6.5-7.5 per cent next year compared with an estimated 8.2 per cent this year due to competition from Vietnam and Japan. However, Chinese travellers are expected to spend more per head, according to Kasikorn Research . An average Chinese tourist spends Bt6,450 per day this year, up from Bt6,300 last year while the average foreign tourist spends Bt 5,340 per day this year up from Bt 5,250 last year.

However, real estate may expand below the economic growth rate due to oversupply and high household debts. Banks will be cautious in lending to both developers and homebuyers. Growth rate of new residential units in Greater Bangkok may be 0-2 per cent next year.

Developers are expected to focus on building condominiums along new mass transit routes in Bangkok.

New trend of industries such as electric vehicle and Internet of Things would not significantly change as it would take time due to supply change and consumer behaviour.

Agricultural products would continue to come under pressure of high supplies, for example white rice price is expected to drop 1.9 per cent.

Total bank lending is expected to expand 4.5 per cent next year, up from 4 per cent this year. Business loan is forecasted to grow 3.5 per cent next year, up from 2.5 per cent this year. Lending to big corporates will be higher than that to SMEs.

Retail loan has limited room to grow due to high household debt. Housing loan growth is expected to decelerate to 6 per cent next year from 6.2 per cent this year and hire purchase loan growth will also be slower at 5.5 per cent from 6.5 per cent this year.

Banks’ non-performing loan is expected to be flat, about 2.97-2.98 per cent of total loans.

Banks will be cautious on SMEs loan, agricultural related businesses, real estate, steel production and wholesale trading.

SMEs will continue to struggle for survival amid high competition, it added.

Non-performing loans would not sharply decline next year as economic recovery has yet to spread.

Chao forecast that the Bank of Thailand may raise interest in the final two quarters of next year, basing on the assumption that the US Federal Reserve would increase rates three times next year and that Thai export growth would continue and investments expand.

Baht value is expected to be about Bt34 per dollar compared with an average Bt 32.7 this year.

Risk factors include tension in the Korean Peninsula and Thailand’s political road map as the government plans to hold general election next year.

Source: http://www.nationmultimedia.com/detail/Economy/30334327

English

English