Car imports from ASEAN states explode in January, sparking fierce local competition

The number of cars of nine seats and less imported from Thailand and Indonesia soared in January, sparking fierce competition between importers and local automakers.

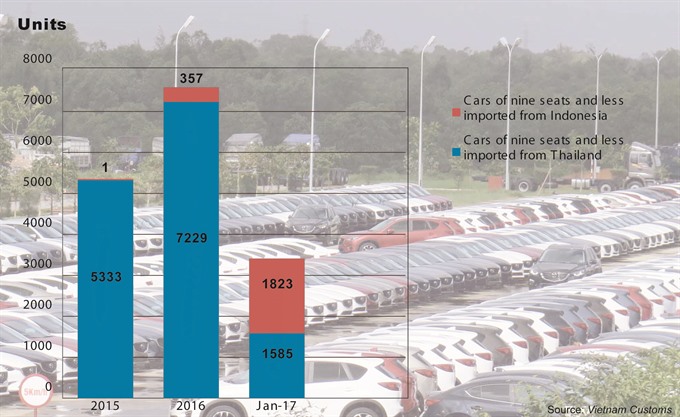

According to figures released by the Vietnam Customs Office on Monday, Vietnam imported 3,408 cars from the two countries in January, accounting for 62.8 per cent of total imports of cars with nine seats or less.

“In just the first month of the year, the volume of imported cars of nine seats and less equalled 45 per cent of total imports in 2016,” the office said.

The spike has been attributed partly to a drop in import tax on this auto segment (nine seats and less) for ASEAN members, from 40 per cent to 30 per cent, from January 1, 2017.

The drop in import tax is part of the 2016-2018 ASEAN Trade in Goods Agreement. It is expected that by 2018, when the import tax becomes zero per cent, prices will fall a further 20-25 per cent over current levels.

Thailand and Indonesia are the only two countries from the ASEAN bloc that exports cars to Vietnam.

In January, Thailand shipped 1,585 cars of nine seats and less worth US$31 million to Vietnam, an increase of 55 per cent in volume and 209 per cent in value over the same period last year.

Meanwhile, auto imports from Indonesia have seen a major explosion. Indonesia exported 1,823 units worth $35 million in January. In the same period last year, just one car priced at $10,000 was imported.

Vietnam imported a total of 7,400 cars in January, of which 5,425 units were nine-seats and less worth $97 million, a year-on-year increase of 121 per cent in volume and 92 per cent in value.

ASEAN is still the country’s largest supplier. As mentioned earlier, Thailand has been the leading exporter of cars to Vietnam with 2,605 units, followed by Indonesia with 1,823 units and India with 1,006 units.

Indian cars were the cheapest, at an average price of $3,708, while those imported from France had the highest average price of $57,000.

Cars imported from the UK and Germany carried average prices of $52,219 and $50,000, respectively, the office said.

VAMA sales down

Industry insiders said the reduction in import tax had put heavy pressure on local automakers who, for the most part, assemble their cars here. If domestic automakers do not reduce their prices, they will no longer be competitive against importers.

“By 2018, when the import tax becomes zero per cent, the volume of imported cars will rise dizzily because many businesses will stop assembling cars in Vietnam and shift to importing as a way to cut costs,” Ninh Huu Chan, General Secretary of Vietnam Automobile Manufacturers’ Association (VAMA) told anninhthudo.vn.

A VAMA sales report released on Monday showed its members sold 20,323 cars in January, a year-on-year drop of 13 per cent. Of the cars sold, 15,504 units were locally-assembled, 11 per cent lower than the same period last year.

VAMA has forecast that its 2017 sales volume will be about 10 per cent higher than 2016.

Due to the attraction of strong price cuts in 2018, many auto businesses feel the trend of buying imported cars will not see a significant increase in 2017.

Nguyen Tuan, Director of Thien An Phuc Company, a car importer, said the reduction in import taxes from 30 to zero per cent was steep. Furthermore, imports offered more variety than locally-assembled ones, so it’s totally understandable that people wait for the tax cut.

It is estimated that car prices in 2018 can fall by between VND100 million – VND300 million each. “If people buy cars in 2017, they will lose hundreds of millions dong in comparison with next year,” Tuan said. — VNS

Source: http://vietnamnews.vn/economy/351198/car-imports-from-asean-states-explode-in-january-sparking-fierce-local-competition.html#uWjY9zKgY37UCTJc.99

English

English