Cambodia: Call for lower interest rates for farmers

A representative from the Cambodia Rice Federation (CRF) has called on financial institutions to review the interest rate for agriculture in order to boost competitiveness, productivity and bolster the growth of this sector.

The call was made at the 6th Annual NBC Macroeconomic Conference on the Agriculture Sector in a Rapid Structural Transformation and Uncertain Global Trade Environment, hosted by the National Bank of Cambodia yesterday.

At present, the interest rate for farmers is high – from 12 percent to 18 percent per year. It is only 6.5 percent to 8.5 percent for the commercial and retail sectors, said CRF Vice-President Chan Sokheang. He said this makes production costs less competitive than other countries.

Mr Sokheang added that the agriculture sector is the backbone of the country’s economy and it contributes to around 30 percent of the country’s gross domestic product (GDP). However, the agriculture sector has faced main issues on production costs upstream and downstream.

“The agriculture sector contributes around 30 percent to the country’s GDP, accounting for $6 billion to $8 billion. However, the loan portfolio from the financial sector to the agriculture sector is only 10 percent among the total loan portfolio. The source of funds and the interest rates are critical to solve problems faced by agriculture,” Mr Sokheang said.

He added that the issue not only affects big and medium enterprises, but also smallholder famers and the community at large. He added that the agriculture sector is considered high risk because of unpredictable weather, market movements and the quality of the products. However, the risk of non-performance loan in the agriculture sector is only around 3 to 5 percent, he said.

“We want to change this mindset that agriculture is high risk and we want the financial sector to see the sector as safe for providing loans so it can expand and strengthen investment,” Mr Sokheang added.

“We are calling on the financial institution partners – both Commercial Banks and MFIs – to reduce their interest rates and facilitate farmers and all stakeholders to enable easier access to working capital to invest, to expand and to strengthen the agriculture sector,” Mr Sokheang continued.

Regarding the high interest rates for agriculture, Ky Kosal, secretary general of the Ministry of Agriculture, Forestry and Fisheries, said the agriculture ministry together with the Ministry of Economy and Finance and the financial institutions are discussing ways to find a mechanism to reduce interest rates for farmers and are considering how much the government can contribute to reduce the production costs of farmers and the whole sector.

“The interest rate provided to farmers is being studied because it does not have any concrete benchmark. We are working on this,” Mr Kosal added.

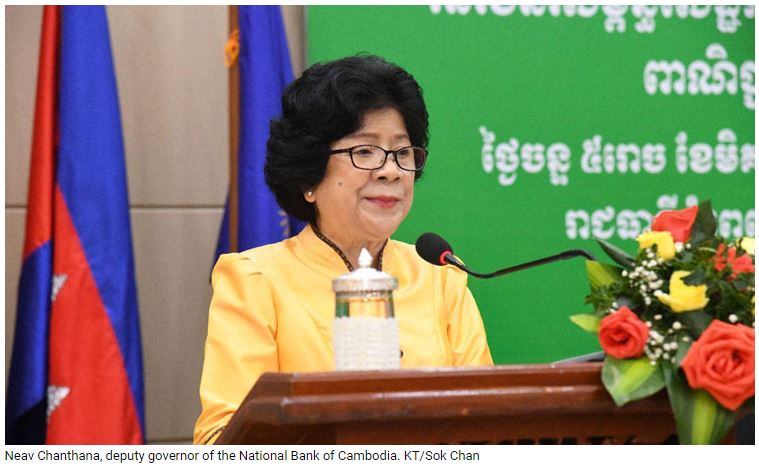

“Loans in the agriculture sector were $381 million in 2010 but, as of August 2019, they have increased to $2.2 billion. The interest rate was set at 18 percent per year in April 2017,” said Neav Chanthana, deputy governor of the National Bank of Cambodia. She added that the role of microfinance organisations is important to provide a source of funds to the agriculture sector.

“The growth of the financial sector will support the growth of agriculture so I would like to encourage the MFIs to increase their available products and provide new financial services by using technology to serve farmers better,” Ms Chanthana said.

“To push the growth of agriculture, we must make productivity in this sector better and increase resilience to climate change,” she added.

Source: https://www.khmertimeskh.com/50670590/call-for-lower-interest-rates-for-farmers/

English

English