Big LNG boost for Malaysia

PETALING JAYA: Malaysia and its national oil company Petroliam Nasional Bhd (Petronas) are expected to benefit from the recent spike in the price of gas.

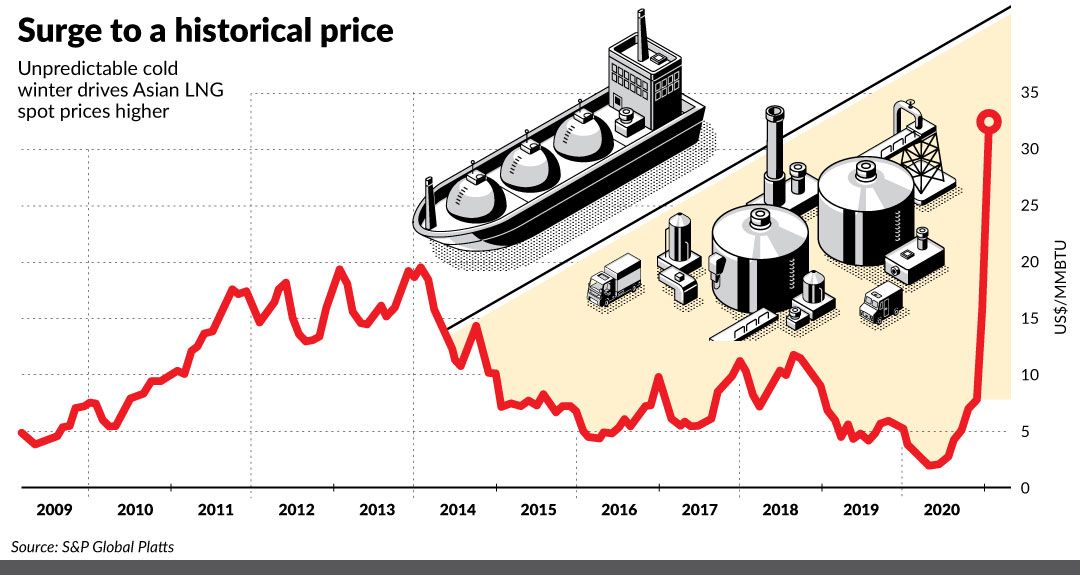

The Asian liquefied natural gas (LNG) spot price has been rallying over the past two months and soared more than 18 times to a record high of US$32.50 per million British thermal units (mmBtu) from the April 2020 low of US$2.40 due to the unusually cold winter in North Asia and Europe, as well as unexpected supply issues.

Asian LNG spot prices have outpaced that of Europe and the United States.

According to a report by Reuters, US gas futures for February at the Henry Hub benchmark currently trade at around US$2.60 per mmBtu, while in Europe, prices at the Dutch TTF hub are around US$10 per mmBtu.

Petronas is the largest LNG exporter in South-East Asia and the third largest in the world. In 2019, Malaysia’s LNG exports accounted for 7% of LNG exports worldwide, according to data provided by BP’s 2020 Statistical Review of World Energy.

S&P Global Platts Analytics expects global LNG demand to grow 3% in 2021, despite the ongoing pandemic. In 2019, the LNG market grew 11%, driven by demand from China.

Juwai IQI chief economist Shan Saeed (pic below) said LNG is finding new use in Asia, including in the petrochemical and transportation sectors to drive demand.

The latest is in South Korea, where LNG will be used to keep extremely low temperatures in storage facilities to house millions of Covid-19 vaccines.

“In 2021, LNG regasification projects would gain momentum in the near future, thus creating more demand for LNG.

“Countries like Pakistan, Vietnam and the Philippines are going for regasification in the short to long term. Moreover, the petrochemicals, infrastructure and transportation sectors are becoming major sources of demand, augmenting LNG use in the power sector.

“LNG demand will grow by 3%-4% in 2021 despite global economic fragilities and the pandemic scare, ” he told StarBiz.

In addition, Shan said as more countries are heading towards cleaner energy as part of their environmental efforts, that would drive the demand of LNG moving forward.

“LNG is the future in the global energy mix. According to the latest report from ExxonMobil/BP, oil, natural gas and coal would remain as the global energy mix by 2040, contributing 50%-60% to the energy equation calculus, ” he said.

Meanwhile, ICE Petroleum Group managing director Abdul Jalil Maraicar expects the spot price of Asia LNG to remain high in the near term, driven by the sudden surge in demand as many countries are coping with an unusually cold winter.

“This was largely due to heavy demand from the US and Europe to cope with the winter season, where the procurement activity is now driven by utility companies that cannot afford to be short of gas.

“This has sparked risk-averse buying behaviour which pushes up the price, ” he explained.

Overall, Jalil reckoned that the LNG price will remain volatile due to the ongoing Covid-19 pandemic and oversupply in the world’s LNG market.

“LNG demand in Asia is growing rapidly, but it is not quick and fast enough to absorb the new and returning LNG supply.

“Around 18 million tonnes of economic curtailments have taken place in 2020 not only from US shut-ins but also from other producers like Malaysia and Egypt. The market will have to deal with this volume in 2021 either by pushing into Europe or shutting in production, ” he said.

Last month, the Malaysian government announced it was targeting to introduce the Natural Gas Roadmap (NGR) as early as the first quarter of 2021, as natural gas will continue to be the energy of choice as the world goes through an inevitable energy transition to tackle the issue of climate change.

According to McKinsey & Co’s “The Future of Liquefied Natural Gas”, Asia is still highly dependent on coal as its primary energy source, accounting for about 47% of its energy mix. Gas makes up about 12% of the region’s energy consumption, a stark difference compared to 20% of consumption in other regions.

“Increasing Asia’s share of gas energy consumption to 20% would add the equivalent of more than 400 million tonnes of LNG to annual gas demand, near doubling the size of the LNG market, ” it said.

“The long-term outlook for LNG is brighter than that of other fossil fuels because of its comparatively lower cost and lower emissions from production and combustion. But to find a true competitive advantage amid a volatile market, the LNG industry must move beyond what were once winning strategies (control of gas resources, reliability of supply).

“Instead, LNG players should focus their efforts on five areas: capital efficiency, supply-chain optimisation, downstream market development, decarbonisation, and digital and advanced analytics.”

Source: https://www.thestar.com.my/business/business-news/2021/02/01/big-lng-boost-for-malaysia

English

English