Huge cash flow continues in Vietnam

Foreign capital flows are not only poured into Vietnam through FDI projects but also through buying shares in leading companies in the country.

Vietnam’s T&T Group, Hanwha Energy JSC, Korea Southern Power Co., Ltd. (KOSPO) and Korea Gas Corporation (KOGAS) recently received a licence to invest in the Hai Lang LNG gas power center in the central province of Quang Tri, with total investment capital of 2.3 billion USD.

This is an investment cooperation project between a leading private economic group in Vietnam and three leading Korean corporations in the field of energy. The project shows that Vietnam is still considered a long-term destination of foreign investors. The foreign capital flow is still pouring into Vietnam.

Previously, T&T Group signed a memorandum of understanding on strategic cooperation in the field of offshore wind power with Denmark’s Ørsted corporation, with a total installed capacity of nearly 10 GW and total investment value of about 30 billion USD.

In late September, T&T Group signed a memorandum of understanding with UPC Renewables (USA) on cooperation in investment in onshore and nearshore wind power and solar power projects in some southern provinces, with a total capacity of nearly 1,500 MW, and a total investment about 2.5 billion USD.

Nestlé Vietnam has announced an additional investment of 132 million USD in a factory in the southern province of Dong Nai, bringing the total investment in Vietnam to 730 million USD. The investor aims to turn Vietnam into a center of coffee production and supply for domestic and international markets.

Japan’s Panasonic has just opened a new factory producing producing ceiling fans and ventilation fans in the southern province of Binh Duong, with an investment of about 45 million USD.

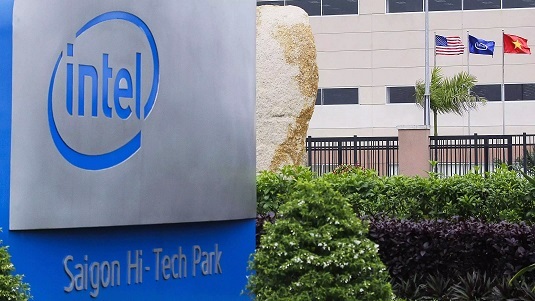

In particular, Intel has invested an additional 475 million USD in Vietnam, bringing the total investment capital in the country to 1.5 billion USD and has committed to invest 2.6 billion USD more into Ho Chi Minh City’s Hi-Tech Park in the near future.

At the end of August 2021, LG Group of Korea announced an additional investment of 1.4 billion USD in its project in Hai Phong. Samsung plans to expand its phone factory in the final months of 2021 to increase the production of foldable phones by 47% to 25 million units.

Meanwhile, Foxconn will manufacture Apple’s Macbook and iPad in Quang Chau industrial zone, in the northern province of Bac Giang with a capacity of about 8 million products per year, with a total investment of about $270 million.

Ja Solar PV Vietnam (from Hong Kong) invested in a project to produce photovoltaic panels, with a capacity of 3.5 million GW/year, with total registered investment capital of 210 million USD in the northern province of Bac Giang.

Purchasing shares of Vietnamese enterprises

Foreign capital flows are not only poured into Vietnam through FDI projects but also through buying shares in leading companies in the country.

In mid-August 2021, another Korean PE fund invested 200 million USD in Masan Group of billionaire Nguyen Dang Quang. According to KedGlobal, the deal helps Korea Investment PE hold about 2-3% of Masan shares and become one of the foreign investors investing in Masan besides the National Pension Service (NPS) of the Korean Government, SK Group and IMM Investment Corp. Previously, in 2019, PE poured 300 million USD into Vingroup along with IMM.

In 2018, Korea’s NPS, SK Group and IMM invested $470 million to hold a 9.5% stake in Masan.

In June 2021, Alibaba Group and Baring Private Equity Asia invested $400 million in Masan.

In 2019, investors witnessed a strong capital injection from Japanese Mitsui into the largest shrimp enterprise in Vietnam.

In the beverage field, the number one giant in Vietnam’s beer industry – Sabeco – has become a foreign company after the State shareholder divested capital, receiving 5 billion USD from ThaiBev.

ThaiBev – through its subsidiary Fraser & Neave – currently holds about 20% of Vinamilk’s shares worth nearly 2 billion USD after about 15 years of continuously buying shares of Vietnam’s No. 1 dairy company.

In the field of building materials, foreign investors, mainly Nawaplastic Industries of Thailand, holds nearly 65% of the shares of the largest plastic enterprise in Vietnam – Binh Minh Plastics (BMP). Thailand’s SCG holds more than 54%. The proportion of shares held by foreign investors in Tien Phong Plastic (NTP) is also very high.

More than half a decade ago, Thailand’s SCG also acquired the leading brick brand Prime. Siam Cement of Thailand’s SCG Group also officially owns 100% of the Long Son petrochemical project (total investment of 5.4 billion USD) after signing a contract with PetroVietnam to buy 29% of the shares in this petrochemical plant.

In recent years, foreign businesses from the US, Germany, South Korea and others have poured money into Vietnam’s pharmaceutical firms.

US pharmaceutical company Abbott currently holds a 52% stake in Vietnam’s Domesco Pharmaceuticals Company (DMC). Taisho Pharmaceutial of Japan also owns more than 50% of shares of Hau Giang Pharmaceutical Company (DHG). SK Group of Korea is also gradually increasing its rate of ownership in Imexpharm Pharmaceutical (IMP).

In the past two years, Korean giant Daewoong Pharma has increased its investment in Traphaco. According to South Korea’s TheInvestor, Daewoong bought a 15% stake in Traphaco in 2018. Daewoong and Traphaco agreed on technology transfer on eight products for production in Vietnam.

Changing to be more attractive

|

Recently, some FDI enterprises have moved orders to other countries when Vietnam imposed social distancing measures.

The Covid-19 pandemic, which has lasted for nearly two years, has turned the activities of many businesses upside down, including the textile and footwear industry. Many businesses face labor shortages in the post-pandemic era. According to the Vietnam Textile and Garment Association, the last three months of the year are expected to be very difficult for the textile industry.

According to Nikkei Asia, the 4th wave of Covid-19 starting from May in Vietnam had a significant impact on production activities of many FDI enterprises.

Vietnam’s gradual easing of social distancing measures is considered a positive sign for FDI enterprises. However, goods are still stuck in warehouses due to rising global freight costs.

Many large FDI enterprises still maintain production activities in Vietnam such as Samsung, TSMC, Intel but experts believe that Vietnam needs to have appropriate policies to retain foreign capital flows. It is proposed that the Government and localities have a consistent roadmap for reopening and epidemic prevention in the future.

According to Nikkei, big players like Panasonic and Nike still firmly believe in Vietnam. Panasonic will continue to strengthen its plan to make Vietnam a center for equipment manufacturing in Southeast Asia, by shifting production from Thailand to Vietnam.

Le Quang Tri, from Tri Viet Securities JSC, said that Vietnam is still attractive to long-term investors. Foreign capital is still flowing into Vietnam. FDI is a medium- and long-term investment. The disruption caused by the pandemic is only temporary.

Luong Bang

Source: https://vietnamnet.vn/en/feature/huge-cash-flow-continues-in-vietnam-792193.html

English

English