Cambodia: Central bank December data indicates an increase in purchasing power

Headline consumer price inflation (CPI) in December 2020 decelerated, resulting in a more stable riel and increasing local purchasing power, the National Bank of Cambodia (NBC) reported in its report on December’s economic and monetary statistics.

The central bank said that December’s CPI eased to 2.9 percent year-on-year because of the drop in oil prices which, in turn, contributed to a lower than expected increase in food prices. As a result, the exchange rate of 4,069 riels a dollar remained unchanged from November 2020 and the CPI and component indices all remained relatively stable, increasing by a modest 0.03 points.

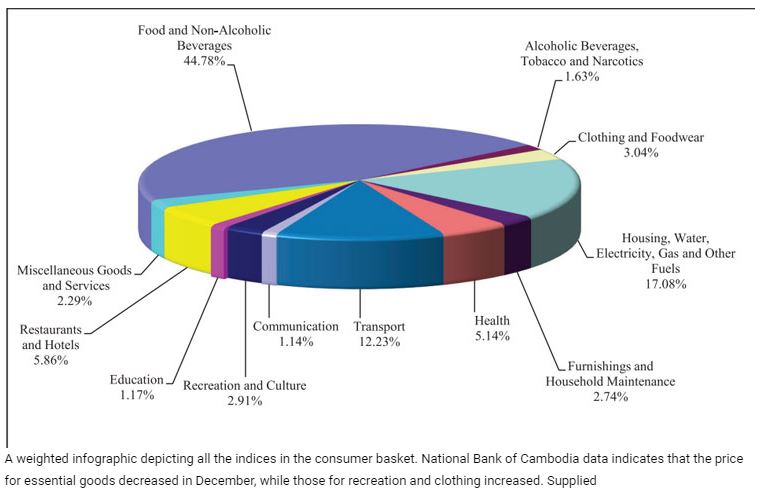

The price of food and non-alcoholic beverages decreased from 230.61 points to 230.25 points, a trend followed by other essential goods.

Housing, water, electricity, gas and other fuels also fell 0.09 to 129.96 points.

However, the price for alcoholic beverages, tobacco and pharmaceuticals increased by .05 points to 188.82. The CPI also reported that the price for dining out clothing, communications and healthcare all increased month-to-month.

Broad money – the total amount of cash circulating in the local economy – increased by 1.7 percent over December 2020, to 136,542 billion riels (approximately $33.46 billion).

Despite the COVID-19 pandemic, depository corporations ended the year on a high note with net domestic assets increasing approximately $16.97 billion, marking a 2.6 percent increase over November, the report said.

As the Kingdom treads forward towards its goal of de-dollarising the economy, December’s data showed that the average interest rate on deposits in the riel increased, while those in the US dollar decreased.

The weighted average interest rate on deposit in riels increased by 0.08 percent to 0.58 percent, while deposits in US dollars decreased by 0.04 percent to 0.36 percent, according to the report.

However, those taking loans in riels saw the opposite effect, with borrowing in US dollars continuing to see favourable interest rates from banks.

The NBC reported that the weighted average interest rate on riel loans decreased by 0.89 percent to 9.82 percent, while loans on the dollar saw a 0.1 percent decrease in interest to 8.45 percent.

In Channy, founder of ACLEDA Bank Plc, previously told Khmer Times that his bank was working towards providing preferential interest rates to clients as an incentive to increase circulation of the local currency in the broad market.

December saw a 10.4 percent increase in foreign visitor arrivals over November, with 48 percent of those arriving saying they were travelling for business.

The Kingdom’s international trade deficit rose moderately in December over November’s results, increasing to 2,865.1 billion riels (approximately $7.083 billion) from 2,426.8 billion riels.

Garments accounted for 51.4 percent of total exports, while fabric accounted for 16.9 percent of imports.

The Kingdom’s construction segment also saw a noticeable hit as the pandemic continues to affect the industrial sector with imports for steel and cement accounting for a mere 1.3 percent and 0.2 percent of total imports, respectively.

Source: https://www.khmertimeskh.com/50832887/central-bank-december-data-indicates-an-increase-in-purchasing-power/

English

English