Thailand: Repayment progress in Q3

Borrowers showed improved debt-servicing ability in the third quarter, especially for numerous auto loan customers that exited from the Bank of Thailand’s debt relief measures.

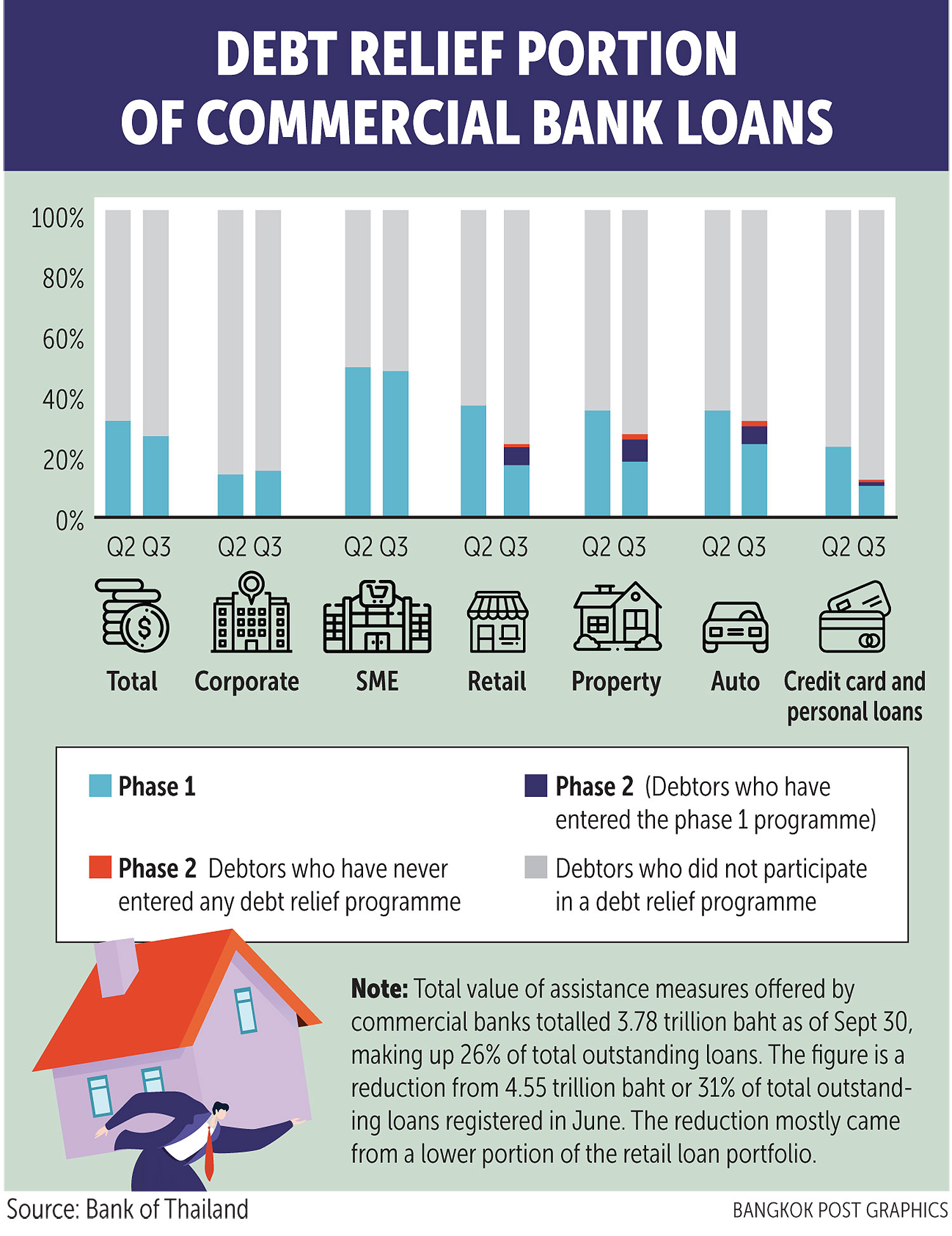

Commercial banks provided financial assistance to customers worth a total of 3.78 trillion baht from July to September, making up 26% of the commercial bank industry’s total outstanding loans, said Suwannee Jatsadasak, senior director of the regulatory policy department. The amount was a decline from 4.55 trillion baht or 31% of total outstanding loans logged in the second quarter.

Financial aid for consumer loans declined significantly from 36% in the second quarter to 24% in the third quarter. Financial assistance for the auto loan segment significantly declined from 54% in the second quarter to 31% in the third quarter.

Financial assistance for mortgage loans also reduced from 35% in the second quarter to 27% in the third quarter, while the rate for credit card loans declined from 23% to 12%.

Small and medium-sized enterprise (SME) loans that were included in commercial banks’ debt relief programme saw a slight decline from 49% in the second quarter to 48% in the third quarter.

Financial aid for corporate loans increased from 14% in the second quarter to 15% in the third quarter.

Ms Suwannee said the improved capability of debt repayment for retail and SME loans was supported by improved economic activities after the government eased its strict lockdown policy. Corporate loan customers, however, received delayed financial assistance from banks compared with other loan segments, hence a higher threshold was registered in the third quarter, she said.

“Improved economic momentum in the third quarter will continue supporting borrowers’ ability in debt repayment. The central bank expects borrowers who require financial aid to continue to decline in this quarter,” said Ms Suwannee.

Thailand’s GDP contracted by 6.4% year-on-year in the third quarter, less of a contraction compared with the second quarter’s 12.1% decline.

Ms Suwannee said the central bank has also considered adjusting the criteria of the 500-billion-baht soft loan scheme to facilitate better loan access for SME customers. The move is expected to be completed within this year.

The central bank expects total loan growth in the commercial bank industry to arrive at 3-5% this year, improving from 2% registered in 2019. For the first nine months, the industry booked a 3.9% loan expansion.

The non-performing loan ratio in the commercial banking industry was 3.17% in the third quarter, up from 3.09% in the second quarter.

Source: https://www.bangkokpost.com/business/2020615/repayment-progress-in-q3

English

English