Malaysia: Moratorium helped many during crunch time

PETALING JAYA: The automatic loan moratorium provided many households with immediate temporary financial relief, particularly those who had lost their jobs and were experiencing income declines.

“At its peak, close to 90% of household borrowers with about 87% of outstanding household loans in the banking system, were under the moratorium as most borrowers elected to defer their loan repayments to secure greater flexibility in managing their cash flows during a highly uncertain period, ” Bank Negara said in its Financial Stability Review for the first half of 2020.

Bank Negara said many of the borrowers would have been able to continue servicing their debt if they had chosen to.

“Based on the enhanced financial margin framework, the bank estimates that household borrowers who may experience difficulties (those with negative financial margins) in servicing their debt as a result of income and unemployment shocks are unlikely to account for more than 15% of total borrowers.”

According to the central bank, house prices as measured by the Malaysian House Price Index continued to register positive, albeit slower growth of 1.1% in the first half-year of 2020 (2019: 2.2%).

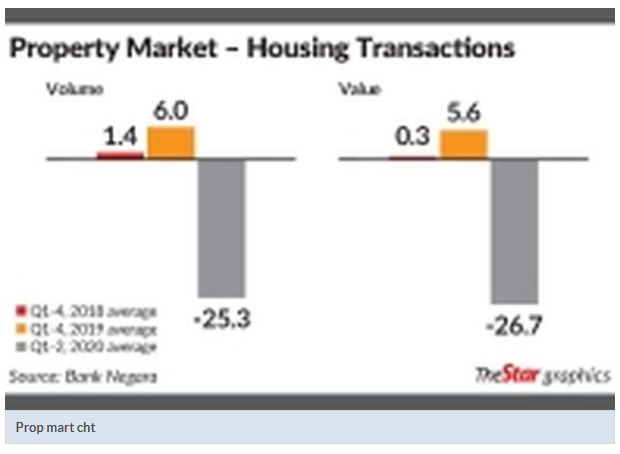

“Market activity weakened considerably, with both volume and value of transactions falling sharply during the period. Fewer housing projects launched during the second quarter further dampened market activity, with the number of new units amounting to only about one-fifth (3,911 units) of the quarterly average in 2019.

“The number of unsold houses has remained elevated at close to 170,000 units, with most still under construction (67% of unsold units) or priced above RM300,000 (73%).”

Bank Negara added that the pandemic may increase risks of a broader decline in house prices due to a deterioration in income and weaker demand conditions.

“This in turn would increase risks to financial stability given that loans for the purchase of residential properties account for the bulk of banks’ total property-related exposures.”

However, the bank said there are several factors that are expected to mitigate this risk.

“First, over 80% of loans are extended for homes that are owner-occupied, which substantially reduces the likelihood of borrowers defaulting. Second, the bulk (85%) of borrowings for investment purchases are associated with higher-income borrowers earning more than RM5,000 per month.

“Such borrowers are generally more resilient to income shocks and are unlikely to dispose of properties at a loss if they can continue to service their debt.”

Additionally, Bank Negara said, speculative activity in the housing market has remained subdued for some years, with prices in some segments already having moderated significantly from exuberant valuations in the past.

“Further, recent interest rate cuts and the reintroduction of the Home Ownership Campaign should continue to provide some support to housing demand, particularly in the primary market, as already evidenced by the strong recovery in the growth of applications of loans for the purchase of residential property in June, mainly in the affordable segment.”

Source: https://www.thestar.com.my/business/business-news/2020/10/15/moratorium-helped-many-during-crunch-time

English

English