Thailand: Planning unit cuts growth forecast

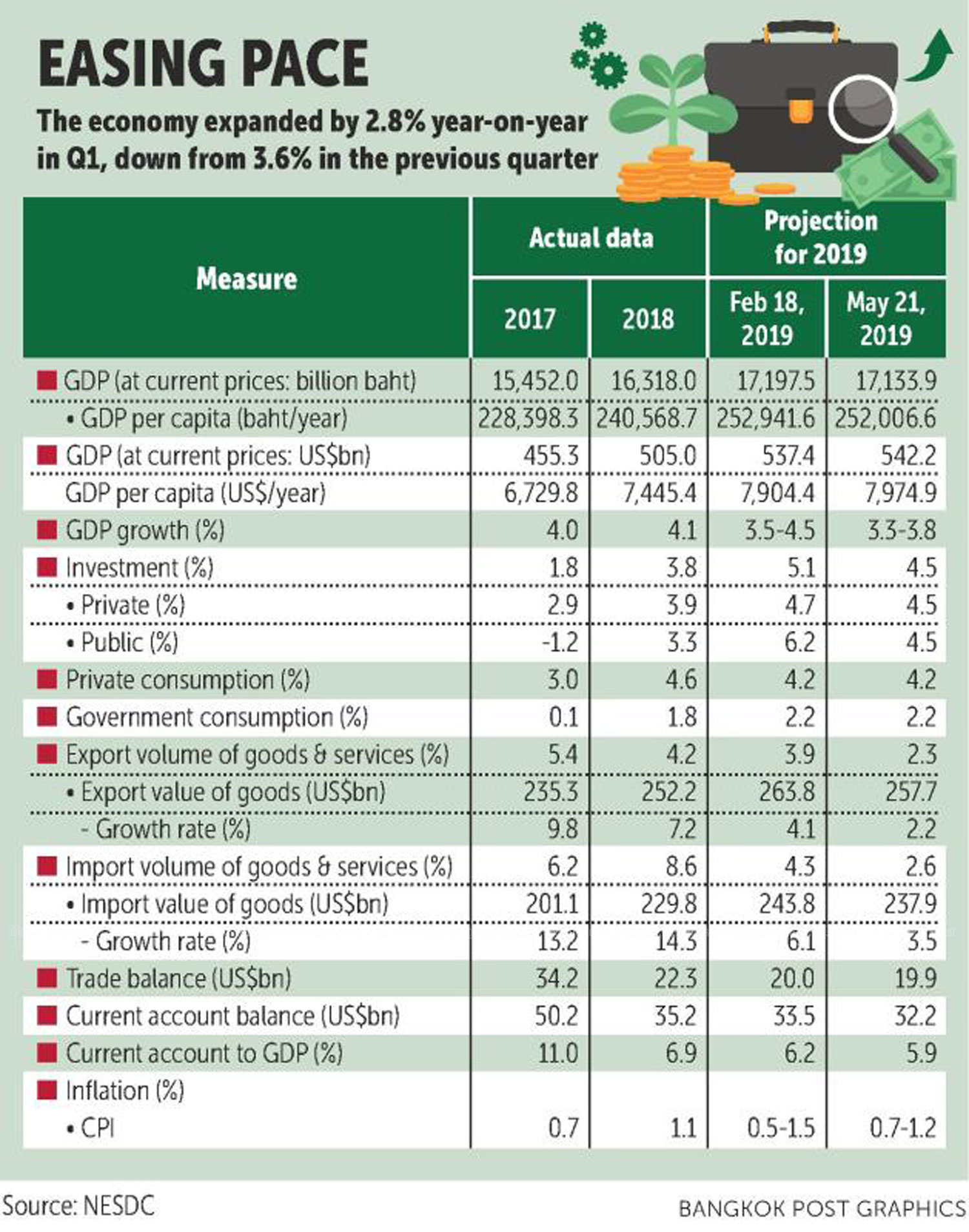

The government’s planning unit has lowered its full-year GDP growth forecast to 3.3-3.8% from 3.5-4.5% after the economy grew at its slowest pace in more than four years in the first quarter.

The National Economic and Social Development Council (NESDC) reported on Tuesday that GDP rose 2.8% year-on-year in the first quarter, down from a revised 3.6% in the fourth quarter of last year. It was the slowest pace in 17 quarters.

After seasonal adjustment, the economy grew by 1% from the fourth quarter of last year.

Weak global demand and rising trade tensions impacted Thailand’s economic performance in the first quarter, said Thosaporn Sirisamphand, the NESDC’s secretary-general.

Lower state expenditure because of a delay in the new government’s formation also affected growth, he said.

“The delay in the new government’s establishment also weakens the confidence of the private sector, which is eagerly awaiting its formation,” Mr Thosaporn said. “This will also affect infrastructure development and the fiscal 2020 budgeting plan.”

The planning body lowered its government investment growth view for the year to 4.5% from the previous projection of 6.2% made on Feb 18.

Private investment growth was cut to 4.5% from 4.7%, while overall investment was also lowered to 4.5% from 5.1%.

The NESDC is maintaining its forecast for private consumption and government consumption at 4.2% and 2.2% growth, respectively.

The council downgraded its estimate for exports, the main engine of the economy, to 2.2% growth from the 4.1% projected in February.

Exports dropped 3.6% in the first quarter from a year earlier. They rose 7.2% in 2018 and 9.8% in 2017.

The NESDC expects export growth to recover in the latter half of the year.

Mr Thosaporn said the private sector needs to rev up its efforts to seek new export markets to offset the impact of the deepening US-China trade row.

The council also suggested that the government spur the tourism sector, which accounts for 20% of GDP, while accelerating disbursement of investment among state-owned enterprises.

“The new government may need to introduce only measures to ease the impact on low-income earners,” Mr Thosaporn said. “If the government wants to boost GDP by one percentage point, it needs to spend 80 billion baht on new stimulus packages.”

Titanun Mallikamas, assistant governor for the monetary policy group at the Bank of Thailand, said that first-quarter economic growth appeared close to the Monetary Policy Committee (MPC) forecast at last month’s meeting and that the growing risk skews to the downside in the period ahead.

Developments in both local and global economies warrant monitoring, he said.

The rate-setters are scheduled to review their 2019 economic growth forecast at the meeting on June 26.

The MPC recently determined that the economy would expand at a slower pace than the committee’s forecast of 3.8%, largely due to weaker-than-expected merchandise exports and private investment.

Nonetheless, lower figures for the first quarter on Tuesday prompted Fiscal Policy Office (FPO) director-general Lavaron Sangsnit to rush to allay jitters, saying he was confident that economic growth would pick up this quarter on the grounds that exports had already bottomed out.

“We believe exports will not deteriorate further, given the significant contraction in the first quarter,” he said. “However, the situation needs to be closely monitored and we don’t think a fresh round of stimulus measures is needed at the moment.”

The 2.8% growth was not a surprise, Mr Lavaron said, adding that the Finance Ministry had launched an economic stimulus package aimed at shoring up momentum.

Despite weak growth in the three months through March, the FPO is sticking to its forecast of 3.8% this year, he said. GDP growth is predicted at 3% for the first half before revving up to 4% in the latter half.

The Finance Ministry’s think tank last month slashed its forecast for economic growth to 3.8% from 4% in January and for exports to 3.4% from 4.5%.

Commenting on the impact of the escalating tit-for-tat trade war between the US and China, Mr Lavaron said that any Thai products in supply chains of the two countries would feel the pinch but that the country can benefit from shipping products substituting for those made by China and the US.

Thailand could potentially reap a windfall from manufacturers relocating plants from China to here, but the domestic political situation remains uncertain, he said.

TMB Analytics appears to have the most pessimistic outlook, trimming its 2019 economic growth forecast to 3% from 3.5% previously.

Source: https://www.bangkokpost.com/business/news/1681740/planning-unit-cuts-growth-forecast

English

English