Moody’s lauds Vietnam’s stricter regulations on unsecured consumer lending

The Vietnamese central bank’s recently-proposed stricter regulations on personal unsecured lending by consumer finance companies is credit positive for the Vietnamese finance companies, Moody’s Investors Service has said in a note.

On March 26, the State Bank of Vietnam, the country’s banking regulator, held a public consultation on its proposed changes to regulations on personal unsecured lending by consumer finance companies. The proposed changes include limiting unsecured personal loans – known in Vietnam as “cash loans” – to existing customers with good credit and no overdue debt; and limiting the maximum amount of personal loans to 30% of total loans.

The regulator has not specified when it intends to implement the new regulations.

The proposal is credit positive for the Vietnamese finance companies because the stricter regulations will help alleviate asset quality pressure by curbing excessive growth in the riskier consumer-loan segment, which will lead to stronger risk-adjusted returns and support internal capital generation in the future. “We also expect that bottom-line profitability of finance companies will decrease in 2019 as the companies adjust to the new rules,” said Moody’s Investors Service analysts.

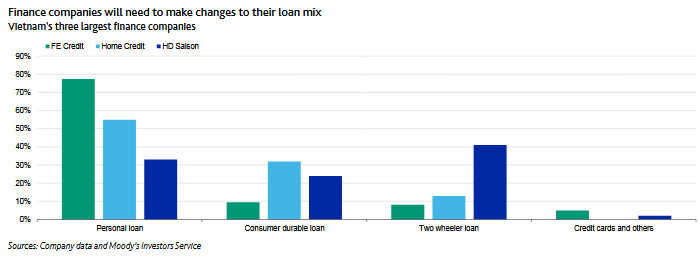

VPBank Finance Company Limited (FE Credit, B1 stable) has the highest proportion of personal loans in its loan portfolio among the three largest finance companies in Vietnam by total loans, which also include Home Credit Vietnam Finance Company Limited (Home Credit, B3 stable) and HD SAISON Finance Company Ltd. This means that FE Credit will need to make the most changes to business practices.

All three companies will need to make adjustments to their businesses by focusing on lower-yield products such as consumer durable and motor vehicle loans. The analysts expect that FE Credit will need to make the most significant adjustments to comply with stricter regulations because of the higher amount of personal loans on its books.

The three companies are also market leaders in other consumer finance segments in Vietnam and will have to make fewer adjustments to their business practices than smaller finance companies as a result of the new regulations. These smaller companies have been more reliant on personal loans for business growth and will have greater pressure on their revenue than the top three companies.

Revenue growth of finance companies remains supported by strong consumer demand for credit, while credit costs will be contained by the tighter lending requirement; both factors will drive stronger risk-adjusted returns for finance companies.

Vietnam’s consumer finance industry grew at a compound annual rate of 41% between 2013 and 2017 on the back of higher personal income and greater penetration of services. “We expect growth in personal loans to slow significantly when the new regulations come into effect after far exceeding growth over the past three years for other less-risky consumer loans, such as those for the purchase of motorcycles and durables.”

The demand for consumer finance is strong and supported by the buoyant Vietnamese economy. Now, finance companies constrained from extending new personal unsecured loans because of the new regulations will focus on growing the other product segments and will benefit from increased diversification in their lending portfolios and more emphasis on lower-risk products.

English

English