Vietnam’s interbank interest rates drop after skyrocketing for last 6 months

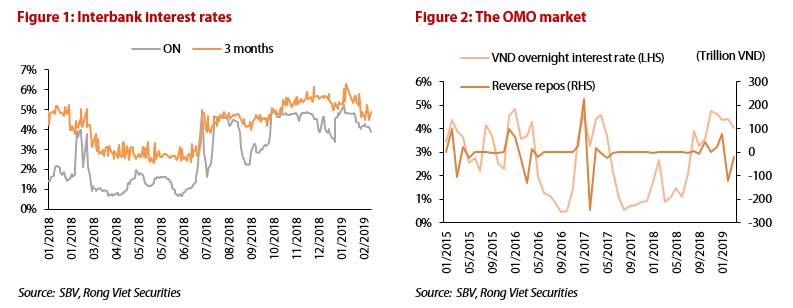

At the last session, the overnight interest rate decreased by 37 basic points (bps) to 3.9% per year. Notably, the one-month interest rate dropped the most, by 52 bps, followed by one week down 18 bps, and 2 weeks 22 bps.

In the case of the three-month rate, the rate went down from the peak of over 6% in January despite increasing by 39 bps last week. Regarding trading volume, the demand remained high, especially at one-week quote. However, there is likely an eased burden put on short-term liquidity.

About State Bank of Vietnam (SBV)’s monetary policy, there seems no urgency to support the banking liquidity via reverse repurchase agreement (or reverse repo). Based on recent years’ changes, SBV takes advantage of reverse repos and bills to control the liquidity. While the former will pump more money into the system in short-term and specific time, the latter is for the purpose of withdrawing the abundant one.

Currently, the outstanding amount of reverse repos is close to 0 after previous strong increases. The offering amount has been lower than the due amount during the last two months. That implies SBV intends to neutralize the pumped amount and stop to support the liquidity.

In addition, that interbank interest rates slumped at the beginning of March is related to SBV’s previous currency forward contracts.

Since the start of 2019, the SBV has actively set a higher FX buying rate and joined long currency forward contracts in order to improve the national foreign reserve in the context of a massive amount of trade surplus, around US$7 billion in 2018.

According to the SBV, the bank has bought over US$4 billion in foreign currency.

Besides, the gap between money supply growth and credit growth is supportive to lower interbank interest rates in the first two months. Recently, the administration has declared that money supply growth and credit growth were at 2.1% and 0.8% year-to-date up to the end of February. That created a big gap and positively affect the liquidity.

Overall, it is expected that the interbank interest rates are likely to decrease further in the case of better situation of geopolitical tensions.

English

English