Vietnam tops major ASEAN economies in 2018: HSBC

The country outperformed most of its regional peers in the third quarter of 2018 with GDP growth of 6.8% year-on-year, according to HSBC.

The manufacturing sector steadied from the previous quarter despite a cyclical slowdown in electronics trade and rising trade tensions globally. Meanwhile, the services sector continues to outperform due to declining unemployment, rising wages, and expansion of the tourism industry.

Vietnam is particularly vulnerable to trade risks given its reliance on exports and manufacturing. As such, rising trade tensions globally are likely to impact Vietnam more significantly than other economies. But the imposition of higher tariffs alone is not the most significant risk. In fact, Vietnam could benefit if trade tensions between the US and China only lead to trade and FDI diversion globally.

But the potential negative impact of trade tensions on global growth would be more detrimental for Vietnam. Moreover, HSBC expected a cyclical slowdown in the US and Europe (two of Vietnam’s top three trading partners) over the next couple of years.

Growth in 2019 is likely to be supported by continued strength in the services sector. The report estimated wage growth over the past six years at just slightly above trend as of the second quarter of 2018, which should fuel private consumption over the near term. Moreover, it is expected that growth in China to remain steady, as the government is likely to offset any potential headwinds from trade tensions through targeted credit easing and fiscal stimulus. These factors point to slowing, albeit not slumping growth for Vietnam.

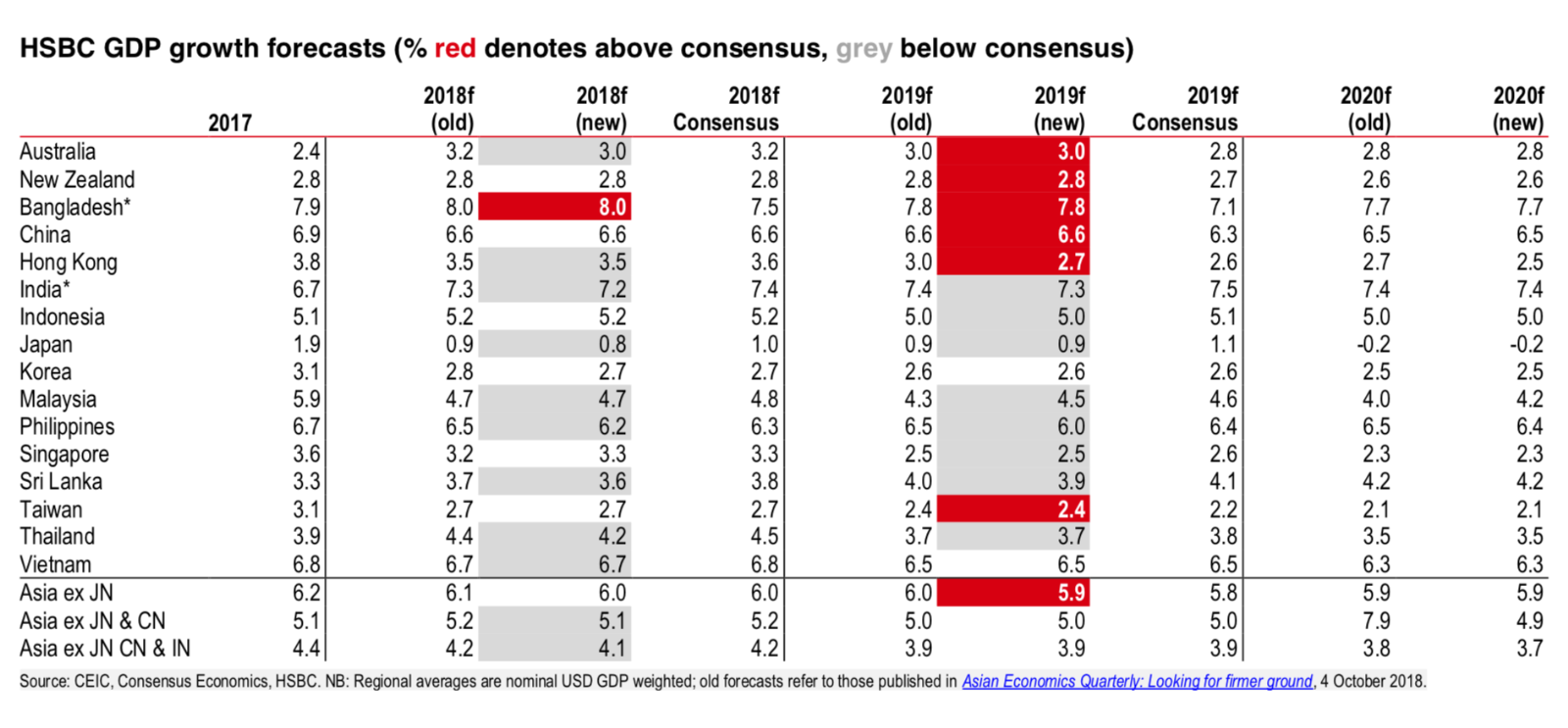

HSBC predicted Vietnam’s growth at 6.5% in 2019 and 6.3% in 2020.

Meanwhile, inflation risks have been greatly reduced given the recent decline in oil prices and marginal credit tightening from the State Bank of Vietnam (SBV) since the second half of this year. Thus HSBC has revised down its average inflation forecast for 2019 from 4.1% to 3.4%. This is likely to be enough for the SBV to keep its policy rate on hold and enable it to instead focus more closely on sustaining growth.

Risks

The risks to Vietnam’s economy are relatively better contained compared to previous years. Vietnam’s public-debt-to-GDP ratio fell in 2017 for the first time since 2012, helped by growth in non-tax revenues and inflows from SOE equitization. The report expected further improvement in 2019, with public debt likely to decline to 61% of GDP from our forecast of 61.4% in 2018.

Meanwhile, credit growth has also declined vs previous years as a result of macro-prudential measures and efforts by the SBV to limit credit growth in light of high inflation in 2018.

However, capital adequacy remains an issue for the country. Persistently high credit growth in recent years has translated to a ballooning of bank assets, which has not been matched by banks’ ability to raise capital.

This problem is exacerbated in the country’s state-owned banks, where capital adequacy ratios (CARs) may fall below the 8% minimum threshold when Basel II standards are applied in 2020. Thus, continued reforms, such as improving data quality and transparency and a further reduction in NPLs, are required to attract greater equity investment.

English

English