Thailand: BOT expected to hike key interest rate

STANDARD Chartered Bank (Thailand) expects the Bank of Thailand (BOT) to start monetary policy normalisation and increase the interest rate by 25 basis points (bps) , from 1.50 per cent to 1.75 per cent, in November.

However, due to current concerns about the pace of the baht’s appreciation, Standard Chartered Bank expects no further rate hikes in December, the bank’s economist, Tim Leelahaphan, said.

Yesterday, the baht weakened to Bt33.30 to the US dollar, its lowest in eight weeks.

“We expect the policy rate to end 2019 at 2.25 per cent with a 25bps hike each in the first and second half of 2019,” Tim said at a press conference yesterday.

The BOT has been slow to normalise its monetary policy when compared to neighbouring countries because of current worries about the baht’s rate of appreciation. In the first quarter of 2018, the baht rose by 4.5 per cent, a clear outperformer in Asia’s emerging markets, he said.

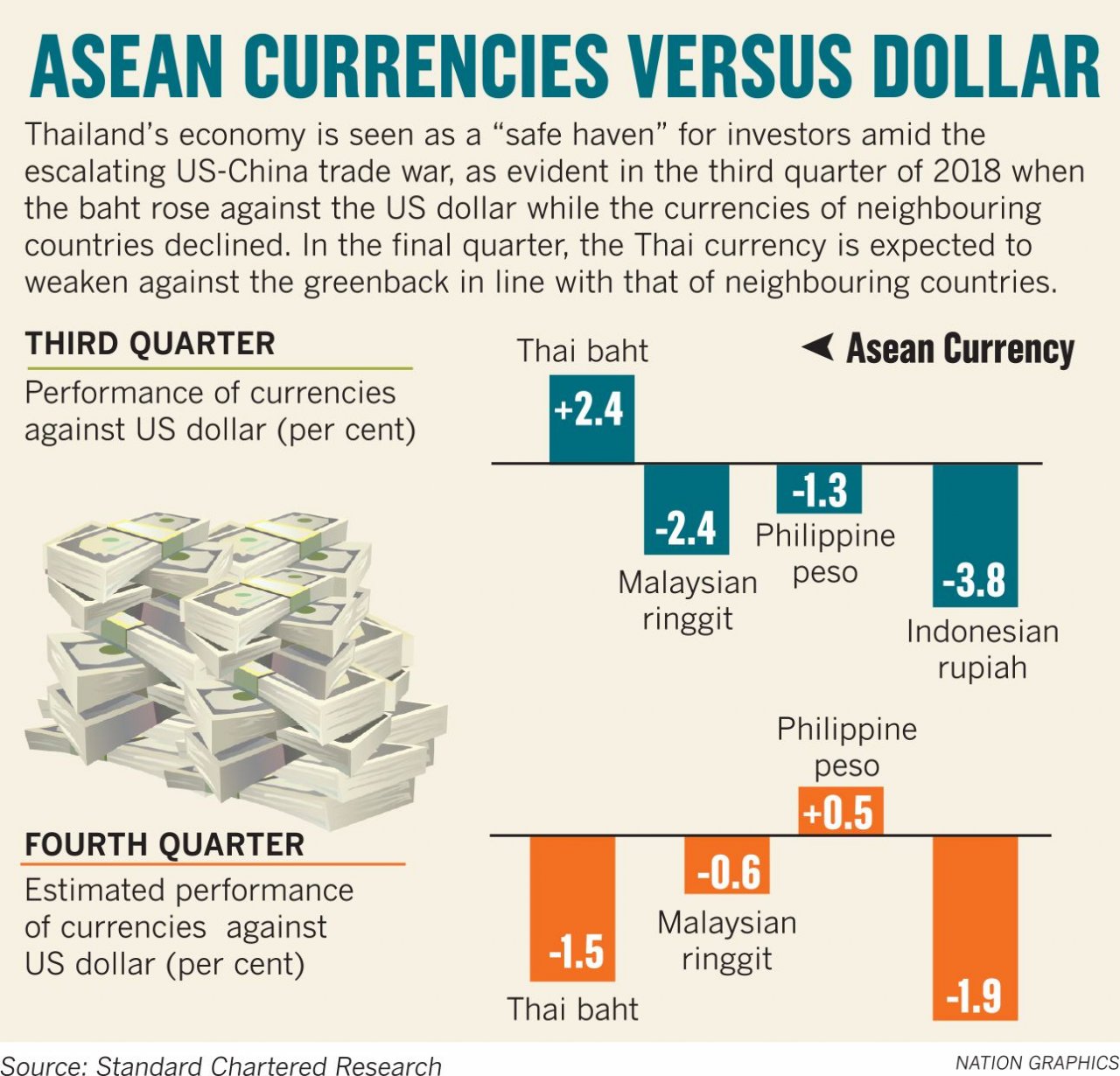

In the third quarter, Asia’s markets were negatively affected by the escalation of the US-China trade war. However, Thailand’s economy was seen as a safe haven in Asia for foreign investors and the baht even appreciated by 2.4 per cent, he explained.

However, in the fourth quarter, there is a slowdown in the baht’s appreciation, and the BOT is expected to hike interest rates in November, according to Tim.

Another motive for the BOT to normalise monetary policy at a faster rate than expected is the signal from the US Federal Reserve that it would increase the interest rate from 2.25 per cent to 2.50 per cent in December, and to 3 per cent by the end of 2019. The Federal Funds rate currently exceeds the BOT rate by 75bps.

If the Federal Reserve increases their interest rates even further, this will create a wide rate differential between the Federal Funds rate and the BOT rate. This gap between the two rates would encourage investors to shift their current investments in Thailand to the US. This may lead to capital outflows from the Kingdom, which makes it likely that the BOT will hike interest rates in November, Tim explained.

Despite these worries, Standard Chartered bank expects Thailand’s economy to grow by 4.5 per cent in 2019 on the back of political progress and long-term economic policies. The road to the election will lead to a wider distribution of capital to rural areas in the country, according to Tim.

Furthermore, the current economic policies are highly likely to be continued in the next government’s policies. This includes boosting Thailand’s exports to Cambodia, Laos, Myanmar and Vietnam, which has seen a 20-per-cent growth thus far in 2018, he said.

The government’s infrastructure investment plans in Bangkok and the Eastern Economic Corridor as well as its Thailand 4.0 policy are expected to boost the economy, leading to a strong economic year in 2019.

Meanwhile, the key risk factor for Thailand’s economy in 2019 is the tourism industry. Total hotel reservations are expected to be low from the fourth quarter of 2018 all the way to the first quarter of 2019, according to Tim.

“With no clear policy to win back Chinese tourists, which have declined since the fatal boat accident in Phuket in July, the tourism industry remains at risk in 2019,” said Tim.

Source: http://www.nationmultimedia.com/detail/Economy/30357539

English

English