Vietnam’s authorities consider tax relief to support local auto production

The Hanoitimes – The Ministry of Industry and Trade (MoIT) is scrutinizing a plan to exempt special consumption tax on locally produced auto parts in a move to promote domestic auto manufacturing and build up a supply chain for the industry.

Under a report sent to National Assembly (NA) deputies recently, the ministry said that it will submit the proposal on revising the special consumption tax rate imposed on vehicles with a high localization rate (measuring the use of locally produced parts) to NA for approval.

The ministry expects the incentive policy will encourage domestic automakers including Truong Hai Auto Corporation (Thaco), Thanh Cong Group and VinFast to promote their projects.

According to the ministry, it has so far also issued policies, such as Decree No.116/2017/ND-CP, to promote the local automobile manufacturing and related supporting industries.

While Decree 116, which took effect early this year, makes it hard for importing automobiles due to tightened controls of origin, types, technical safety and environment protection requirements, it gives many opportunities for firms to develop the local automotive industry, raise localization rate and create jobs.

The policies have so far shown effectively, helping the country attract significant investments from both domestic and foreign investors in the local automobile manufacturing and related supporting industries.

According to data from the Foreign Investment Agency under the Ministry of Planning and Investment, the manufacturing and processing industry led 17 industries and sectors in Vietnam’s FDI attraction in the first half of this year with US$7.91 billion, accounting for 38.9 percent of the total FDI capital. Notably, most of the investments were poured in the manufacturing and supporting industries to serve for the automobile industry.

Improving local supply chain

The supply chain for automobile industry in Vietnam is still underdeveloped, causing domestic auto manufacturing and assembling enterprises having to mainly import spare parts.

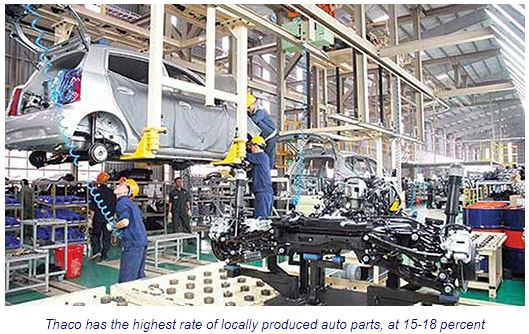

According to experts, the localization rate of several types of cars is still lower than the target because the industry lacks a network of material suppliers and large-scale parts producers. Although the target rate was set at 40 percent in 2005 and 60 percent in 2010, it currently stands at just 7-10 percent on average. Thaco tops among manufacturers with a rate of 15-18 percent, while Toyota Motor Vietnam reaches 37 percent for the Innova model alone.

Localized parts are primarily simple components like tubes, tires, sears, mirrors, wires, batteries and plastic products. Meanwhile, 80 to 90 percent of the raw materials for automobile production, including steel, aluminum alloys, plastic resin and high tech rubber, are currently imported. This amounts to US$2-3.5 billion.

Until 2025 and 2035, the MoIT said the industry will focus on small sedans suitable for Vietnamese people and follow the worldwide trend of environmentally friendly vehicles like hybrids and electric cars.

The industry target is to meet 60-70 percent of market demand with a localization rate of 35-40 percent by 2020. It will continue to focus on trucks, buses and specialized vehicles serving agriculture and rural development.

According to Nguyen Thi Xuan Thuy from the Ministry of Industry and Trade’s Institute of Industrial Policies and Strategies, the Vietnamese automobile market has good prospects as the country has over 90 million people and a growing middle class, with per capita income estimated to reach US$3,000 by 2020.

Besides, the country’s automobile market is expected to soon have an automotive consumption rate (known as motorization) of 23 vehicles per 1,000 people, Thuy said, adding that road traffic systems are expanding with intercity connections through a network of highways, creating more favorable conditions for private cars.

Source: http://www.hanoitimes.vn/investment/2018/10/81E0CE66/vietnam-s-authorities-consider-tax-relief-to-support-local-auto-production/

English

English