PwC: Almost half of Thais victims of fraud

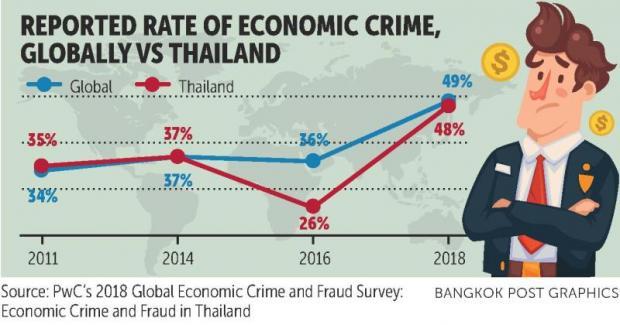

Almost half of Thai respondents were victims of fraud or other economic crimes in the last two years, up significantly from just above a quarter in the 2016 survey, according to PwC’s 2018 Global Economic Crime and Fraud Survey.

The portion nearly doubled to 48% in 2018 from 26% two years ago, the survey said.

The survey found that asset misappropriation was the most common economic crime in Thailand, affecting 62% of companies that responded, compared with 45% globally, it said.

Business misconduct (40%) affected more companies in Thailand than globally (28%), suggesting that internal fraud prevention policies have gaps, grey areas or loopholes that are being exploited.

Although cybercrime is a serious threat, just over one in five respondents (21%) said their company had been the victim of cybercrimes in the last 24 months, with just over one in ten (11%) ranking it as the most serious in terms of impact on their organisation.

Despite these numbers, almost a third of respondents (32%) predicted that it would be the most serious crime over the next two years.

“The numbers certainly stand out,” said PwC Thailand’s forensics partner Vorapong Sutanont.

Paradoxically, the figures can be viewed as a positive sign for the country.

“A closer look at the survey results and my personal experience indicate that rather than fraud and other economic crime almost doubling, organisations are simply becoming more aware of the risk and better at detecting crimes when they happen,” Mr Vorapong said.

Fraud and economic crime effect every country and sector and can come in many shapes and forms, all designed to evade detection by definition.

“The important question isn’t are you a victim of fraud,” Mr Vorapong said, “the important questions are — are you aware of how fraud is affecting your organisation? And are you fighting it blindfolded, or with your eyes open?”

More than three-quarters (71%) of Thai respondents said that their companies put a medium or high level of effort into business processes to combat fraud or economic crime internally, compared with 83% globally.

Just 23% of respondents said that they put a high level of effort into improving the ethical standards of individual employees, compared with 34% globally. This is despite employees being responsible for 70% of the most serious economic crimes in terms of financial impact.

“Once companies get a handle on how exposed they are to fraud and other crimes, they need to invest in people, business processes and other tools to effectively minimise their exposure,” Mr Vorapong said.

Being aware of and talking about economic crime is the first step for companies to take to protect themselves, and it is also critical for positioning Thailand as a good place to run a business from, said PwC Thailand chief executive Sira Intarakumthornchai.

Source: https://www.bangkokpost.com/business/news/1527402/pwc-almost-half-of-thais-victims-of-fraud

English

English