Thailand: Foreign funds drive baht

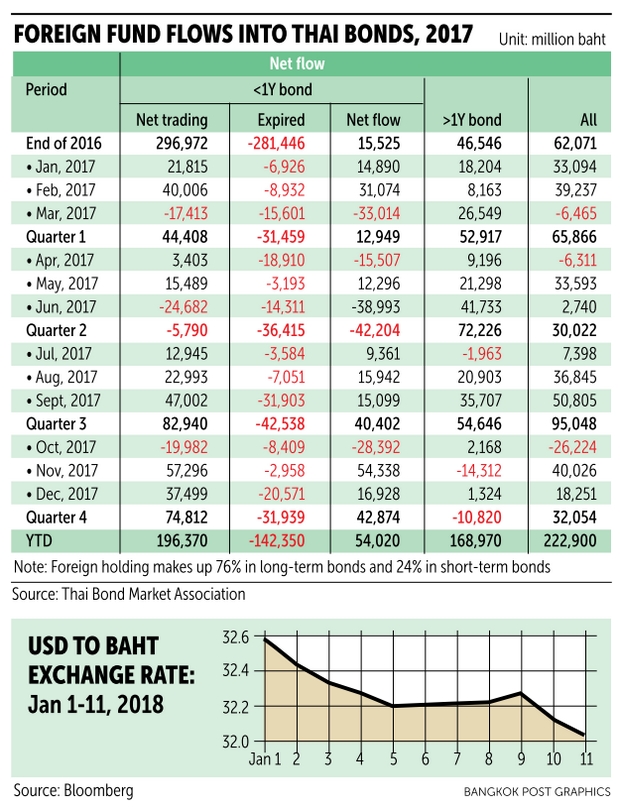

Year-to-date net foreign inflows into Thai bonds have reached 47 billion baht, with foreign investors viewing Thailand as a destination to park their funds.

Some have fingered the movement as the source of the baht’s strengthening value.

The baht rose 0.3% Thursday to a nearly 3½-year high of 32.02 against the US dollar. The baht is the year-to-date best-performing currency in Asia, appreciating 1.75%.

Early Friday, currency dealers in New York quoted the baht at 31.99 per dollar in trades of $1 million or more.

The strong baht has caused heartburn among exporters, with the Thai National Shippers’ Council set to discuss the issue with the Bank of Thailand Friday.

Tada: Thai bond market an attractive destination

Foreigners are probably taking a wait-and-see attitude before the Federal Open Market Committee’s meeting at the end of this month, with the minutes set to be released in February, said Ariya Tiranaprakit, executive vice-president of the Thai Bond Market Association (TBMA).

Net foreign outflows in the Thai equity market are worth 8.4 billion baht this year, the TBMA said.

Ms Ariya said foreign inflows parked in short-term bonds are valued at 27 billion baht, while long-term bonds total 20 billion.

Foreign funds moving into Thai bonds are uncertain because these inflows might turn into outflows if Thailand’s inflation picks up or there is an increase in the US Treasury yield, she said.

“This is a time when foreign investors are parking their money in emerging markets, and the Thai bond market is an attractive [destination] because there is a good return and the economy is picking up,” said TBMA president Tada Phutthitada.

The TBMA expects domestic inflation to remain low, while the benchmark interest rate is projected to stay unchanged at 1.5% throughout the year.

The long-term US yield curve will gradually pick up, but occasional dips in the US bond market are expected, Mr Tada said.

“In the past, when the US economy recovered, dips sometimes occurred in the US bond market because of the significant sale of bonds,” he said. “But the possibility of a crash in the US bond market is minimal, as the US Federal Reserve’s balance sheet reduction will be gradual.”

Such a scenario repeating itself in Thailand’s long-term bonds is unlikely because financial institutions and insurance firms have a surplus of liquidity, Mr Tada said, adding that the country also has a huge number of local players investing in foreign investment funds (FIFs).

“The size of outstanding investment in FIFs is 1.1 trillion baht — larger than the net foreign inflows into Thai bonds,” he said. “It is more worthwhile keeping a close eye on FIF movements than foreign inflows.”

Foreign investors increased their holdings in Thai bonds to 223 billion baht in 2017.

Some 76% of those holdings were long-term bonds and the rest went to short-term debt instruments.

Source: https://www.bangkokpost.com/business/news/1394206/foreign-funds-drive-baht

English

English