Consumer spending in Vietnam continues to outpace ASEAN peers

The Hanoitimes – Vietnam’s modern grocery retail and pharmacy sector will benefit specifically from the country’s consumer spending growth story.

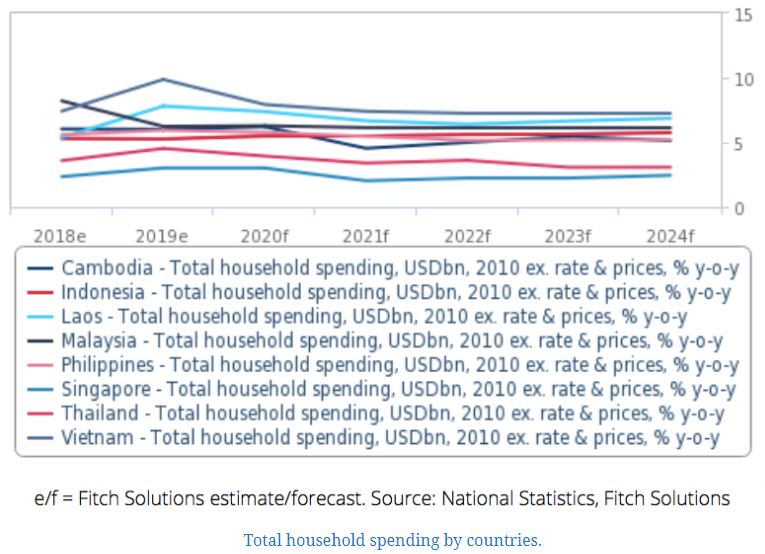

Consumer spending in Vietnam continues to expand and outpace its ASEAN peers as the country’s real household spending is predicted to grow by 7.9% year-on-year in 2020, a slight slowing on the 9.9% recorded last year, according to Fitch Solutions.

The rate, however, is higher than the 3% projected for Singapore, 3.9% for Thailand 6.3% for Malaysia, 5.8% for the Philippines and 5.5% for Indonesia, Fitch Solutions has said in a report.

Fitch Solutions projected high growth in consumer spending to continue over the medium term (2020-2024), with real household spending forecast to average growth of 7.4%, Vietnam will retain its position as the growth outperformer in ASEAN over this time period.

Vietnam’s modern grocery retail and pharmacy sector, therefore, will benefit specifically from the country’s consumer spending growth story is due to the fact that the products stocked in these retail segments are forecast to record the strongest growth in 2020 and over the medium term.

Household spending is, in nominal terms, forecast to expand by an annual average of 13.6% over the medium term. Outpacing this growth outlook is Fitch’s spending projections over the same period for food (13.7%), health spending (14%), personal care (15.1%), and personal effects (15.3%).

|

In the short term, it is expected the grocery and pharmacy sector will also witness increased demand on the back of Covid-19 fears.

During the outbreak, consumer behavior and purchasing patterns shift as consumers stock up on groceries. This is partly due to panic buying, but also partly from consumers seeking to cook at home to minimize the risk of exposure in public settings, such as eating at restaurants or markets.

Additionally, there is an uptick in demand for health-related products (masks, sanitizers, vitamins, among others) as consumers seek to protect themselves.

Initial data is bolstering this view. Saigon Co.op, one of the largest Vietnamese grocery chains, has reported that the most commonly purchased products are fresh food, dry food (instant noodles, sugar, rice), hand sanitizer and antiseptic water. Emart Vietnam, a South Korean grocery chain that also has a significant presence in Vietnam, has also stated it has experienced a double-digit daily sales growth, peaking at 40 % in one day, with dry food sales increasing by 150% and toilet paper sales increasing by 200%.

Fitch Solutions notes that local, regional and international modern grocery retail and pharmacy companies are expanding within Vietnam and so will be well placed to benefit from the strong medium-term consumer spending outlook.

Source: http://hanoitimes.vn/consumer-spending-in-vietnam-continues-to-outpace-asean-peers-311169.html

English

English