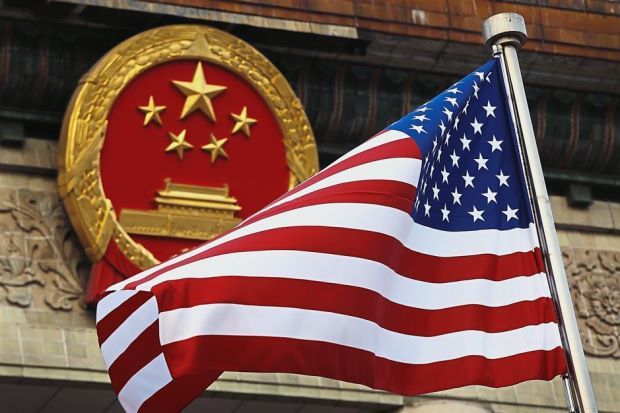

Trade worries to impact growth, investment in Asia-Pacific, S&P says

KUALA LUMPUR: Trade uncertainty will weigh on growth and investment in Asia-Pacific despite somewhat easier financial conditions, S&P Global Ratings says.

Despite what appears to be a temporary truce in the US-China trade and technology dispute, policy uncertainty has risen since earlier in 2019 when a deal also looked likely, it said in its report “Asia Pacific quarterly: Weaker outlook as trade tensions bite”.

The ratings agency said for some time, it believed investment rather than exports would be the most important casualty from a trade war, and this risk now appears to be partly materialising.

Capital expenditure growth has slowed across the Asia-Pacific and is now negative in the region’s more trade-oriented economies.

“We have long believed that trade-tech tensions will have a limited impact in the short run but potentially larger-than-expected effects in the long run,” said Shaun Roache, Asia-Pacific chief economist for S&P Global Ratings.

“This means we worry less about bilateral tariffs and more about the disruptions caused by investment and export restrictions.”

Overall, achieving a comprehensive trade deal that would remove uncertainty from the bilateral economic relationship would be challenging.

Thorny issues remain on market access, intellectual property protection, an agreement-monitoring mechanism, and potentially restructuring China’s state-owned entities (SOEs.) One side may need to make substantial concessions to arrive at a lasting deal. While this is possible, it seems unlikely, at least over the next 12 months.

Easier financial conditions are partly offsetting trade policy uncertainty. Dovish guidance from the U.S. Federal Reserve and the European Central Bank has signaled to markets that monetary policy will be more accommodative.

Bond yields across Asia-Pacific have declined and several central banks have cut policy rates so far this year. Further rate cuts are likely, especially in emerging markets, given low inflationary pressures and expectations of easier global monetary policy.

S&P Global Ratings lowered the growth forecast for the region to 5.1% in both 2019 and 2020, from our earlier forecast of 5.2%, due to the drag from trade tensions.

More accommodative monetary policy will partly offset the drag from trade, but not enough to keep growth at the 5.4% expansion seen in 2018.

In China, policy stimulus is likely to stabilise growth. Indirect effects of trade tensions will weigh on growth by affecting investment spending.

Manufacturing investment has been particularly weak during the year. Stimulus measures will offset this slowdown in the near-term.

In addition, renminbi depreciation can reduce direct effects from trade tensions.

“Financial conditions in China are now firmly in easing territory and filtering through to the real economy,” Roache said. “This careful easing should be enough to put a soft floor under China’s growth later this year.”

Source: https://www.thestar.com.my/business/business-news/2019/07/10/trade-worries-to-impact-growth-investment-in-asia-pacific-sp-says/#bkC5h3ivzKKIFBBf.99

English

English