Singapore’s payments transformation pushes ahead with single QR code

A LONG-AWAITED piece is finally in place that will get Singapore’s electronic payments transformation going.

Singapore on Monday launched a single, standardised QR or Quick Response code for e-payments in what could be a global model for other jurisdictions.

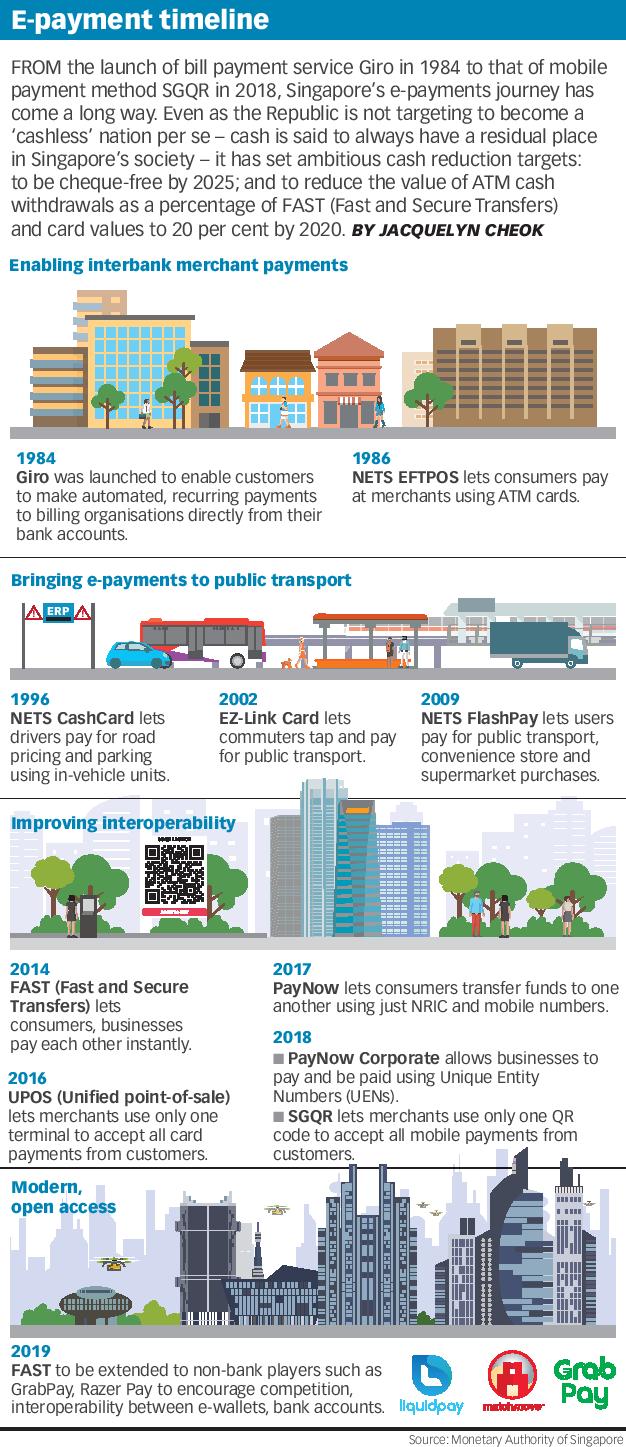

Just as significant, the government also announced it will open the interbank payment gates to fintech firms by 2019. This will bring non-bank e-wallets into the national e-payment loop and also spur digital innovation.

Speaking at the launch of the common QR code, Monetary Authority of Singapore board member and Education Minister Ong Ye Kung said: “These may well be the last few jigsaw pieces we are putting in place to complete the national e-payment infrastructure.”

The newly minted Singapore Quick Response Code (SGQR) will be adopted by 27 payment schemes including PayNow, Nets, GrabPay, Liquid Pay and Singtel Dash, and will be rolled out progressively over the next six months. More than 19,000 QR codes will be replaced with SGQR codes from this month.

To pay by SGQR, consumers choose their preferred payment scheme from the accepted options, and login to the relevant payment app. They then scan the SGQR code and pay the amount required. SGQR does not require a terminal, and so is a cheaper way to accept various e-payment options. A common problem now is that QR codes can be designed differently from each other, which prevents certain e-wallets from reading them all. This resulted in F&B outlets such as Toast Box having to display several QR codes, confusing consumers.

Tan Su Shan, group head of consumer banking and wealth management at DBS, said the standardisation of QR code standards gives consumers greater freedom in their choice of payment platforms and will further popularise the adoption of e-payments.

Speaking to The Business Times, Louis Liu, co-founder & chief executive of FOMO Pay – which designs QR codes for cashless payments – said the SGQR’s design also allows it to communicate with international payment schemes. Being able to take payments from overseas visitors is key to capturing the tourism dollar.

“Many regulators in Asia are watching how Singapore develops a common QR code that will bring together a fragmented e-payments market and allow for cross-border payments.”

In a report in June, Frost & Sullivan said the mobile payments market in Singapore stood at about S$1.5 billion, with an expected revenue growth of 26.1 per cent between 2016 and 2021 on a compound annual growth rate basis.

Fintech firms can now get into the action.

The interbank fund transfer rails known as FAST is a round-the-clock service offered since 2014. Singapore will now open it to fintech firms to broaden access to payments players, in the same way that UK and India have done to open up central payment infrastructure to spur competition, said Mr Ong.

“We will allow non-bank players to have direct access to FAST. This is to enable their e-wallets to bring greater convenience to consumers,” he said.

Singapore will form a Direct FAST industry working group, which would include banks, non-banks, and the MAS, to develop business and technical requirements for non-banks to connect directly to FAST. Grab, Liquid Group, MatchMove, Razer and TransferWise have signed up for this working group.

“As we enable more non-bank players to connect to FAST, MAS expects them to adopt a mindset of open accessibility and good customer service. They have to provide two-way payments between e-wallets and bank accounts,” said Mr Ong.

“Open access to a common infrastructure like FAST means that banks and non-banks will have to compete harder to gain and retain customers. They will have to innovate and offer value-added services constantly to stay ahead of the curve.”

Ooi Huey Tyng, managing director of GrabPay in Singapore, Malaysia, and the Philippines, said the latest move signals the growing popularity of e-wallets by non-bank players.

“We are glad that MAS is taking a proactive approach to work with everyone in the industry. By enabling non-bank players like GrabPay to have access to FAST, we believe that this will bring us a step closer to a unified e-payment system in Singapore.”

Pranav Seth, OCBC’s head of e-business, business transformation and fintech and innovation group, said: “We believe Singapore has the collective will to become an e-payments and cashless society that is on par with the best we see globally.”

As it is, there is heft behind Singapore’s cashless pursuit. Frost & Sullivan forecasts that 82 per cent of transactions in Singapore should be cashless by 2020, up from an estimated 61 per cent in 2016.

Singapore this year also put out a target to eliminate cheques by 2025, and to reduce ATM cash withdrawals.

Banks here have seen a significant uptick in consumers using mobile payments, with DBS PayLah! recently hitting a peak of 1.2 million monthly QR code transactions. This is about 15 times higher than the average monthly QR code transactions recorded in the first quarter of this year. Over at OCBC, digital payments on the Pay Anyone app have more than tripled in the last year.

There are also collaborations between banks and fintechs. In July, UOB said it would partner Razer to launch Razer Pay in Singapore soon.

With the changes, Mr Ong said that financial institutions, including banks and payment providers, must put in place “robust” cyber defences so that customers have confidence in carrying out online financial transactions, while consumers should maintain their own cyber hygiene. MAS is due to issue user protection guidelines for e-payments as well, soon.

Source: https://www.businesstimes.com.sg/government-economy/singapores-payments-transformation-pushes-ahead-with-single-qr-code

Thailand

Thailand