World Bank warns Vietnam of ‘vulnerable’ credit-to-GDP ratio

Amid tighter financing conditions, corporate and household balance sheets in Vietnam are increasingly leveraged with the country’s credit-to-GDP ratio at about 135%, according to World Bank in its latest “Managing Headwinds” report.

“This leaves the economy vulnerable to shocks and potential financial market stress, especially given legacy non-performing loans (NPLs) and relatively thin capital buffers in some banks,” stated the report.

In 2019, the State Bank of Vietnam (SBV) targets credit growth at 14% in 2019, unchanged from the five-year low rate recorded in 2018 and down from 18% in 2017.

External balances continue to improve

Vietnam’s external balances continued to improve in 2018, despite uncertain global trade developments. Vietnam’s merchandise exports are estimated to have expanded by 13.2% in 2018—below the 21.8% recorded in 2017, but significantly outperforming global trade growth.

Merchandise import growth posted a stronger deceleration to 11.1% in 2018, compared with 21.9% in 2017, reflecting a slowdown in imports of investment and intermediate goods.

“Vibrant trade activity has positioned Vietnam as one of the most open economies in the world, with its trade to GDP ratio reaching nearly 200% for the year,” stated the World Bank.

According to the report, strong exports also helped Vietnam sustain a current account surplus for an eighth consecutive year. Vietnam’s capital account surplus also remains sizeable owing to sustained high FDI inflows.

Robust external positions eased foreign exchange pressures, and helped the SBV build up international reserves, which increased from the equivalent of 2.1 months of import cover at end-2015 to about 2.8 months at end-2018.

However, there remain concerns about real exchange rate appreciation of the dong, and its possible negative impacts on Vietnam’s export competitiveness.

Importance of budgetary discipline

Vietnam’s fiscal stance has improved, with the overall fiscal deficit estimated to have narrowed to 4% of GDP in 2018 from 4.3% in 2017 and 4.9% in 2016.

Total revenues are estimated to have remained at 23.6% of GDP in 2018—about the shares reported in 2016 and 2017—supported by a cyclical recovery in major tax revenues tied to strong consumption and income growth.

Over the same period, total expenditures have declined to an estimated 27.6% of GDP in 2018 from 28.5 % in 2016 and 27.8% in 2017, to a large extent reflecting lower capital expenditures and rationalization of other discretionary spending items.

These measures, while effective in the short term, could hamper needed investments for infrastructure and human capital development. The government’s commitment to strengthen budgetary discipline, therefore, needs to be balanced with reforms that create fiscal space to maintain critical investments in infrastructure and spending on essential public services.

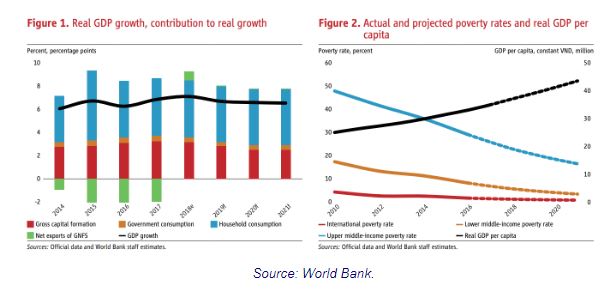

Growth projected to moderate

Vietnam’s economic growth is projected to moderate to 6.6% in 2019, driven by credit tightening, slower private consumption and weaker external demand, according to the bank. Inflationary pressures are projected to remain moderate, due to subdued global demand conditions and moderate global energy and food prices.

Over medium term, growth is projected to stay around 6.5%, as the impact of current cyclical uptick dissipates. Poverty is expected to decline further, as labor market conditions remain favorable.

Domestically, a slowdown in the restructuring of SOEs and the banking sector could adversely impact the macro-financial situation, undermine growth prospects, and create public sector liabilities.

A continued slowdown of public investment could undermine long-term development objectives, and further fiscal consolidation should focus on containing recurrent spending while stabilizing revenue performance.

Vietnam’s economy also remains susceptible to further volatile developments in the global economy, given its high trade openness and relatively limited fiscal and monetary policy buffers.

“Weaker external demand and heightened global financial volatility call for a continued focus on sound macroeconomic management to safeguard against possible shocks. Growth is also spatially uneven, which may see regional disparities continue to widen,” the report revealed.

Thailand

Thailand