The search for e-commerce talent in Asean

When Google and Temasek undertook a study of the internet economy in Southeast Asia in 2017, they predicted it would be worth US$200 billion by 2025. In November last year, they revised that prediction upward to $240 billion to reflect the rapid rise of e-commerce, fuelled by demand for everything from vacation rentals to food delivery, subscription music and video on demand.

The revised study also estimated that the internet economy in Asean reached $72 billion in gross merchandise value in 2018, an increase of 37% from a year earlier. E- commerce is expected to account for copy02 billion or nearly half of the total regional internet economy by 2025.

But to reach that goal, the study says a bigger talent pool of internet economy professionals will be required.

IPrice Group, an online shopping aggregator based in Kuala Lumpur, conducted a study to analyse the e-commerce workforce and measure whether Asean would be able to reach its full potential based on the current state of employment.

The study analysed employee data and hiring trends of the biggest e-commerce players as of the third quarter of 2018. It was conducted through LinkedIn and covers Thailand, Singapore, Malaysia, Indonesia, Vietnam and the Philippines.

ABOVE-AVERAGE GROWTH

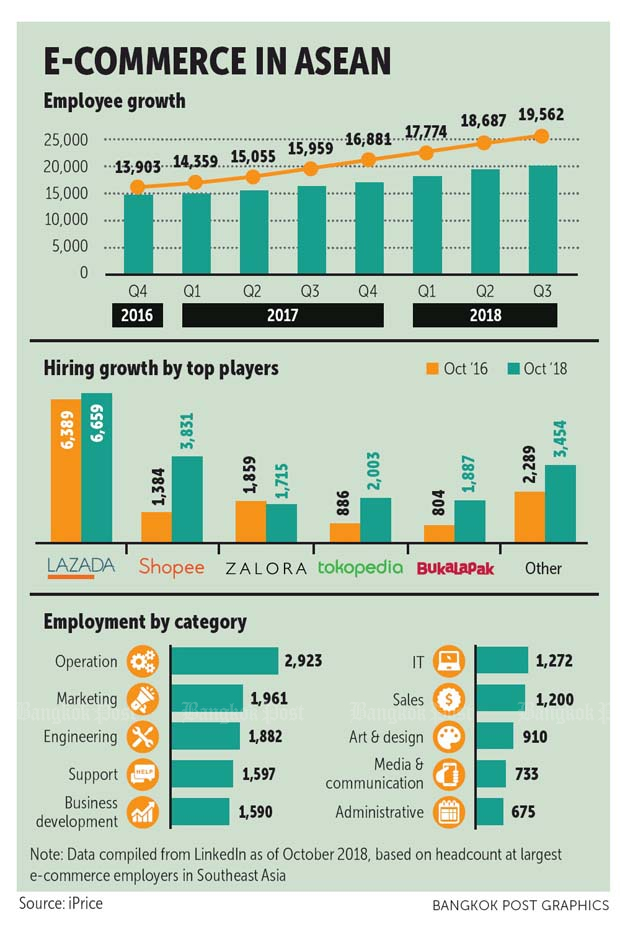

Workforce growth is above the industry average, with headcount at the largest players growing by an average of 808 employees per quarter between the fourth quarter of 2016 and the third quarter of 2018. That rate was much higher than the 10% growth rate that Google and Temasek said was necessary for the internet economy to reach its full potential. This is a positive sign because digital companies usually face difficulty when looking for suitable candidates, said iPrice.

Supporting this claim is Shopee, which has expanded its workforce by 176% over two years, from 1,384 to 3,831 employees by the third quarter of 2018. Expansion really took off when its Singapore-based parent company Garena raised US$720 million between 2016 and 2018 and an additional $575 million after listing on the New York Stock Exchange in 2017.

Its regional peers such as Lazada, Tokopedia and Bukalapak experienced growth in their workforces as well. Zalora is the one exception among the big players with a reduction from 1,859 to 1,715 employees.

The big investment in Shopee was evident in its recent financial results when it reported a wider third-quarter loss that reflected rising investments in its e-commerce unit. Nonetheless, the huge investment is starting to pay off as Shopee has overtaken more experienced players in a short time to become Lazada’s closest competitor.

Among all the job vacancies reported by the region’s e-commerce players, more than 62% were at Shopee. Lazada still has the highest number of staff with 6,659, and continues to invest significantly in hiring, with 19% of all reported job vacancies.

SPECIALISED TALENTS NEEDED

SPECIALISED TALENTS NEEDED

Departments with the highest number of employees at e-commerce firms are operations and marketing. Engineering ranked third and IT sixth. Studies have shown that the real challenge comes when employing highly skilled professionals in functions such as software engineering, digital marketing, data science and product marketing.

Hiring people for these technical roles has been particularly challenging as the rapid growth of e-commerce meant that there was no prior supply for the digital workforce.

The lack of people with e-commerce-specific expertise was identified as the most critical and unresolved challenge by Google and Temasek. As such, it is common practice for e-commerce firms to recruit foreign talent with the relevant experience and knowledge.

However, this might not be the best long-term solution as most expatriates work on short contracts and only a handful intend to stay more than five years in a developing country. The ideal solution is to invest in local talents who are more likely to commit to long-term careers.

Mitigating this issue requires the participation of both recruiters and the emerging workforce. A spokesperson from [Facebook Indonesia] said that digital companies need to move away from the traditional hiring process to adopt a more effective hiring style.

This would include rethinking interview processes and internal expectations to prioritise candidates who are self-motivated and effective in problem and conflict resolution. This means placing less emphasis on hard skills and industry-specific knowledge. Recruiters from the digital sector should invest their resources in training their workforce to mitigate the lack of technical skills and knowledge.

The skills most lacking are problem-solving, strategic thinking and teachability. This is a widespread issue as most fresh graduates in the region do not have work experience when entering the workforce. This is unlike North America, where young people are expected to hold part-time jobs, complete internships and gain relevant experience alongside their tertiary education.

“Fresh graduates tend to lack basic skills entering their first job — ownership, professional communications, stress management, etc — and are often overwhelmed at fast-paced companies such as digital startups,” said market researcher Cynthia Luo.

Young people now in the educational system should also be made aware of the great potential of e-commerce in order to be inspired and motived to start a career in the digital arena, said iPrice. This requires the active involvement of both educators and e-commerce players through collaborative initiatives aimed at showing what it takes to thrive in the digital economy.

Source: https://www.bangkokpost.com/business/news/1612622/the-search-for-e-commerce-talent-in-asean

Thailand

Thailand