The conundrum of low Thai inflation

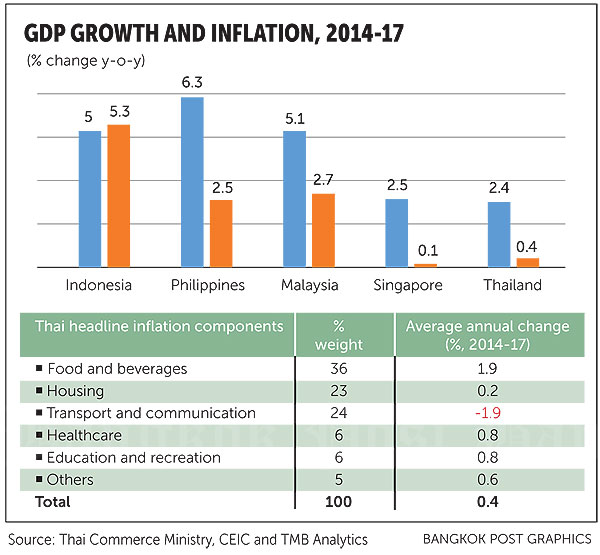

Subdued inflation in recent years might raise concern about the health of the Thai economy in general. In the past three years, inflation in Thailand has been almost the lowest among Asean countries. A casual observer might blame this on the tepid economy, leading to weak demand that has subsequently reduced price pressure.

However, before jumping to any conclusions, it helps to understand how inflation is constructed and measured.

Thailand’s headline inflation rate is calculated by the Commerce Ministry based on a monthly survey of prices in a basket of some 450 goods and services. The results from the survey are then used to assign a weight to each component and construct the consumer price index.

There is no argument against the validity or legitimacy of the survey framework as it is aligned with global practices for constructing price indices. However, one could question how representative the survey results are in terms of the selected samples and the basket of expenditure components in the index and, above all, the resulting inflation figures.

Given the prevailing public perception in Thailand that prices and the cost of living have been rising quite a bit, how can inflation have been this low for the past three years?

Before we get to that, let’s delve into some major components of Thai inflation and see whether the figures make some sense to you.

First, housing, accounting for 25% of the inflation basket, has barely changed in the past three years. When we break down housing costs, we find rental costs remained stagnant at only 0.9% growth per year in the past three years compared with 3% annually in Malaysia.

Stagnant housing costs are also dragged down by lower electricity prices, which are set by a state regulator based on utilities’ production costs, mainly energy prices. Thus, supply-side factors also have some influence.

Does the Thai populace feel their housing affordability was unchanged the past three years? We doubt that.

Another core component of inflation is transport and communication which constitutes around 23.5%. Costs of transport and communication services have been stable since 2008, while car prices have risen about 3% per year in the last 10 years and do not vary much with demand for vehicles.

Also, prices of car equipment increased when oil prices surged. And once they increased, they rarely went down even when oil prices dropped. After two waves of oil price increases in 2007 and 2011, the price index for car equipment went up accordingly and remained stable. This is because there is no need to increase prices now that oil prices are significantly lower.

Other large components representing a total of 12% in the consumer price index are medical and personal care, and recreation and education. Many of the items in these baskets are subject to government policies more than domestic demand, so the rate of price increases is quite low and stable.

The extremely low inflation in the past three years can be attributed mainly to the drop in transport and electricity costs driven by a major decline in energy prices. Also, government support has kept a lid on price growth in education and healthcare, while subdued communication price changes are caused by strong competition among service providers.

Besides the supply-side factors, weak demand or a fragile economy can also contribute to low inflation. In the past three years, Asean countries with low inflation also exhibited low GDP growth and weak private demand.

Be careful when talking about low inflation as a side effect of a weak economy, as inflation is strongly influenced by the supply side and government intervention as well.

Source: http://www.bangkokpost.com/business/news/1282515/the-conundrum-of-low-thai-inflation

Thailand

Thailand