Thailand: Tariff for import duty dodgers

The government is imposing an anti-circumvention tariff on cheap imported products that dodge anti-dumping duties.

Wanchai Varavithya, deputy director-general of the Foreign Trade Department, said the Anti-Dumping and Countervailing Act (ADC Act) is being amended to protect domestic entrepreneurs, with a new chapter regarding anti-circumvention penalties being added. The draft amendment has already been completed.

Circumvention is any activity designed to avoid the payment of anti-dumping or countervailing duties imposed on a particular product manufactured in and/or exported from other countries. Circumvention of anti-dumping and countervailing duties has long harmed domestic industries as it is not actionable under the current ADC Act. The draft amendment will fill the gap in the current ADC Act and make the circumvention activities actionable.

The amendment will empower the Anti-Dumping and Countervailing Board to carry out an investigation on suspected circumvention and implement anti-circumvention duties in response.

If circumvention is found to be taking place, the anti-dumping or countervailing duties imposed in the original investigation will be extended to the product from the circumventing third country, to the parts/components of the product or to the slightly modified product, depending on the case.

Mr Wanchai said the draft amendment to the ADC Act needs to be vetted by the Council of State. He expects the new act to come into force later this year.

“We truly understand the concerns of domestic industries, but for any legal amendments time is needed and the drafting panel should be cautious and take all factors into account,” said Mr Wanchai.

The Ministry of Commerce has received many complaints from the owners of domestic industries, saying that since the ADC Act came into force, many foreign manufacturers and exporters to Thailand have been circumventing anti-dumping or countervailing duties by various means.

Some methods include modifying a product so that it can be classified under a combined nomenclature code that is not subject to duties; exporting through a producer with a lower duty rate; or exporting a product in parts and having it assembled in Thailand, where the parts are not subject to duties.

These practices have been detrimental to domestic industries and made the anti-dumping and countervailing duties ineffective for many years.

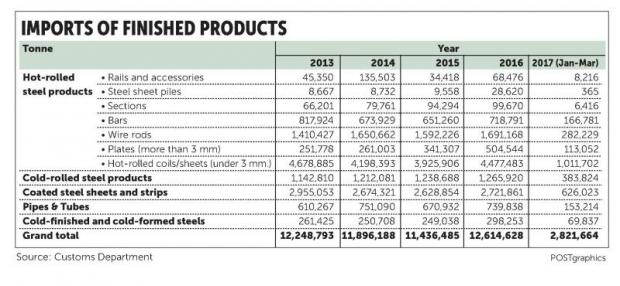

Nava Chantanasurakon, vice-president of the Association of Thai Cold-rolled Steel, said seven steel-related associations have long called on the government to step up applying anti-circumvention duties to curb related imports. Those calls led the cabinet to approve in principle the draft amendment to the ADC Act and forward it to the Council of State for review, after which it will be sent to the National Legislative Assembly (NLA) for final approval.

“Foreign steel exporters have been trying to explore all the loopholes and opportunities to avoid the anti-dumping and countervailing duties,” he said. “For many years we’ve called on the government to impose the anti-circumvention tariff, which is now widely applied in many corners of the developed world such as the United States and the European Union.”

Anuwat Wangvanichakorn, secretary-general of the Thai Cold Rolled Steel Sheet Association, said the import of products that avoid the anti-dumping measures have become a key concern for the Asean region, especially regarding steel products imported from China.

“Chinese steel exporters are clearly attempting to avoid anti-dumping duties. One tactic they quite commonly employ is using other compounds such as chromium instead of a compound of boron, which is now subject to anti-dumping duties from several Asean steel manufacturing countries like Thailand, Indonesia and Malaysia, qualifying them for import duty exemptions,” said Mr Anuwat. “More importantly, Chinese exporters have also benefited from tax rebates offered by the Chinese government to steel mixed with other alloys other than boron, for which the tax rebate has been rescinded.”

Mr Anuwat said after the Chinese government scrapped its tax rebate for boron-mixed steel products in 2015, a number of steel products mixed with other alloys imported from China have flooded the Asean market. The imports of alloyed steel bar, for instance, rose to 11 million tonnes in 2015 and 13 million tonnes in 2016 from only 1.5 million tonnes in 2014. Those from alloyed steel plates rose from 160,000 tonnes in 2014 to 2 million tonnes in 2015 and 2.4 million tonnes in 2016.

The imports of alloyed wire rods also surged from 320,000 tonnes in 2014 to 3.2 million tonnes in 2015 and 4.3 million tonnes in 2016.

“It is now a must for the government to apply the anti-circumvention duties as soon as possible, as given the current prospects it is highly likely that Chinese steel products will continue flooding the Asean region, now that the Chinese administration itself has failed to control domestic steel oversupply. Meanwhile, the US government is shifting more to using policies to protect its domestic steel industry, prompting Chinese exporters to focus more on Asean,” said Mr Anuwat.

In a related development, The Galvanising Steel Sheet and Strip Producers Association has called on the Commerce Ministry to help speed up the investigation into dumping and impose anti-dumping duties on imported galvanised iron (GI), especially from China, South Korea and Taiwan. The investigation, requested by domestic GI producers, was initiated on Sept 14 of last year. According to Lee Dae-Ghul, the association’s director, given the authorities’ slow progress on the investigation, Vietnamese producers have also stepped up their GI exports and sales to Thailand.

Mr Lee said the amount of imported galvanised steel from Vietnam has exceeded 3,000 metric tonnes a month since March 2017, up from almost zero previously, raising concerns among domestic GI producers.

Source: http://www.bangkokpost.com/business/finance/1258294/tariff-for-import-duty-dodgers

Thailand

Thailand