Thailand: On-demand app struggle poised to intensify in 2023

Thailand’s on-demand commerce battle between “super apps” is expected to intensify in 2023 amid slower market growth, economic headwinds and an exodus of funding, as some food delivery players are likely to exit the market next year, according to industry pundits.

“In 2023, the intense battle will shift from e-marketplaces to on-demand commerce players,” said Pawoot Pongvitayapanu, an e-commerce pundit and founder of Tarad.com, a local e-commerce solutions provider.

“Competition in e-marketplaces will ease as they focus more on a path towards profitability,” he said.

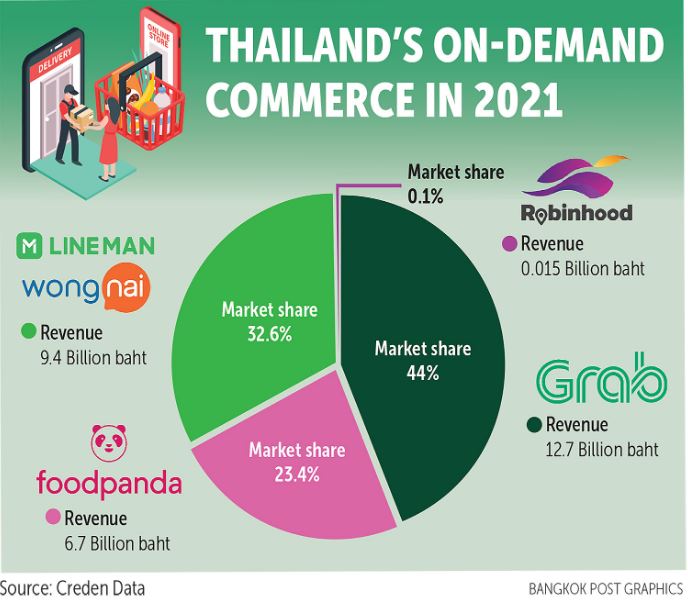

According to Creden Data, a data analytics provider, Grab led the on-demand commerce market share in terms of revenue with 12.7 billion baht in 2021, followed by Line Man Wongnai at 9.4 billion, Foodpanda at 6.7 billion and Robinhood at 15.8 million.

GrabTaxi, the ride-hailing service of Grab, booked 325 million baht in losses, but its payment services and lending services posted profits of 48 million baht and 57 million baht, respectively.

“Grab is still the dominant player in the ride-hailing segment and its service gradually improved from the country’s reopening,” said Mr Pawoot.

Grab is now focusing more on profitability following the decline in its stock price as it has yet to reach the break-even point, he said.

Foodpanda by Delivery Hero (Thailand) registered 4.7 billion baht in losses in 2021. The company has not reported income from its logistics, cloud kitchen and advertising businesses.

Line Man Wongnai racked up 3.4 billion baht in losses, while Robinhood faced 1.3 billion baht in losses.

According to Mr Pawoot, Foodpanda had high borrowing costs, while racking up 9.8 billion baht in losses attributable to equity holders. It relies on loans with a crucial interest burden.

While Grab is geared towards profitability, Foodpanda is the operator with the most to lose because of its crucial losses following 10 years of operation in the country, Mr Pawoot said.

Line Man Wongnai recently received funding of 10 billion baht, despite its high operation costs.

Robinhood also has elevated operating costs, but is backed by its parent SCB 10X.

Other smaller players, such as airasia Super App, ShopeeFood and TrueFood, are offering a variety of services, including ride-hailing, grocery delivery, tourism and financial services.

Anantaporn Lapsakkarn, senior researcher at Kasikorn Research Center, said on-demand commerce, particularly food delivery, is expected to see slower growth from 2022 following the country’s opening as more people return to work at offices, with less dependence on online services.

In 2023, the industry is likely to enter “survivor mode” throughout its ecosystem that involves platforms, drivers and restaurants, he said.

Platforms will find it difficult to cut the benefits of drivers as they risk facing protests or complaints, said Mr Anantaporn.

“With the market size and current circumstances, at least one player may have to exit the market next year, reducing the number of key players to only three,” he said.

The prospect of a global recession and the flight of funding by investors are the challenges facing the operators, said Mr Anantaporn.

Revenue growth for food delivery operators in 2023 will be slower than in 2022 — between flat and low single-digit growth, he said.

Grab targets its adjusted Ebitda (earnings before interest, tax, depreciation and amortisation) to break even by the second half of 2024.

Source: https://www.bangkokpost.com/business/2437867/on-demand-app-struggle-poised-to-intensify-in-2023

Thailand

Thailand