Thailand: New Retail

The relentless rise of e-commerce made last year the worst yet for traditional retailers. Shoppers around the world have made it clear that they want to do more browsing as well as buying online.

Shares of Amazon.com rose 55% last year and this month it became just the second UScopy-trillion company in history (Apple was the first). Founder Jeff Bezos is the world’s richest person with a net worth of more than copy50 billion. Those numbers tell us how far e-commerce has evolved.

Experts say traditional brick-and-mortar retailers can expect more of the same, or even worse, this year in the United States. Toys R Us, Payless Shoes, Gymboree and rue21 were some of the bigger names featured in store-closing announcements, which more than tripled to a record 7,000 last year, according to Fung Global Retail and Technology.

Physical retail in Southeast Asia has not suffered nearly as much, but the warning signs are there. The closure of the last Forever 21 shop in Bangkok last month is an example. But a new trend that combines the best of the online and offline worlds in new ways has been emerging in China and it will reach Asean sooner rather than later, according to the Chinese e-commerce giant Alibaba.

ALWAYS IN FLUX

There are always winners and losers in the retail industry because it is “constantly in a state of flux”, points out Tom McGee, CEO of the US-based International Council of Shopping Centers.

“The whole image of the demise of traditional retailing is overblown,” he told CNN, pointing out that occupancy rates at US malls remain intact at about 93% even though department store chains such as Sears, JC Penney and Macy’s have closed some anchor locations.

US retail sales actually grew 4.7% last year and the holiday shopping period was the best in six years, Mr McGee said, downplaying talk of a “retail apocalypse”.

The emergence of “New Retail” in China seems to support his argument that the industry is just going through one of its evolutionary periods.

“New retail is something that, eventually, we want to bring to this part of the world,” said James Dong, the CEO of Lazada Thailand. “It will take a little bit of time, but probably after the ecosystem is up and running and everything is going smoothly.

Lazada, Southeast Asia’s most popular e-commerce portal, is majority owned by Alibaba, where Mr Dong previously served as head of globalisation strategy and corporate development. In that capacity he helped orchestrate deals with Lazada, Daraz, PayTM and the Turkish online fashion retailer Trendyol.

Mr Dong believes some of the best practices in China and the US, where e-commerce and digitisation are highly advanced, can be replicated in Southeast Asia. This includes a broader ecosystem for e-commerce and the New Retail concept, he told the CLMVT Forum held recently by the Thai Commerce Ministry in Bangkok.

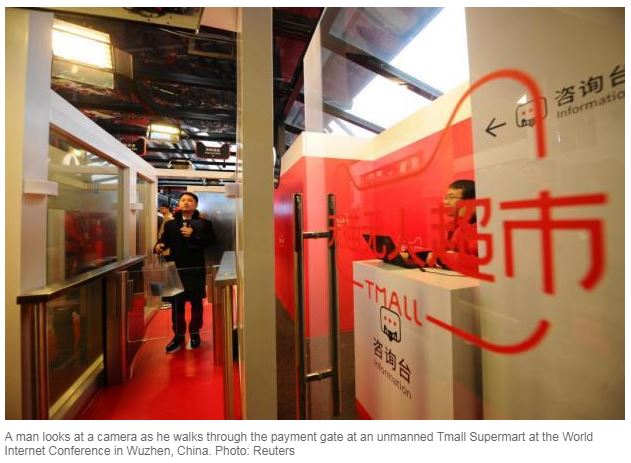

The Alibaba network is among the most formidable in the world, encompassing Alibaba.com, the C2C (consumer to consumer) market Taobao, the B2C (business to consumer) marketplace TMall, and other businesses such as AliCloud and AliPay.

Alibaba learned early on that merchants, especially smaller ones, would be the most important participants in the system, he said.

“At the very beginning of Alibaba, SMEs in China were the core pillar of the merchant part. This is because a lot of small businesses in China were being pressured by big brands but they soon realised that online would be a new channel to grow their business in a very different way,” he said.

“The game has changed because e-commerce has given them the opportunity to leapfrog the bigger merchants.”

Nevertheless, the e-commerce platform alone cannot do everything for the more than one million active sellers on Alibaba.com. This opens opportunities for its “Taobao Partner” service providers to step in and fill the gaps.

Nevertheless, the e-commerce platform alone cannot do everything for the more than one million active sellers on Alibaba.com. This opens opportunities for its “Taobao Partner” service providers to step in and fill the gaps.

“They are very innovative and they provide a lot of services that help offline merchants to do business online,” said Mr Dong.

Once there are platforms and service providers, the next step is infrastructure including payment and logistics. In China, e-commerce used to be cash-on-delivery only, but easy online payment coupled with digitisation of the logistics industry have brought about a massive change.

The final step in e-commerce development is consumers, and once all the other elements are in place to make shopping easy, they tend to flock online to create critical mass.

“The switch from offline cash-on-delivery to online was almost overnight for us in China, where the e-commerce app plays a very different role in consumers’ daily lives and this is a core difference between the US and China,” Mr Dong said.

In the US, where the likes of eBay and Amazon pioneered e-commerce long before it arrived in China, people spend less time on shopping apps, and simplicity and efficiency are the key.

But a very different model has emerged in China, where consumers spend a lot of time immersed in their apps, studying products and other content and also engaging with online influencers.

Because customer engagement is very important for Alibaba, the company invests heavily in customer service personnel, both full- and part-time. It employs around 58,000 full-time staff worldwide but the merchants using its platform number in the millions. Directly or indirectly, the jobs created by the Alibaba ecosystem amount to about 34 million.

“This is the power of an ecosystem where there is absolutely no chance for one company, on its own, to deliver the whole digital transformation to the entire society,” said Mr Dong.

NEW PHENOMENON

In the West, every move Amazon makes is closely watched for signs of how retail will evolve. Its copy3-billion acquisition of Whole Foods last year was a big bet on physical retail and the potential of online to offline (O2O) sales.

But that sort of thing is old news in China, according to Mr Dong.

“When Amazon invested in Whole Foods, there was a lot of talk about this new retail model where offline and online can finally integrate together,” he said. “In those few days I still remember that Alibaba’s stocks surged. [The market] realised that Alibaba had been doing this for three years already.”

Even though online sales penetration in China is the highest in the world, brick-and-mortar retail still accounts for more than 80% of all sales. Alibaba CEO Jack Ma knows this, which is why the company started its own O2O integrated grocery business called Hema in 2015, essentially doing what Amazon would do later with Whole Foods.

In the 19 years it has been in business, Alibaba has come to realise that being an online sales portal would only take it so far. That is why it has repositioned itself from being an e-commerce company to a technology and data infrastructure provider for offline merchants.

Omni-channel and online-offline customer journeys were among the buzzwords Mr Dong used to use in the past, but nowadays he says “there is no boundary between online and offline anymore”.

Alibaba now provides tools for offline merchants to enable them to better understand their customers, while providing them with an online touchpoint to set up stores, with traffic going two ways between offline and online.

“Everything is fully integrated and we became a technology transformation partner to a lot of offline retailers and brands,” he said. “They can choose to have their own customer touchpoint or leverage on Alibaba’s customer touchpoint.”

Shopping at Hema supermarkets is now a smartphone-powered experience that can be done from home or at the store. Shoppers in the stores scan a barcode to get product information while payment is cashless via the Alibaba platform embedded in the Hema app.

One of Hema’s hooks is the ability to choose fresh seafood and decide whether you want to take it home raw or cooked, or have it prepared to eat in-store. Delivery takes under 30 minutes for those living within three kilometres.

Each store also serves as its own warehouse and logistics centre that collects, fulfills and delivers customer orders as fast as they come in, online or offline.

“This has been working out pretty well in China where we have started from food and grocery with Hema, and we have now entered into furniture and fashion,” Mr Dong said.

In Thailand, Pomelo Fashion is building a successful new retail ecosystem led by CEO David Jou, a former managing director at Lazada Thailand. The firm last year secured copy9 million in investment led by JD.com, China’s second biggest e-commerce firm after Alibaba.

“E-commerce is already over and we are moving on to the next thing and for us it is about new retail. The important thing is to really find out what the customers want and to think about the customer experience,” he said.

“We do not have a long history. We do not have a style that we have to do. We do not have these rules that we set. We always look at the customers to tell us what to do.”

Customers today love to be on social media. When they go shopping, they will look at YouTube for inspiration and book Grab services to go somewhere, he said. That is the new lifestyle.

“They don’t think, ‘Am I buying from an e-commerce company?’ It is all very seamless and we have to build an experience that is seamless around the way today’s customer thinks.”

Pomelo, he says, enables shoppers to pick exactly what they want, when they want, and where they want it to be while choosing to pay however they want.

“Your clothes will fit better. They are better in quality. The outfit gets to you faster in the colour you like. It is the fashion that you just saw yesterday. It’s made with good practices,” he said.

“The supply chain is accurate and there is no quality control issue. From an employee perspective, you can work in Bangkok but still be able to compete globally and you can take your talents anywhere.

“All the boundaries that were set before are going away. If there is one thing that I would like to ask it is to keep thinking about how to roll away boundaries and increase access, because that naturally will create more entrepreneurs and opportunities.”

Source: https://www.bangkokpost.com/business/news/1537142/new-retail

Source: https://www.bangkokpost.com/business/news/1537142/new-retail

Thailand

Thailand