Thailand: Moody’s: Digital tactics to cut costs

Thai consumers’ preference for digital transactions is credit positive and demonstrates the initial success of Thai banks’ digital strategies, which should eventually allow banks to rationalise their branch networks and improve cost efficiencies, says Moody’s Investors Service.

Over time, widespread use of digital banking channels also will allow banks to increase revenue by expanding their product offerings beyond transactional products.

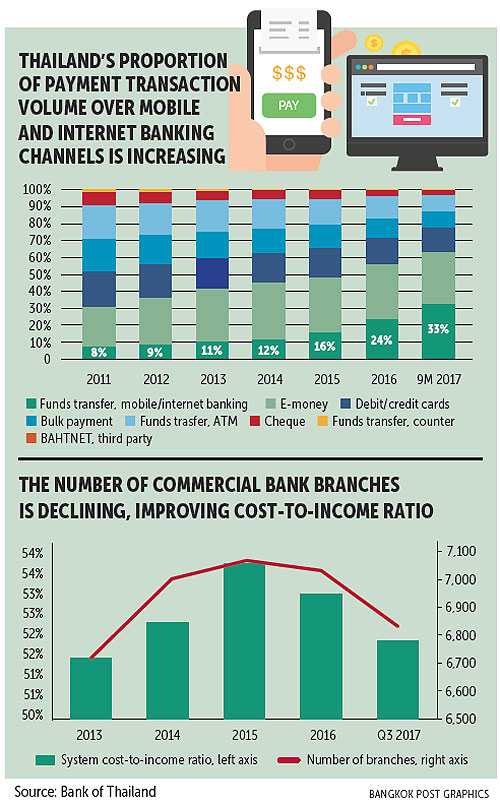

The volume of internet and mobile banking transactions continues to expand at a rapid pace as both internet and mobile penetration improve in Thailand. Mobile and internet banking accounted for 33% of total payment transaction volume for the first nine months of 2017, a marked increase from 8% in 2010.

In value terms, mobile and internet banking accounted for 23.4 trillion baht in the first nine months of 2017, a 22% compounded annual increase in value since 2010.

Thailand’s increased usage of digital banking channels since 2015 reflects banks’ increasing focus on digital strategies. Kasikornbank (KBank, Baa1 stable, baa21) in 2014 began investing around 480 million baht annually to enhance its digital banking services.

As of year-end 2017, KBank had 7.3 million users on its mobile banking channel, recording around 3 billion transactions during the year, a tenfold increase from 2014. This year, Bank of Ayudhya (BAY, Baa1 stable, ba1) said that it would invest 20 billion baht to develop its technology infrastructure and digital banking platform. Siam Commercial Bank (SCB, Baa1 stable, baa2) last year planned to invest 40 billion baht to enhance its digital banking capability.

“We expect the volume of digital banking channel transactions to continue increasing. The shift to online transactions provides Thai banks an opportunity to rationalise their branch networks, thereby extracting operational cost efficiencies,” it said.

Number of commercial bank branches decreased to 6,826 as of Sept 30, 2017 from a peak of 7,061 branches as of Dec 30, 2015.

Concomitantly, the banks’ annualised cost-to-income ratios declined to less than 52% as of the end of September 2017, from 54% in 2015.

In January, SCB announced plans to reduce its traditional branches to 400 from 1,153 by 2020, while BAY said it will transform half of its traditional branches into digital or hybrid-digital platforms. BAY expects its investment in IT to result in a 10%-15% decline in operating costs over the next three years.

Source: https://www.bangkokpost.com/business/news/1419447/moodys-digital-tactics-to-cut-costs

Thailand

Thailand