Thailand: Logistics lures Japanese

Four Japanese investors will spend a total of 10 billion baht within the fourth quarter to develop warehouse and logistics facilities in response to the boom in e-commerce, online shopping and the export sector amid the Covid crisis.

Phattarachai Taweewong, associate director of the research and communications department at property consultant Colliers Thailand, said several investment groups from Japan were interested in Thailand’s warehouse and logistics sectors.

“We have been in discussion with these investors since last year and at least four of them will start investment by the end of this year. They will do it through joint ventures with existing players,” he said.

Most of the locations where they plan to develop new warehouse and logistics facilities include Bang Phli in Samut Prakan and areas in the Eastern Economic Corridor (EEC).

According to research and advisory company Oxford Business Group, Thailand’s e-commerce revenue is estimated to grow 12% to US$5.30 billion this year from US$4.74 billion last year.

“The pandemic affects purchasing power but the growth and shift to online shopping is a positive trend because of limitations on offline channels,” he said. “E-commerce in Thailand will continue to rise.”

The e-commerce boom has driven demand for warehouse and logistics facilities in Bangkok and Samut Prakan.

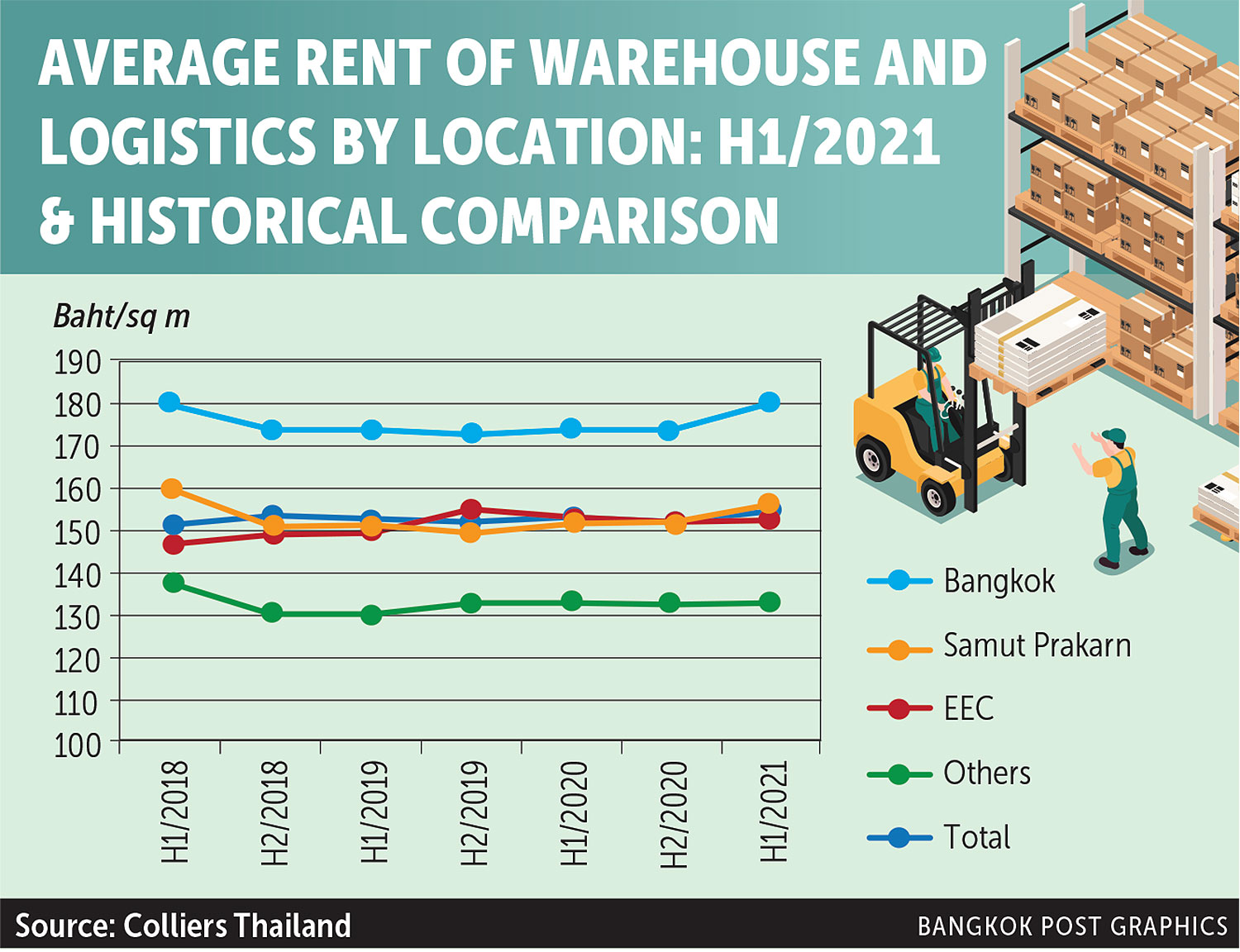

Mr Phattarachai said average rent per square metre per month in Bangkok and Samut Prakan rose to 180 baht and 156 baht, respectively, from 175 baht and 152 baht. Some warehouses in Bangkok have rents of more than 200 baht for a three-year contract.

“It is still not too late to start a greenfield development of new warehouses and logistics facilities as it mostly takes no longer than one year to complete after a contract is signed,” he said.

This sector will keep growing with yield as high as 8% per year in some projects, he added.

Besides Japanese investors, local developers in other sectors are also interested in warehouses and logistics.

These include residential developers Sansiri Plc and Origin Property Plc.

He said Sansiri had a joint venture with industrial property developer Prospect Development to develop 110,000 sq m of warehouses and factories for rent on a 145-rai plot in Wang Noi, Ayutthaya. Construction will start by year-end for completion of phase one in early 2023.

Origin Property joined logistics service provider JWD Infologistics Plc to develop logistics properties and provide logistics solutions.

According to Colliers’ research, new contracts of warehouses and logistics properties totalled more than 150,000 sq m in the first half of 2021, driven by major players including WHA Corporation Plc and Frasers Property Industrial (Thailand).

“Despite the high number of new infections in the third quarter, revenue targets of the major players remain unchanged,” he said. “They continue development of more than one million sq m in new supply to support robust demand.”

As of the first half of 2021, supply of warehouses and logistics totalled around 6.9 million sq m.

Occupancy rate in the period rose slightly to 87.6% from 87.3% and 87.5% in the first and second half last year, respectively.

Colliers estimated that more than 200,000 sq m of new supply will be launched in the second half, mostly developed by large developers in Samut Prakan, the EEC and Ayutthaya.

“The progress of infrastructure projects in EEC like high-speed trains linking three airports and the new U-tapao international airport will benefit the industrial sector and attract new investors in the future,” he added.

At present, warehouse supply in EEC areas was the second largest, accounting for 32% of the total.

The largest one was in Samut Prakan (38%), followed by Bangkok (10%), while other areas represented 20%.

The growth of new warehouse supply in the first half mostly derived from WHA Mega Logistics Centre Laem Chabang Phase 2 totalling more than 50,000 sq m.

Key tenants were electronics manufacturers and logistics providers for exporting to neighbouring countries.

There was also a new warehouse developed by Wice Logistics Plc with 10,000 sq m on Bang Na-Trat KM 18 which had 60% occupancy.

Meanwhile, Frasers Property Industry Thailand opened a new logistics centre in Bang Phli, comprising three buildings with a total area of 74,000 sq m with 60% signed contract.

Frasers is also developing more than 34,000 sq m at a logistics park in Wang Noi for Thai Beverage Plc, and plans to develop more than 1 million sq m in the next five years.

Source: https://www.bangkokpost.com/business/2170043/logistics-lures-japanese

Thailand

Thailand