Thailand: Future of department stores redefined

While department stores have been a familiar destination for Thai people for decades, lower growth and a decline in popularity has been evident in recent years, particularly in 2020 when the pandemic battered the retail sector, according to the property consultancy CBRE.

To adapt to the disruption caused by e-commerce and changing consumer behaviour, department stores in 2021 will have to fine-tune their business model, says CBRE. This will include the customer shopping experience, innovative activities and value-added programmes if they want to remain a “second home” for Thai shoppers.

“While department stores offer shoppers convenience, saving them time with a variety of goods grouped in different departments and allowing shoppers to find and compare products and choose what they want, the traditional department store model does not fit the needs, lifestyle and behaviour of shoppers anymore, especially the new generations,” said Jariya Thumtrongkitkul, head of advisory and transaction services (retail) with CBRE Thailand.

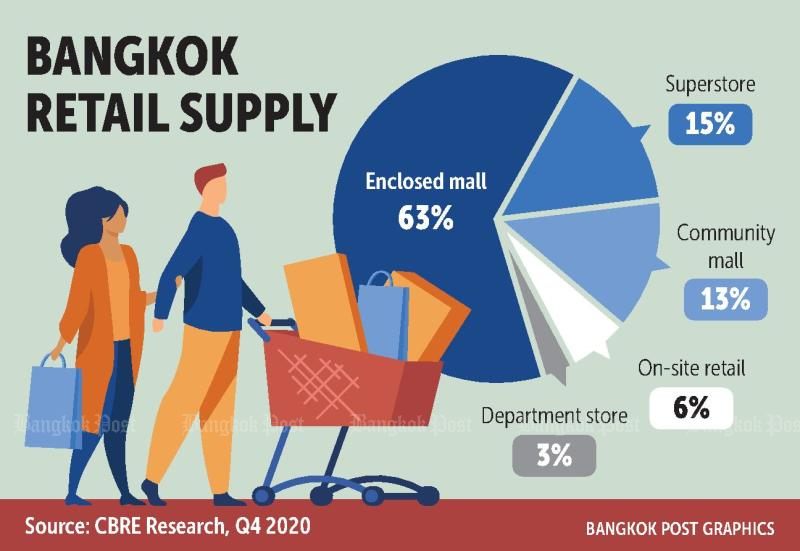

According to CBRE Research, retail supply in Bangkok as of the fourth quarter of last year totalled 7.8 million square metres, an increase of 1.2%. Of this total, department stores represented just 3%.

The local department store market is dominated by two domestic retail giants, Central Group and The Mall Group. After building a major presence in Bangkok, they have branched out to many major provinces throughout the country, allowing them to build bigger networks and broaden their customer base.

Some Japanese investors also showed interest in the Thai market, with offerings well known in Japanese department stores: simplicity, premium quality and services. However, amid strong competition, they have scrapped expansion plans or left the country.

“The department store concept as a one-stop shopping place is still in demand for certain groups of customers,” said Ms Jariya. “However, with the disruption of e-commerce and changing consumer behaviour, department store operators need to adapt their models, offerings and value-added services to their customers to cope with challenging economic and market conditions.”

The required adaptations fall into three categories: customer shopping experience, inventive sales and marketing activities, and value-added programmes. While many younger consumers prefer to shop online to save time and money, the brick-and-mortar store is still considered a second home for many Thai shoppers. Department stores should be more agile in the era of e-commerce and adopt some technological innovations such as in-store automation and mobile payment solutions to reach younger crowds.

Design is another important part of the customer shopping experience. Department stores can be more creative in remodelling traditional sales areas into more ingenious and interactive spaces with great design and the right product portfolio mix for their customers.

The Mall Group, for example, launched its first “Lifestore” concept at The Mall Ngamwongwan at the end of 2020 with a major renovation to enhance the customer shopping experience and enjoyment.

Inventive approaches to sales and marketing are also essential. One reason is that prices of products sold in department stores are normally high to reflect higher establishment and operating costs. This limits the target market to upper- to high-income customers. Existing brand offerings may also no longer meet fast-changing customer needs since today’s shoppers have more choices online, not to mention the declining footfall due to the growth of e-commerce.

CBRE Research has seen domestic players pushing hard to drive sales growth via numerous promotions, marketing campaigns and activities and collaborations with credit card companies during seasonal sales.

The third element consists of value-added programmes such as personal shoppers, customer loyalty programmes, on-demand solutions and service personalisation, which have become a new trend as customers of all ages are now more sophisticated and demanding.

The retail landscape has changed dramatically in the past few years because of various factors including technological advancement, consumer behaviour and preferences as well as Covid-19. The cookie-cutter strategy will be a thing of the past, especially for department stores where the format and offerings have remained the same for decades.

“Going forward, CBRE believes department stores still have opportunities by being adaptive,” according to Ms Jariya. “Operators are likewise encouraged to capitalise on their mixed-use nature, focus on the needs of each store’s catchment area, lean more towards younger customers who are hungry for whatever is next, as well as adjust existing space to be more innovation-oriented,” she said.

“These could be a part of the answer to captivate consumers and also be the key to success.”

Source: https://www.bangkokpost.com/business/2053279/future-of-department-stores-redefined

Thailand

Thailand