Thailand: Four banks trim prime lending rates

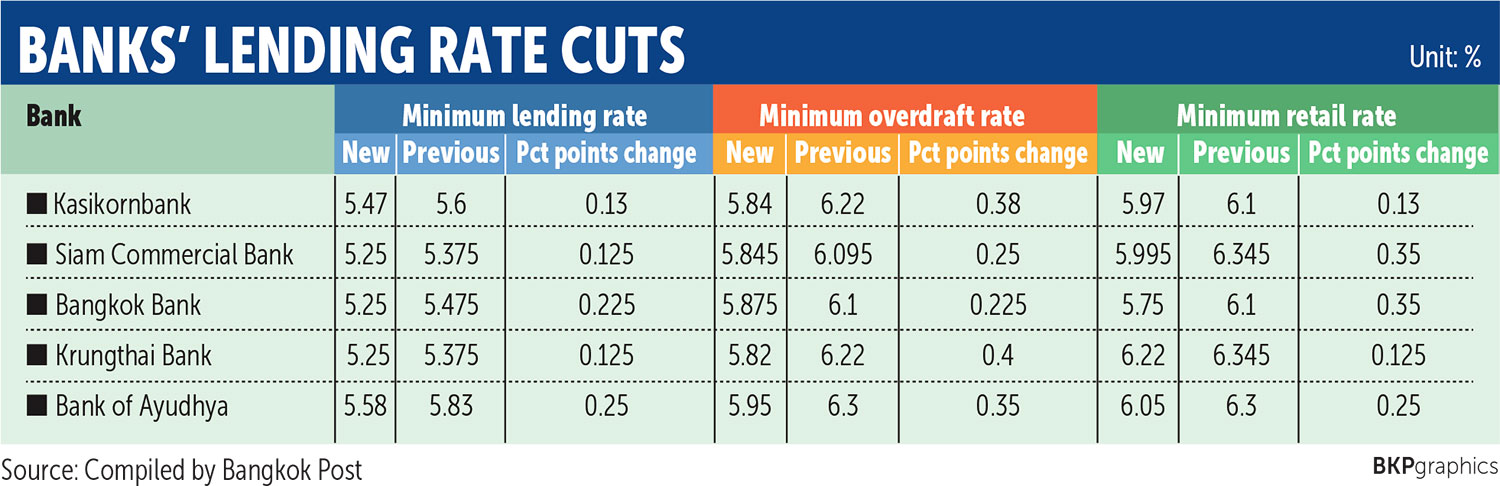

Four commercial banks — Kasikornbank (KBank), Siam Commercial Bank (SCB), Krungthai Bank (KTB) and Bank of Ayudhya (BAY) — followed in the footsteps of Bangkok Bank (BBL), passing on some or more than the central bank’s 25-basis-point rate cut for their prime lending rates.

The new rates for KBank, SCB and KTB take effect from today, while BAY’s were effective on Thursday. The latest lending rate reduction marked the fourth cut this year.

SCB trimmed its prime lending rates in a range of 12.5-35 basis points.

Its minimum lending rate (MLR) was clipped by 0.125 percentage points to 5.25%, minimum overdraft rate (MOR) by 0.25 percentage points to 5.845% and minimum retail rate (MRR) by 0.35 percentage points to 5.995%.

Arthid Nanthawithaya, chief executive at SCB, said the bank’s prime loan rate cut would help relieve financial costs for both business operators and consumers to overcome the coronavirus crisis.

The country’s fourth largest lender by assets has also offered to support the liquidity of small- and medium-sized enterprises through the central bank’s soft loan scheme, he said.

Spearheading the rate cut, BBL lowered its prime lending rates by 22.5-35 basis points shortly after the Bank of Thailand’s Monetary Policy Committee on Wednesday voted 4-3 to cut the policy rate by 0.25 percentage points to an all-time low of 0.50%.

The policy rate reduction marked the fifth since last August.

The domestic economy is on the path to a recession after shrinking 1.8% year-on-year in the first quarter, the deepest contraction since the flood-hit fourth quarter of 2011.

The central bank earlier downgraded the economic growth outlook for 2020 to a 5.3% contraction from 2.8% growth, largely rattled by the coronavirus outbreak.

BBL’s MLR now stands at 5.25%, MOR at 5.875% and MRR at 5.75%.

KBank lowered its prime loan rates by 0.13-0.38 percentage points.

The country’s largest lender by assets’ new MLR and MRR is reduced by 13 basis points to 5.47% and 5.97%, respectively, and MOR is slashed by 38 basis points to 5.84%.

BAY, the country’s fifth largest lender by assets, slashed its benchmark lending rates across the board in a band of 0.25-0.35 percentage points.

BAY’s MLR is cut by 0.25 percentage points from 5.83% to 5.58%, MOR by 0.35 percentage points from 6.30% to 5.95%, and MRR by a quarter-point from 6.30% to 6.05%.

The bank’s president and chief executive Seiichiro Akita said BAY stands ready to support the authorities’ monetary policy through mechanisms to relieve the impact of the coronavirus outbreak on local businesses and reduce customers’ funding costs.

Source: https://www.bangkokpost.com/business/1922296/four-banks-trim-prime-lending-rates

Thailand

Thailand