Thailand: Exporters set to gain from a weaker baht

Export stocks in many industries are expected to gain from a 6% depreciation of the Thai baht since mid-May as the prospects of US economic recovery and an inflation rate hike has caused the US dollar to rise, according to KTBST Securities.

Petrochemical, energy and material import stocks from businesses abroad face losses on the foreign exchange (forex), said the brokerage.

KTBST executive vice-president, Mongkol Puangpetra, said the baht stood at 31.90 baht per US dollar as of June 24, down 6% from its peak in mid-May at around 30.00 to the dollar. This is the weakest point in 13 months.

The US inflation rate has risen rapidly so far, pushing the Federal Reserve to raise the interest rates one year earlier than expected in 2023 rather than 2024 as previously expected. The news caused capital to flow into the dollar again, causing the currency to rise and in turn pressure the Thai baht.

In addition to the dollar appreciation, other domestic factors related to the slowdown were also causes of the baht’s depreciation, Mr Mongkol said.

KTBST expects the baht will average at 31.20 baht per US dollar in 2021. The currency is expected to rise again at the end of 2021 thanks to reopening, allowing the Thai economy to recover.

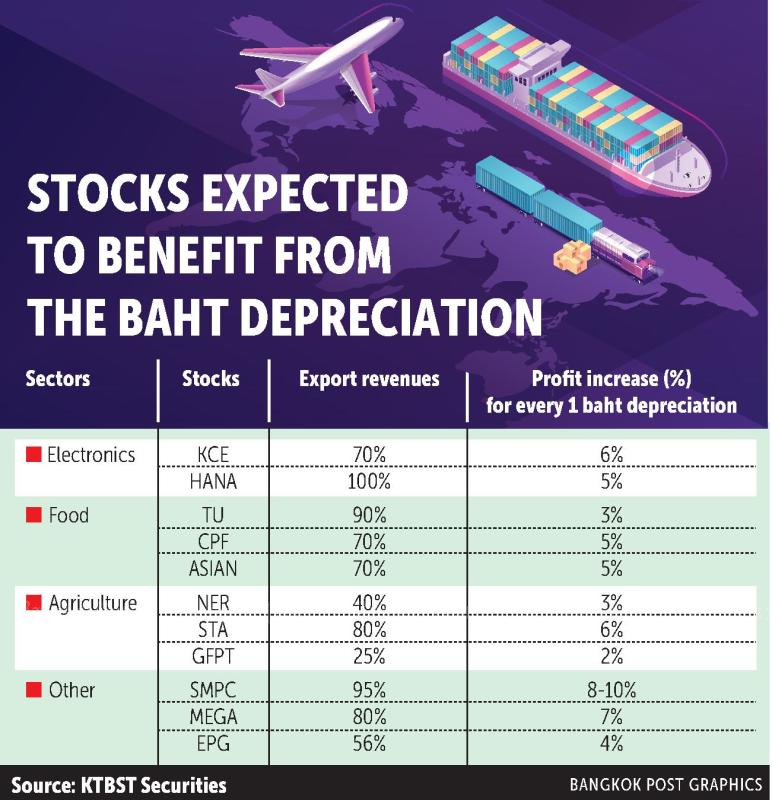

Due to the baht depreciating, many exporters will benefit from this situation including electronics stocks as demand for electronic components rises.

Food and agriculture exporters are expected to be beneficiaries as most of their income is generated from the international market.

However, some industries are expected to suffer from the depreciation, especially airlines which have around 60% of their costs in dollars.

The energy sector will also be affected by the movement of the dollar against the baht as the industry uses it as its functional currency. As a result, firms will face unrealised forex loss.

Power plant stocks are another group that will face negative sentiment from the baht’s depreciation as they have dollar-denominated loans, subjecting them to an unrealised forex loss.

However, the forex transaction will happen on the balance sheet but does not affect cash flow.

Import-reliant industries are also expected to be hit by the depreciation as it will raise the cost of importing raw materials such as Thai Vegetable Oil (TVO). TVO imports 75-80% of soybeans and therefore for every one baht that is depreciated, its profit is reduced by about 3%.

Source: https://www.bangkokpost.com/business/2140215/exporters-set-to-gain-from-a-weaker-baht

Thailand

Thailand