ThaiBev riding Asean acquisition wave

Thai Beverage Plc, Thailand’s largest food and drink company, controlled by billionaire Charoen Sirivadhanabhakdi, is getting close to fulfilling its 2020 vision to become a sustainable Asean leader after completing four major acquisitions worth 200 billion baht in the first quarter of its fiscal 2018 (October to December 2017).

Chief executive Thapana Sirivadhanabhakdi said the acquisitions comprised a 53.6% stake in Vietnam’s largest beer player, Saigon Beer-Alcohol-Beverage Corporation (Sabeco), worth 156 billion baht; a 75% stake in Myanmar’s largest whisky player, the Grand Royal Group, for 25 billion; a franchise agreement worth 11.4 billion to operate 252 KFC restaurants in Thailand; and a 76% stake in hotpot and Thai food restaurant operator Spice of Asia Co for 115 million.

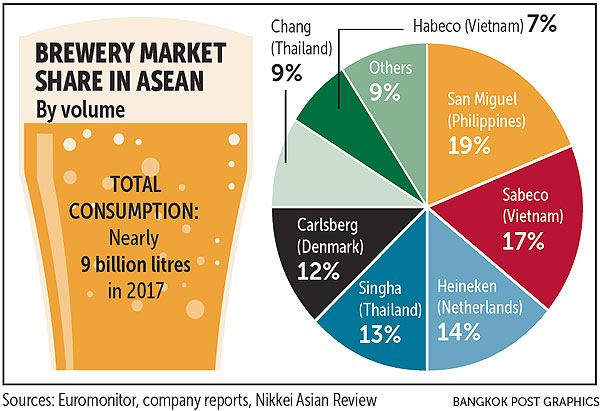

The acquisition of Sabeco in Vietnam helped ThaiBev jump to become the leader in the Asean beer market, which is estimated at 9 billion litres.

Together with Chang beer, the group controls 26% of the Asean beer market.

The acquisitions also raised the proportion of ThaiBev’s revenue from its alcoholic drink business to 78%, up from 55% last year.

ThaiBev is expected to begin releasing earnings from Sabeco from its second quarter onwards.

Mr Thapana said funding will stem largely from the company’s free cash flow available from operating results, dividends worth more than 30 billion baht annually and short-term debentures.

ThaiBev is due to launch the first batch of its two-year debentures worth 50 billion baht in March.

“Strategic partnerships with two local beer and whiskey champions will increase our business potential in Asean, which is the fastest-growing emerging market in the world,” Mr Thapana said. “It is another transformative step for us in Asean.”

He said Vietnam is attractive for investment because the country’s GDP grew by 7% last year and the consumption of beer was the highest in Asean at 4.4 billion litres last year — twice the level in Thailand.

Of total consumption, Sabeco is the leader with a market share of 41%.

As of December, Sabeco reported 48 billion baht in revenue and a 7.2-billion-baht net profit.

Moreover, Mr Thapana said Vietnam has a population of 92 million people, many of whom are young people with high spending power.

In Myanmar, the Grand Royal Group sells 60 million litres of whisky annually, controlling 60% of the market there.

In a related development, ThaiBev reported that revenue and net profit in the first quarter of its fiscal 2018 (Oct-Dec 2017) totalled 45.6 billion baht and 3 billion baht, respectively. The company’s revenue and net profit dropped from 46.8 billion baht and 7.7 billion in the same period last year.

The decline was mainly due to fluctuations in sales agents’ spirits and beer inventory levels and a 2.35 billion baht one-off, non-recurring recognition of expenses related to those acquisitions.

Excluding the non-recurring item and other acquisition-related finance costs, net profit would have amounted to 5.5 billion baht. The group’s non-alcoholic drinks business registered a 5.8% year-on-year increase in sales revenue and narrowed its net loss by 5%.

Meanwhile, the food business recorded a 42.3% year-on-year revenue spike and a 2,080% surge in net profit, driven by contributions from the KFC acquisition.

The company’s food business earnings before interest, tax, depreciation and amortisation and net profit margins also rose from 8.5% and 0.3% a year ago to 14.1% and 4.7%, respectively, in the first quarter of fiscal 2018.

Thailand

Thailand