Study: Singaporeans spending more than income growth, lowest earners will suffer as inflation stays high

SINGAPORE, Aug 2 — A study by DBS bank has found that the monthly expenses of its customers grew 22.2 per cent this May compared to May last year, which is twice that of their income growth of 11.1 per cent in the same period.

Releasing the findings on Monday (Aug 1), DBS said that 40 per cent of its customers saw their income grow less than 5 per cent in the past year, which is slightly below the country’s average consumer price index inflation of 5.2 per cent in the first half of the year.

Customers within the lowest-income group, who earn below S$2,500, had just a 2.5 per cent increase in income between May last year and this year.

This group also saw their expenses grow 13.8 per cent, which is 5.6 times faster than their income growth at 2.5 per cent.

The results were drawn from an analysis of the aggregated and anonymised database of about 1.2 million of the bank’s non-wealth customers in May this year, and compared with data from the same period last year.

During a media roundtable on Monday, Irvin Seah, senior economist at the bank, attributed this to pent-up spending over the last year and inflationary effects.

He said: “If inflation continues to stay high, obviously, this group (the lowest-income group) will continue to feel the strain.

“Having more policy support, such as business support coming from the Government, and also strong currency (will help).

“Beyond that, I think it is important for all Singaporeans to exercise sustainable financial planning and investing.” In June, Singapore’s core inflation hit its highest level since November 2008, with stronger price increases across most categories such as services, food, retail, as well as electricity and gas.

Core inflation — which excludes accommodation and private transportation costs — was at 4.4 per cent year-on-year in June. This was more than the previous 13-year high of 3.6 per cent in May, official data released on July 25 showed.

The Monetary Authority of Singapore (MAS), which is also Singapore’s central bank, announced last month that it had tightened its monetary policy for the fourth time since October last year.

How has spending increased

The cost of living here had gone up, the DBS study showed, with its customers now spending 64 per cent of their income — 5 per cent more than what they were spending a year ago.

This was due to a combination of both pent-up spending and inflation over the last year, the report stated.

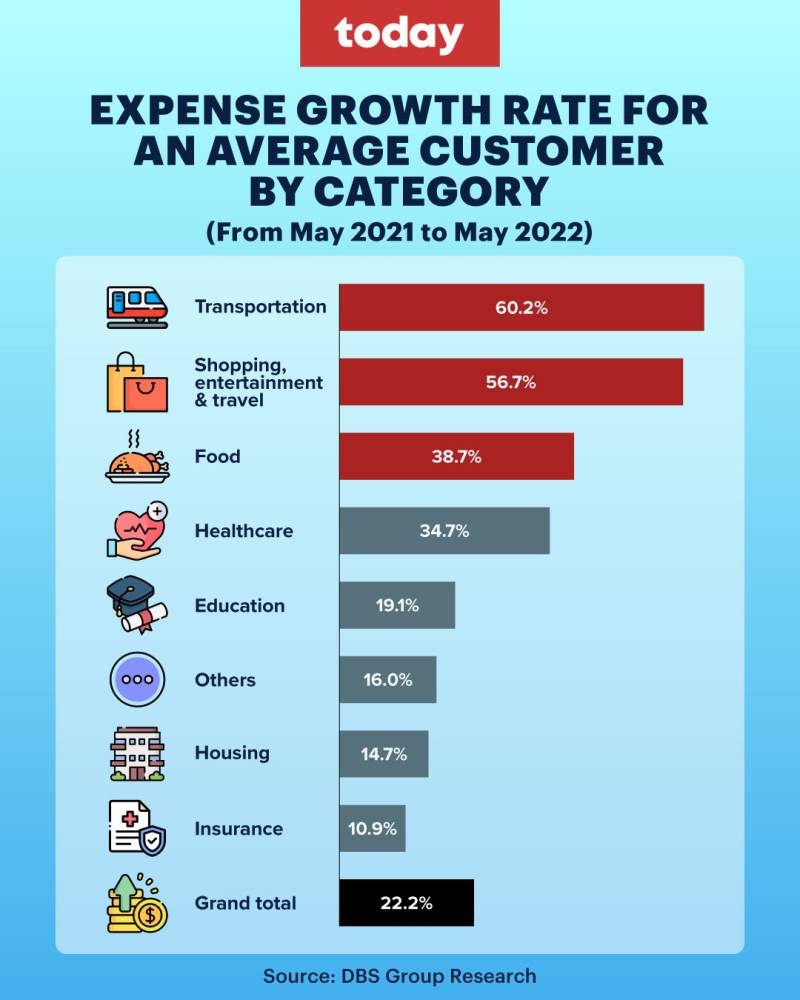

In terms of spending patterns, there was double-digit growth in the last year. People were spending a lot more on transport, shopping and food.

The growth rate for transport expenses was 60.2 per cent and discretionary spending — which includes shopping, entertainment and travel — saw a sharp 56.7 per cent growth rate. For food, it was at 38.7 per cent.

The increase in transport and food spending is driven by both inflation as well as Singapore’s reopening of its borders and the easing of Covid-19 regulations, which has brought about greater mobility and higher spending, the report showed.

Seah said: “From one regressive event to another, it seems like the odds are stacked against the financial well-being of Singaporeans.

“With inflationary pressures creeping up, slow wage growth and a growing propensity to ‘revenge-spend’, low-income earners are especially vulnerable to the ill effects of the current economic situation.” The DBS study showed that the three key drivers of inflation in Singapore have been food, transportation, as well as housing and utilities, which is considered as one category. Together, these three components accounted for around 63 per cent of the overall basket of spending.

Analysing data, the report stated that in June, Singapore’s headline consumer price index inflation recorded a multi-year high of 6.7 per cent. The three top contributors were food rising to 5.4 per cent, housing and utilities going up to 5.2 per cent, and transportation seeing a 18.8 per cent surge compared to the same period last year.

When asked how long the impact of inflation will last, Seah said that “inflation is here to stay” for the next two to three years.

“Although central banks around the world are normalising this and they are tightening monetary policy to tame inflation, it takes time for the price dynamics to gradually adjust back to normal.” — TODAY

Thailand

Thailand